Michael Saylor’s Strategy (MSTR) has dropped to its lowest level in nearly four months amid a broader decline in crypto treasury firms, a Bitcoin dip, and after Saylor indicated the company would lower restrictions on issuing more shares.

The stock price has fallen 8% since Monday, and the plunge also comes alongside an 8.6% decline in Bitcoin’s (BTC) price since hitting a new all-time high of $124,128 last Thursday.

Saylor lowers the threshold for selling MSTR to buy Bitcoin

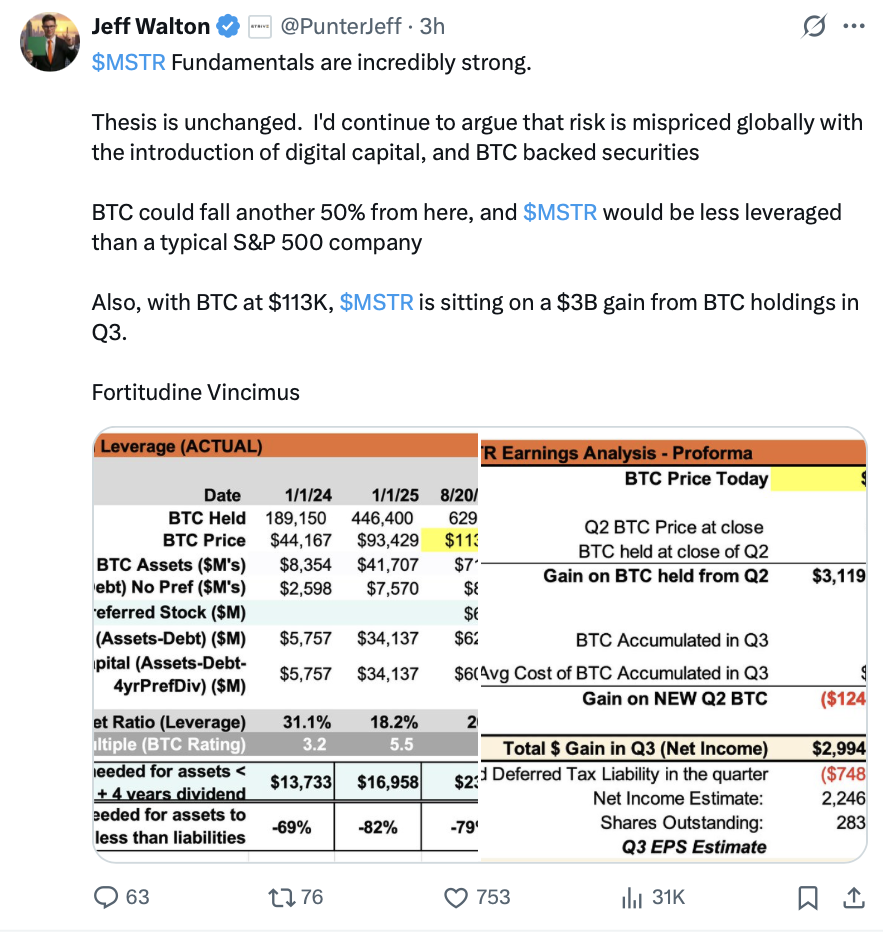

“Strategy today announced an update to its MSTR Equity ATM Guidance to provide greater flexibility in executing our capital markets strategy,” Saylor said in an X post on Monday, including a chart showing changes to the company’s ability to issue shares below its previous limit.

The update specified that when MSTR trades below 2.5 times its net asset value (mNAV) — which shows how much more or less the market values a Bitcoin-holding company than its actual BTC stash — the company can “tactically issue MSTR” to cover debt interest, fund preferred equity dividends, and “when otherwise deemed advantageous to the company.”

Some MSTR shareholders slammed the change, arguing it was a stark reversal of its Q2 earnings report, which only mentioned issuing shares below this level to pay debts or fund preferred equity dividends.

Others, however, saw it as a positive for Bitcoin, as it would potentially allow MSTR to buy more.

Strategy’s mNAV stands at 1.55 at the time of publication, according to Strategy data.

Saylor’s announcement divides the community

Crypto trader Kale Abe said, “He’s literally telling you straight up he’s gonna buy a… ton more BTC.”

At the time of publication, the firm holds 629,376 Bitcoin, worth approximately $71.34 billion, according to SaylorTracker.

Related: Michael Saylor signals Strategy will buy the Bitcoin dip

Another commentator, Josh Man, who claims to be a prior shareholder, said, “The head of the company said he wouldn’t sell below 2.5 mNAV, so I bought. He made this agreement with the shareholder at the live earnings release. And then he sold below mNAV 2.5.”

Meanwhile, Bitcoin maxi and developer Endre Stolsvik said it may be a more feasible option for Strategy.

“The ‘no issue below mNAV 2.5’ was too strict, given that we’re far away, now at 1.59,” Stolsvik said.

Over the past month, MSTR has declined 21.04%, and is now trading at $336.57. The last time MSTR traded at this level was April 17, when Bitcoin was $84,030.

Several other public companies holding Bitcoin have also posted stock price declines over the past month. MARA Holdings (MARA) is down 19.44%, Coinbase Global Inc (COIN) is down 26.97%, and Riot Platforms (RIOT) is down 14.69%.

Magazine: Solana Seeker review: Is the $500 crypto phone worth it?