Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ripple’s dollar-pegged stablecoin, Ripple USD (RLUSD), has spent the past six months quietly becoming one of the fastest-growing assets in the $160 billion stable-value sector, even though almost all of its issuance still sits on a rival network, not the XRP Ledger. That dichotomy—95 percent of the $455 million supply now lives on Ethereum—was the starting point for a lively weekend exchange on X between XRP pundit “Crypto Eri” and sceptics who questioned whether Ripple’s plans would ever benefit the XRP Ledger (XRPL) itself.

XRP’s Hidden Advantage?

“Ripple is a long-game player,” Eri wrote. “Its public statements to integrate smart contracts on the mainnet will eventually position RLUSD on XRPL as a more competitive stablecoin, with faster and cheaper settlements than Ethereum.”

The remark landed just days after Ripple switched on its EVM-compatible sidechain, bringing full Ethereum-style smart-contract functionality to XRPL on 30 June 2025. More than 1,400 contracts were deployed in the first week, according to developer telemetry, and the bridge is already live to 80 other chains through Axelar.

Related Reading

On-chain data underscore the stakes. RLUSD’s circulating supply rose by 47 percent in June alone to $455 million, the fastest pace among major stablecoins, with roughly $390 million now native to Ethereum after a four-fold expansion since January. Only about $65 million remains on XRPL. That imbalance prompted one user to tell Eri that RLUSD’s utility “impacts ETH more than XRP.” She conceded the point—“correct, for now”—but argued demand would migrate once XRPL’s programmability and liquidity deepen.

Ripple’s strategy hinges on more than code. On 2 June the company applied to the US Office of the Comptroller of the Currency for a national trust-bank charter. A parallel filing by its subsidiary, Standard Custody & Trust, seeks a Federal Reserve master account so that RLUSD reserves can eventually sit at the central bank rather than a correspondent institution.

The timing aligns with the pending GENIUS Act, bipartisan legislation that for the first time would impose a single federal regime on payment-stablecoin issuers. While the bill’s $10 billion-asset threshold means RLUSD could remain under New York oversight for now, the application positions Ripple to graduate into federal supervision voluntarily—a move CEO Brad Garlinghouse has called a “new (and unique!) benchmark for trust in the stablecoin market.”

Eri underscored the charter angle in her post: “The national banking license application, aligned with the GENIUS Act, secures a Federal Reserve master account … enhancing trust, expanding crypto financial and payment services, and removing the patchwork of state licenses, enabling continued scalability at lower cost.”

Related Reading

If the charter is granted and RLUSD begins to migrate on-demand to XRPL, two flywheels favor the native token, analysts say. First, RLUSD remittances on XRPL would pay transaction fees in XRP, turning every dollar of stablecoin volume into incremental demand for the asset Ripple still holds in large quantities. Second, the EVM sidechain lets decentralized-finance builders tap RLUSD liquidity without leaving XRP’s low-cost consensus layer, potentially reversing the flow of users and liquidity that has so far moved toward Ethereum.

“These calculated steps in the $$$$$-dollar stablecoin market give the digital asset XRP enormous potential, but require more time to unfold,” Eri argues.

For now, RLUSD’s growth is still driven by Ethereum’s DeFi economy, and sceptics like user “sammie” insist “it’s always going to be like this.” Eri’s final reply was succinct: “Let’s see. I know we’ll be touching base often!”

That brevity captures both the promise and the uncertainty ahead. Technical rails are in place; regulatory applications are filed. Whether capital, compliance, and market demand will converge quickly enough to shift billions of RLUSD onto XRPL—and in turn lift XRP’s utility—remains the multi-billion-dollar question.

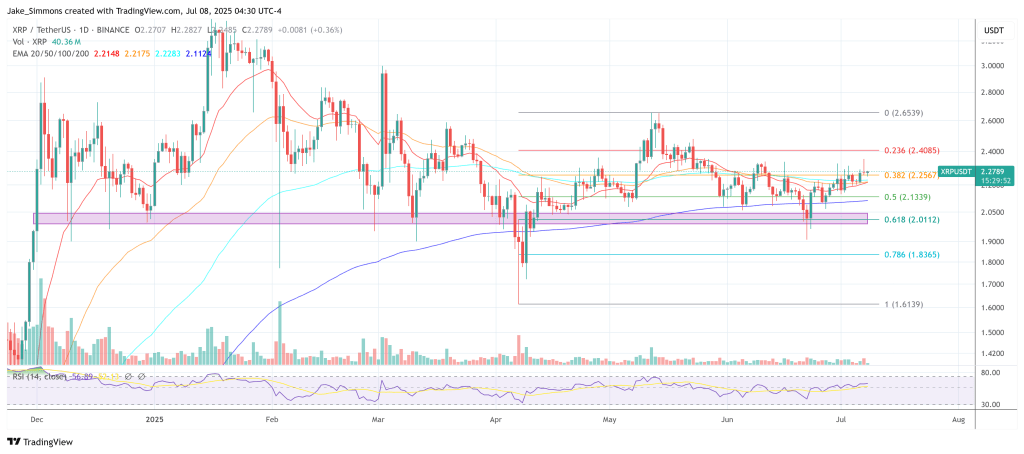

At press time, XRP traded at $2.27.

Featured image created with DALL.E, chart from TradingView.com