Key Points

- Borrowers with federal loans issued after July 1, 2026, will choose between the new Standard Plan or a new income-based option called the Repayment Assistance Plan (RAP).

- Existing borrowers must transition by July 1, 2028, from plans like SAVE or PAYE into either RAP or a revised version of Income-Based Repayment (IBR).

- Parent PLUS borrowers remain largely excluded from RAP and amended IBR, locking many into the Standard Plan without income-based options.

The final Senate version of the One Big Beautiful Bill is going to reshape the future of student loan repayment.

Starting July 1, 2026, all new federal student loan borrowers will only have two options: the revised Standard Plan or the newly introduced Repayment Assistance Plan (RAP). For current borrowers, the transition comes between 2026 and 2028, when legacy plans like SAVE, PAYE, and ICR will be phased out and borrowers will be forced to move into either the RAP plan, or an Amended IBR plan.

The RAP plan calculates monthly payments on a sliding scale, ranging from 1% to 10% of adjusted gross income. A key feature is that unpaid interest is forgiven, and a $50 monthly principal match helps chip away at the balance. Loans are forgiven after 30 years of payments.

Amended IBR, the other remaining option for existing borrowers, retains most of the features of Old and New IBR, depending on loan origination date. Those with loans from before July 1, 2014, pay 15% of discretionary income and receive forgiveness after 25 years. Borrowers with loans after July 1, 2025 will pay 10% of discretionary income, with forgiveness at 20 years. Discretionary income is defined as earnings above 150% of the federal poverty level.

Would you like to save this?

What Borrowers Should Know

Borrowers with existing loans have time to evaluate which option makes more sense. However, by July 1, 2026 and July 1, 2028, everyone on legacy income-driven plans will need to transition to either RAP or amended IBR.

The law requires that all loans eligible for income-based repayment be paid under the same plan, though exceptions remain for loans like Parent PLUS.

RAP can offer more flexibility on monthly payment amounts, especially for borrowers with children. IBR remains more familiar to current borrowers and offers slightly faster forgiveness for many, especially those with moderate incomes.

You can see our Repayment Assistance Plan Calculator here. You can see your IBR payment on our regular Student Loan Calculator here.

