The following is based on “Redefining the Optimal Retirement Income Strategy,” from the Financial Analysts Journal.

Retirement, like life, is fundamentally uncertain. That’s why we need to provide clients with more context about what missing their retirement-income goals might look like and do it in a thoughtful way.

In my two previous articles, I explored how retirees tend to have more flexibility in their retirement spending than the conventional models imply and discussed a basic framework to dynamically adjust their spending. Here, I examine how commonly used financial planning metrics — the probability of success, in particular — are flawed and why we should consider other outcomes metrics that can offer additional and better insights into clients’ retirement income situations.

The Rise of Monte Carlo

Financial advisers often use Monte Carlo projections to demonstrate the uncertainty associated with funding retirement income and other retirement goals. The element of chance, or randomness, is the key differentiator with Monte Carlo projections compared to time value of money calculations and other methodologies.

While showing the likelihood that a goal may not be achieved is important, so too is outlining the array of potential scenarios. The probability of success is the most common outcomes metric in Monte Carlo tools and refers to the number of runs, or trials, in which the goal is fully accomplished in a given simulation. For example, if a retiree wants $50,000 in annual income for 30 years, and that goal is achieved 487 times in 1,000 runs, there’s an estimated 48.7% chance of success.

Success-related metrics treat the outcome as binary, however, and don’t describe the magnitude of failure or how far the individual came from accomplishing the goal. According to such metrics, it doesn’t matter whether the retiree fails in the 10th or 30th year or by $1 or $1 million dollars. All failure is treated the same. So, a retiree can have a relatively small shortfall yet also a low probability of success, especially when their retirement income goal is primarily funded through guaranteed income and for a relatively extended assumed period, say 30 years.

Goal Completion

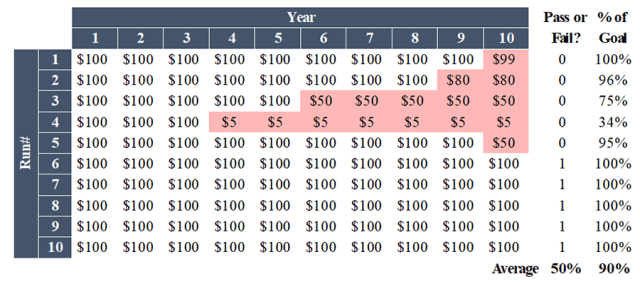

But a financial goal is not a discrete set of pass or fail outcomes. It is a spectrum of possibilities. That’s why adding context about the degree of potential failure is so important. The percentage of the goal that is completed is a critical metric. The chart below illustrates this effect with an assumed goal of $100 a year for 10 years.

Percentage Chance that $100 a Year for 10 Years Goal Is Met

In runs 1 to 5, for example, the goal is only partially met. The percentage varies across the five simulations, but each run constitutes a “failure” based on success-related metrics. Other metrics tell a different story. Using the average goal completion, 90% of the goal is covered, on average, while success rates indicate a 50% chance of success. Though based on identical data, these two metrics give very different perspectives about the safety of the target level spending.

The relatively low success rate suggests reaching the goal is far from assured. But the goal completion score offers a much more positive picture. This is especially important with extended-duration goals like retirement where “failure” is most likely in the final years of the simulation.

Diminishing Marginal Utility

While goal-completion percentages demonstrate a more colorful perspective on the results of Monte Carlo simulations, they also fail to account for how the disutility, or pain, associated with missing a goal may vary. For example, not funding essential expenses like housing or health care will likely lead to more dissatisfaction than cutting back on travel or other flexible items.

The concept of diminishing marginal utility describes this relationship: The pleasure of consuming, or funding, something typically increases, but at a decreasing rate. This may explain why people buy insurance even though it reduces wealth on average. They guarantee that they will be able to fund some minimum level of consumption.

Goal-completion percentages can be further modified to incorporate diminishing marginal utility, whereby the implied satisfaction associated with achieving a given level of consumption changes, especially depending on whether the consumption is discretionary or nondiscretionary. I developed a framework for making these adjustments based on prospect theory. These values can be aggregated across years within a given run, and across all runs. This yields a goal-completion score metric that may necessitate much different advice and guidance than modeling based on probability-of-success rates.

Working with What We’ve Got

Our industry must deploy better outcomes metrics in financial plans. Such metrics must consider goal completion and more directly incorporate utility theory. To be sure, relatively few instruments accomplish this today, so financial advisers may have to offer improved guidance using the current toolset.

Those financial advisers who continue to rely on success rates should dial their targets down a bit. According to my research, 80% is probably the right target. This may seem low: Who wants a 20% chance of failure? But the lower value reflects the fact that “failure” in these situations is rarely as cataclysmic as the metric implies.

Clients also need more context around what exactly a bad outcome entails. As financial advisers, we can explain how much income is generated in the unsuccessful trials. How bad are the worst-case scenarios? Will the client have to generate $90,000 at age 95? This is much more meaningful than a success rate and demonstrates just how poorly things could go if they don’t go well.

Conclusions

The probability of success may be the primary outcomes metric for advisers using Monte Carlo projections, but it completely ignores the magnitude of failure. Success rates can be especially problematic for retirees with higher levels of longevity-protected, or guaranteed, income and for those with more spending flexibility. Alternative-outcomes metrics can help us fill in the gap and ensure we provide reasonable and accurate information to clients to help them make the best financial decisions possible.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / gilaxia

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.