Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

So intertwined are the gilt market and the structure of the UK pension system that it’s hard to understand one without studying the other. As Liz Truss will attest, failure to do so can lead to a chaotic defenestration be problematic.

Pension funds’ almost price-insensitive demand for long-dated bonds over many years moulded the term structure of the market and the shape of the yield curve. But on Monday, the UK Office for Budget Responsibility — in its annual assessment of fiscal risks and sustainability — called time on the relationship.

From a gilt-holder’s perspective, this is their wow chart:

As Sam Fleming and Mary McDougall reported in MainFT:

The watchdog projected that UK pension fund ownership of gilts will fall from almost 30 per cent of GDP in 2025 to 11 per cent by 2074.

As the chart makes clear, the big change is among private sector defined benefit pension schemes that are closed to either new entrants or further accruals.

These funds collectively own around £560bn of gilts, according to the OBR’s estimates. As scheme members retire or die over the next twenty odd years, so will they liquidate their holdings — and the OBR projects that the bulk will be sold liquidated over the next decade.

For comparison, the Bank of England’s QE stock of gilts stood at around £590bn at the beginning of July, and QT has been running at £100bn per annum (though the pace is expected to slow from September).

And neither bulk annuity insurers nor defined contribution pension funds will be taking up the slack.

DC pension allocations to gilts today are a modest 7 per cent of assets, and while the size of the DC funds are projected to grow, the OBR does not project an increased allocation — or at least not one sufficiently large to offset the DB fund sales. Even in an alternate scenario where fund assets allocated to gilts ramp up by 25 percentage points, they see overall pension demand falling.

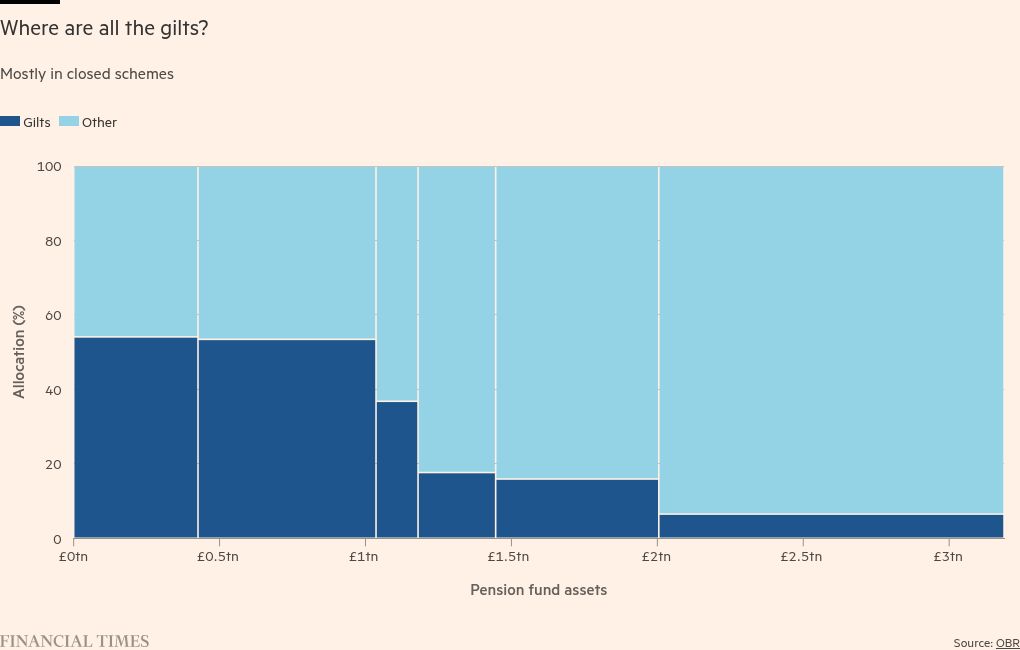

Helpfully the OBR — drawing on analysis by the PPI — breaks down current gilt holdings across the £3.2tn funded UK pension system. Hover your mouse over our Marimekko chart to see how many gilts are owned by each pension fund type:

Closed defined benefit schemes are the two categories on the left — collectively accounting for more than £1tn of assets, and each allocating more than half of their assets to gilts. These funds are in run-off mode and will have expired over the OBR’s long-term forecast horizon, having sold all their assets.

What does reduced pension fund demand for gilts mean for yields? Using elasticities of demand pulled from a Banque de France working paper examining demand for Eurozone bonds, the OBR calculates that:

. . . if pension funds lower their demand for gilts by 19 per cent of GDP, the overall interest rate on UK government debt could rise around 0.8 percentage points. This would increase debt interest spending over the next several decades by around 0.8 per cent of GDP, were total government debt to remain at around its current level of close to 100 per cent of GDP. In current prices and at today’s level of GDP that would eventually result in an increase in annual debt interest costs of around £22 billion.

But they heavily caveat this number, based as it is on a series of unknown variables.

The number could — they argue — be much larger than £22bn if debt rises. Or smaller if bond yields decline. And the calculation is based on the ideas that a Eurozone elasticity translates to the UK market, that nothing else might shake up global supply and demand for government bonds, and that peak pension demand for gilts is not already in the price.

Peak gilt demand from pensions should not be new news to gilt-types, to pension-types, to the government, or the DMO. Nor should it be a great surprise to loyal Alphaville readers — we covered the issue most recently in March when BofA’s Mark Capleton and Barclays’ Moyeen Islam called for a material reduction in long-dated gilt issuance.

But we’ve not seen the issue so comprehensively or so clearly analysed before. Nor using charts so beautifully and effectively.

The author has direct holdings of gilts in a personal capacity. 😬