The S&P 500 did something in August that hasn't occurred under any second-term president since 1950.

For more than a century, the stock market has been a stomping ground for wealth creation. Though other asset classes have generated positive nominal returns, stocks have delivered the highest average annual return over ultra-long stretches.

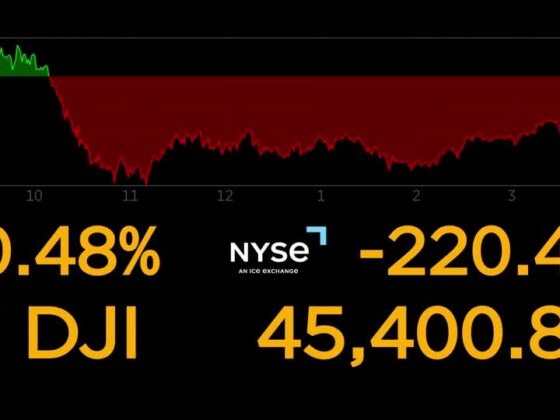

But building wealth on Wall Street isn't without its hiccups. Stock market corrections, bear markets, and even crashes are the price investors pay for admission to this long-term prosperity machine. We witnessed this volatility in action earlier this year, with the benchmark S&P 500 (^GSPC -0.32%) registering its fifth-steepest two-day percentage decline since 1950, along with the iconic Dow Jones Industrial Average (^DJI -0.48%) and the growth-fueled Nasdaq Composite (^IXIC -0.03%) dipping by double-digit percentages.

President Trump delivering remarks. Image source: Official White House Photo by Tia Dufour, courtesy of the National Archives.

The primary catalyst behind this heightened volatility was President Donald Trump. Though his policies and proposals have, on occasion, whipsawed Wall Street, Trump has also overseen a bit of stock market history by accomplishing something no other president has in 75 years.

President Trump accomplished something six presidents before him failed to do

As you've probably noticed, the S&P 500, Dow Jones, and Nasdaq Composite have all zoomed to record closing highs in recent weeks.

Investors have been excited about the possibility of the Federal Reserve recommencing its rate-easing cycle when it meets in less than two weeks. Lower interest rates tend to encourage borrowing, which at the corporate level can lead to increased hiring, more spending on innovation, and an uptick in merger and acquisition activity.

Additionally, the euphoria surrounding artificial intelligence (AI) has helped lift the broader market. By one estimate, AI could add $15.7 trillion to global gross domestic product come 2030, which makes it the most game-changing technological innovation since the proliferation of the internet in the mid-1990s. Aggressive spending on AI data center infrastructure by most members of the “Magnificent Seven” is fueling investor optimism.

There's also the possibility that Trump's tariff and trade policy uncertainty will be mostly in the rearview mirror. This may have been the primary catalyst that led to Trump's history-making moment in August.

Stocks have never been higher in August under a second term president in a post-election year.

6 for 6 lower. pic.twitter.com/Ej4CFwftNe

— Ryan Detrick, CMT (@RyanDetrick) August 1, 2025

According to data collected by Carson Group's Chief Market Strategist, Ryan Detrick, all six second-term presidents since 1950 endured an S&P 500 decline in August in their post-election year. But with the S&P 500 climbing by 1.9% in August, Trump broke this streak.

Though overseeing this bit of stock market history isn't necessarily a predictor of things to come, it is noteworthy considering how well the S&P 500, Dow Jones, and Nasdaq Composite performed during Trump's first term.

Don't uncork the champagne just yet…

While optimists have undoubtedly enjoyed the strength Wall Street has exhibited over the last five months, it's a bit premature to go uncorking the champagne bottles. Even though some clouds have cleared, two monumental headwinds stand directly in the path of this bull market.

Arguably, the most front-and-center issue for the stock market is its historically expensive valuation. While the rise of AI has expanded earnings multiples and increased growth expectations for most of the Magnificent Seven, there's little denying that stocks are pricey.

