Florida’s top prosecutor has opened an investigation into trading platform Robinhood, alleging it has been falsely promoting its crypto services as the least expensive on the market.

However, Lucas Moskowitz, Robinhood’s general counsel, told Cointelegraph in a statement that the platform is transparent about its fees, and customers trade crypto at the lowest cost on average.

In a statement on Thursday, Florida Attorney General James Uthmeier accused Robinhood of breaking Florida’s Deceptive and Unfair Practices Act and issued a subpoena asking for various documents from the platform.

“Crypto is a vital component of Florida’s financial future,” and when “consumers buy and sell crypto assets, they deserve transparency in their transactions,” said Uthmeier.

“Robinhood has long claimed to be the best bargain, but we believe those representations were deceptive.”

On its website, Robinhood claims traders can buy and sell crypto at the lowest costs on average in the US.

Attorney general claims payment for order flow is to blame

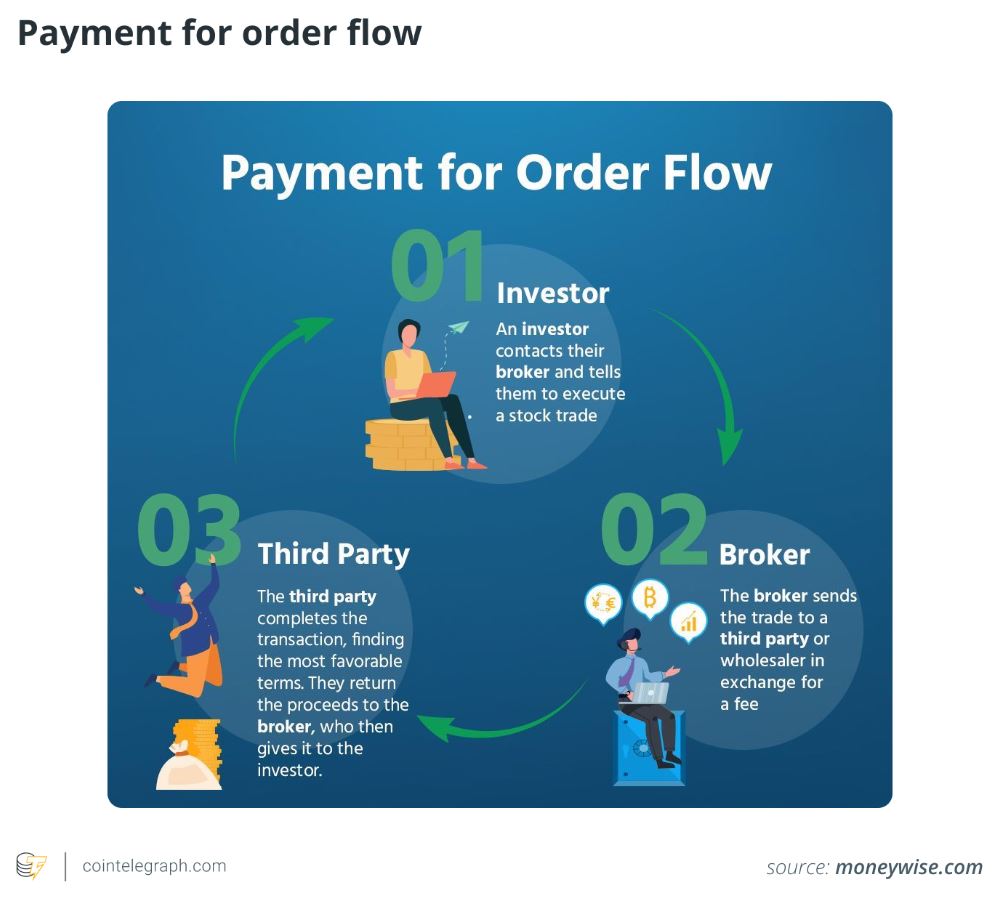

Robinhood generates revenue through payment for order flow (PFOF), which Florida’s attorney general alleges makes the platform more expensive because “third parties that pay Robinhood for order flow might have to charge less favorable prices” to be profitable.

Brokerage firms using PFOF receive a fee for directing orders and executing trades to a particular market maker or exchange, usually in fractions of a penny per share.

In a December 2023 CNBC interview, Robinhood CEO Vlad Tenev defended the practice amid concerns that it created a conflict of interest where brokers weren’t always acting in clients’ best interests.

Robinhood agreed to pay a $65 million fine in December 2020, with no admission of guilt, to settle charges from the SEC alleging, among other things, that Robinhood falsely claimed its customers’ orders were being executed at prices lower than other brokers.

Robinhood argues its operations are transparent

Robinhood General Counsel Lucas Moskowitz told Cointelegraph the “disclosures are best-in-class.”

“We disclose pricing information to customers during the lifecycle of a trade that clearly outlines the spread or the fees associated with the transaction and the revenue Robinhood receives,” he said.

“We are proud to be a place where customers can trade crypto at the lowest cost on average,” Moskowitz added.

Robinhood has until the end of July to respond to the subpoena.

Related: Private companies line up to join Robinhood’s tokenized equity platform: CEO

Stock up at close of trading

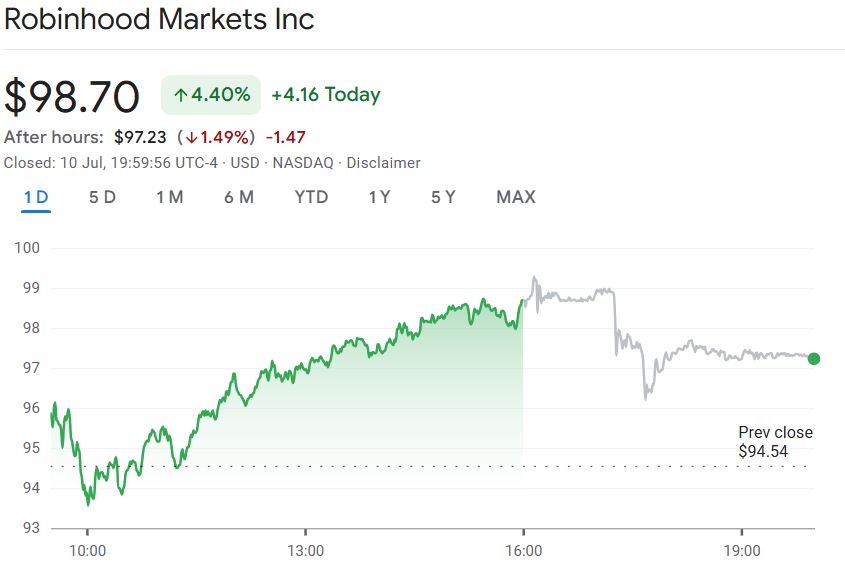

Robinhood investors seemingly shrugged off the news about Florida’s probe, with the stock closing Thursday’s trading session up 4.4% to $98.70 alongside a crypto market rally.

It is now only a stone’s throw from its all-time high of $100.88.

However, in after-hours trading, the stock retreated slightly to $97.23, representing a drop of 1.49%.

In the last month, its shares have staged a 30% rally, which has been attributed to its strategic embrace of blockchain technology and tokenization.

Magazine: Growing numbers of users are taking LSD with ChatGPT: AI Eye