Sample Scenarios: IBR vs. RAP

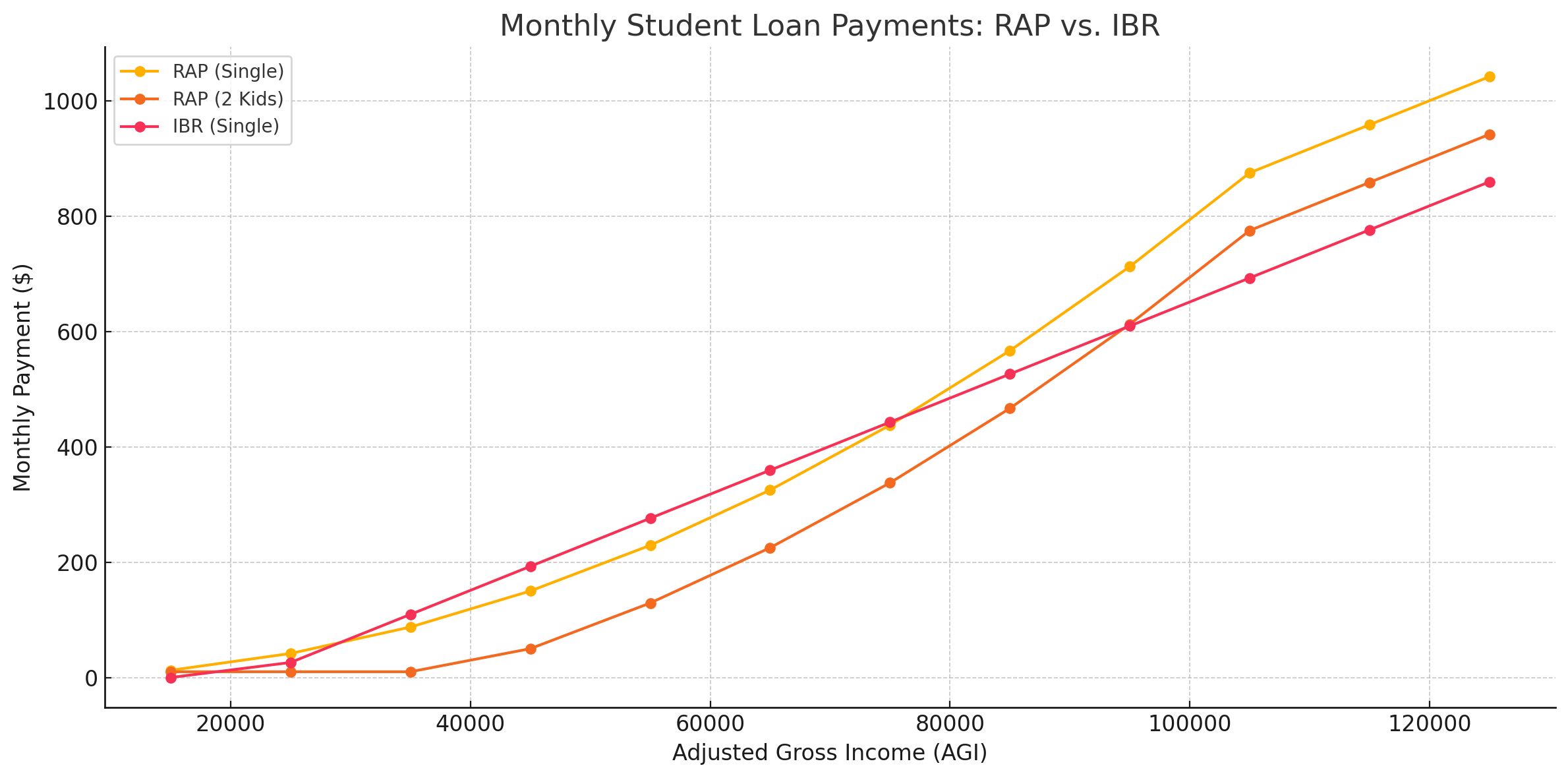

To better understand the differences between RAP and IBR, consider three typical borrower profiles.We're assuming the borrowers all have $40,000 in student loans and live in the lower 48 states.

1. Single borrower, $50,000 income, no children

- IBR: $228/month

- RAP: $167/month

In this scenario, the RAP plan offers a lower monthly payment.

2. Married borrower, $100,000 income, two children

- IBR: $443/month

- RAP: $650/month

In this scenario, the IBR plan would be a better option.

3. Single borrower, $80,000 income, one child

- IBR: $411/month

- RAP: $417/month

In this scenario, the monthly payments are nearly identical, but IBR is slightly lower (and since it would also offer 20 year forgiveness, versus 30, it's a better option).

Other Scenarios

We ran some other scenarios as well, and you can see that RAP typically has a lower monthly payment for borrowers earning less than $80,000 per year. However, once you cross about $90,000 in AGI, IBR starts to generally become the lowest monthly payment plan.

But every situation is different: marriage status, dependents, income. You need to run the RAP calculator and see your payment to know for sure.

Parent PLUS Loans Left Out

While the bill rewrites repayment options for most borrowers, Parent PLUS loans remain excluded. New Parent PLUS borrowers after July 1, 2026, will only be eligible for the Standard Plan. Existing Parent PLUS borrowers have narrow pathways to ICR via student loan consolidation.

If a borrower consolidates a Parent PLUS loan before June 30, 2026, they may become eligible for ICR and later transition to Old IBR. Those who have already double-consolidated can move to Old IBR before the July 1, 2028, deadline.

However, these strategies are complex have strict timelines.

Final Thoughts

It's frustrating to have to navigate new student loan repayment plan options. However, the new Repayment Assistance Plan (RAP) may be better for some borrowers than the current IBR options available.

For new borrowers, the decision on repayment plans will be easier – less plans means less confusion.

But for existing borrowers, having to migrate and decide on a new repayment plan option will be confusing. It's essential that you run the numbers and see which plan may work best for you depending on your financial situation.

Don't Miss These Other Stories:

Editor: Colin Graves

The post RAP vs. IBR: What Student Loan Borrowers Need To Know appeared first on The College Investor.