The best apples-to-apples valuation measure is the S&P 500's Shiller price-to-earnings (P/E) ratio, which is also known as the cyclically adjusted P/E Ratio (CAPE ratio).

When back-tested over 154 years, the Shiller P/E has averaged a multiple of 17.28. Recently, it surpassed 39, marking the third-priciest continuous bull market in history. Prior instances where the Shiller P/E ratio surpassed 30 for a period of at least two months were eventually followed by downturns of 20% or greater in the S&P 500, Dow Jones, and/or Nasdaq Composite.

S&P 500 Shiller CAPE Ratio data by YCharts. CAPE ratio = cyclically adjusted price-to-earnings ratio.

Secondly, we don't know the full effect that Donald Trump's tariff policy is going to have on the U.S. economy. Putting aside that U.S. courts are still determining whether or not many of Trump's tariffs are legal, the president's policies run the risk of reigniting the prevailing rate of inflation in the U.S.

A study published by four New York Federal Reserve economists via Liberty Street Economics in December 2024 (Do Import Tariffs Protect U.S. Firms?) pointed to Trump's China tariffs in 2018-2019 as a warning of what may come.

Specifically, they noted that Trump's China trade policy during his first term made little differentiation between output and input tariffs. The former is placed on a finished product imported into the country, while an input tariff is a duty assigned to a component used to complete the manufacture of a product domestically. Input tariffs can make domestic production pricier and increase inflation.

Although some level of inflation is expected, rising prices, when coupled with a weakening jobs market, as we've witnessed in recent months, may pave the way for the Fed's worst-case scenario: stagflation.

Image source: Getty Images.

Statistically, stocks have been a slam-dunk long-term investment

Uncertainty and volatility are unavoidable aspects of putting your money to work on Wall Street. But even though there's no quick fix to Trump's tariff uncertainty or an undeniably expensive stock market, historical precedent clearly favors investors with a long-term mindset.

For example, the analysts at Crestmont Research refresh a data set annually that examines the rolling 20-year total returns (including dividends paid) of the benchmark S&P 500 when back-tested to the start of the 20th century. Even though the S&P didn't officially exist until 1923, researchers were able to track the performance of its components in other major indexes from 1900 to 1923. This led to 106 rolling 20-year periods of total return data to analyze (1900-1919, 1901-1920, and so on, to 2005-2024).

What Crestmont discovered was that all 106 rolling 20-year periods yielded positive annualized returns. In simpler terms, if you had, hypothetically, purchased an S&P 500 tracking index at any point between 1900 and 2005 and held it for 20 years, you'd have generated a positive return, including dividends, every time. Regardless of whether you held through a recession, depression, war, tariffs, stagflation, hyperinflation, a pandemic, or whatever other scenario you can think of, the benchmark S&P 500 was always higher 20 years later.

Bespoke Investment Group also highlighted the disproportionate nature of stock market cycles via a post on X (formerly Twitter) in June 2023.

It's official. A new bull market is confirmed.

The S&P 500 is now up 20% from its 10/12/22 closing low. The prior bear market saw the index fall 25.4% over 282 days.

Read more at https://t.co/H4p1RcpfIn. pic.twitter.com/tnRz1wdonp

— Bespoke (@bespokeinvest) June 8, 2023

The analysts at Bespoke compared the length of every bull and bear market in the S&P 500 dating back to the start of the Great Depression in September 1929. This yielded 27 separate bull and bear markets.

On one end of the spectrum, the average S&P 500 bear market lasted 286 calendar days, or approximately 9.5 months. But when the pendulum swung in the other direction, it led to bull markets lasting about 3.5 times as long (1,011 calendar days) over this nearly 94-year stretch.

Regardless of what uncertainties may unfold over the next week, month, or year, historical precedent is quite clear that the U.S. economy and stock market are both expected to grow over time.