PayPal (ticker: PYPL) got on my radar because it has earnings, beaten down (for a long time), and on paper looks surprising cheap enough at first glance.

This is not the kind of high quality stock that has a defensible moat that was sold down for reasons that looks fixable.

What PayPal Does (In Brief)

Paypal in its early days was an internet checkout payments gateway before it was acquired by internet auction company Ebay in 2002. Ebay made Paypal its default payments option.

Being the default option of an internet commerce automatically gives it a business. The early builders of Paypal eventually went on to do great things. You can Google up “the PayPal Mafias” to see who came out of there. They are Peter Thiel, Max Levchin (Slide, Affirm), Elon Musk, Reid Hoffman (LinkedIn), David Sacks (Yammer, Craft Ventures), Jawed Karim & Steve Chen (YouTube), Russel Simmons (Yelp).

These days, Pypl (I will refer to it by its ticker symbol) is known as a business made up of digital wallets (PayPal, Venmo, PayPal Credit, and Honey), merchant services that links and process for B2B (Braintree, Zettle) and a payment gateway/infrastructure.

As a digital wallet, PayPal, Venmo and Honey hold your balances, link bank credit cards and accounts and help you pay. Venmo has not much presence internationally but it is very popular in the US as a social-digital wallet.

While it looks free, there are many points that Pypl will be paid:

- Merchant Transaction Fees: This is the main source of fees.

- When you pay with your PayPal balance, linked card, or bank via the wallet, the merchant is charged a transaction fee (a percentage + fixed fee). E.g. 2.9% + 0.3% per transaction (this varies by country, merchant type, and pricing plan)

- If you pay with Venmo, merchants accepting Venmo as a payment type via Pypl’s network also pay fees.

- Currency Conversion Fees: If you pay in a foreign currency with the wallet, Pypl has an exchange rate markup

- 3-4% above the mid-market (Kyith: This is damn fxxked up. This bothered me for a long time and I went on a quest to find alternatives)

- Peer-to-Peer Funding Fees: Send money to friends/family from PayPal balance or link bank is free but if you transfer with a credit or debit card, Pypl charges 2.9% + fixed fee.

- Withdrawal & instant transfer fees: Standard bank transfers are free but instant transfers to debit cards or bank accounts cost 1.75% per transfers. Instant transfers gives people immediate access to wallet funds.

- Credit: PayPal Credit, Pay in 4 (BNPL), Venmo Credit Card. Pypl earns interest income, late fees and a cut from issuing bank partners.

- Others: Bill pay, remittances, deals and cashback integration via Honey.

A digital wallet charges when you want to move out, or you wish for convenience.

The second segment is the B2B segment where Braintree and Zettle belong to after Pypl acquired them. Pypl called them the unbranded processing business because they work in the backend and people don’t see Pypl’s logo.

If you are an online business, you want to let your customers checkout and have access to a bunch of payment options. That is what Braintree does. It is to make it seem you have a payment means but doesn’t show PayPal to your client front and center.

Zettle is like Square for small shops which provides card readers, point of sale systems and software.

The final segment is Pypl as a process infrastructure. Processing is doing the middleman work of moving money securely from the customer’s bank to the merchant’s bank. We can decompose this to a few areas:

- Authorization:

- Does the customer have enough funds/credit?

- Check with the card network (Visa/Mastercard/Amex) and the customer’s bank.

- Authentication & security:

- Making sure that the payment is legitimate (through fraud checks, tokenization and encryption).

- Settlement & funding:

- Move money from customer account -> through the card network -> into merchant account.

- Do it fast enough (1-2 days)

- Reconciliation and reporting:

- Gives the merchant records, dashboards, and tools to track transactions.

The charging is through segment 2 but this is pretty much a cost center. This whole set is the fixed cost even though in a non-traditional fixed cost sense.

PayPal Looks Not too Expensive on Paper

If you sum up this business is about: [How many people x % of people actually use, the quality] x how much you charge by transactions – the fixed cost.

PyPl is cheap relative to known competitors like Adyen, Block, Visa, Mastercard in terms of price earnings.

If we use last 4 quarter’s earnings per share, Pypl trades at a 7.2% earnings yield or 13.8 times PE (31 Aug 2025). Pypl currently have committed to buying back U$6 billion worth of stocks. They are committing 75% of their free cash flows to buybacks so you can kind of guess how much flow money they have. Now it is very common for tech companies to buy back stock because they have so much stock-based compensation. Buying back is to prevent the dilution from the share issuance via stock-based compensation. Pypl stock based compensation comes to U$1 billion.

PyPl has a net debt of U$2 billion and current market cap of U$68 billion based on a share price of $70.19.

The free cash flow yield (express via buyback amount) is 8.5% and if less the stock-based compensation is 7.1%. I think if you read this article of mine before, you would know the significance of buybacks done right.

Here are the operators in PyPl’s digital wallet, payment processor and BNPL space:

- Mastercard (MA): 40 times

- Visa (V): 34 times

- Adyen: 27 times FCF (no debt), 45 times earnings.

- Block (XYZ): 17 times

- Wise (Wise.L): 26 times

- Global Payments (GPN): 15 times

- Remitly (RELY): 296 times

- Fiserv (FI): 23 times

Block and Global Payments are close to where PyPl trades at and you can see the similarities in that they experience some sort of plateau in user growth. Block whose Cash App is competitive with Venmo, saw it’s growth plateau in 2024. Its revenue is still rising, and so is its user engagement. Like PyPl, Block is also in the optimization phase of getting more out of its base. Global Payments also saw a deceleration in growth in 2024. This might be a reason why they acquired WorldPay in Apr 2025.

You can see here that this place is competitive.

Steve Eisman said in his podcasts that many of these companies said they are here to disrupt Mastercard and Visa. But a few years later, they all changed their tune.

The big shots here is Mastercard and Visa with the real moat of having created that train track between consumers, banks and being so widely accepted.

Everyone else is trying to fight for different parts of the pie.

Thus you can see the premium that the two trades at. The rest (Adyen, Wise, Remitly) do have some sort of growth, in the eyes of investors. In a way, Fiserv which serves 42% of banks and 31% of credit union seem to trade at a valuation that implies that they have an advantage.

If you don’t have growth, or give a poor guidance of future growth, your share price is going to be punish severely.

So companies like Block, GPN, PyPl trades like they either going to die or a value stock.

I guess their valuation shows that some years they will face significant challenges to top and bottomline (due to their lack of quality) and some years they will make up for it. This means the earnings experience is going to be volatile.

If so, for business which looks relatively large scale, but not the most dominant, and some years good, some years bad, 15 times PE looks reasonable.

I am not sure if they are cheap. I think reasonable would be the right word.

What will be the thesis if we buy PyPl at this point?

- Valuation on no growth not demanding.

- 6-7% stock buy back at 14% ROIC and 22% ROE.

- This business as it is is sustainable. I.e. if it does not invest in growth capital expenditure, it can still do okay.

- The business has its flaws (if something is cheap, usually there are some challenges, just long lasting or fixable), but it trades reasonably cheap versus the flaws.

- There are call options, or areas that people have not detect because they didn’t do deep enough work. Since the market is so unforgiving to the downside, they also celebrate real upside if those misunderstood areas really materialized.

Reasons Why We Should Not Waste Our Time with PayPal

For those who would not buy or think that Pypl is not a good business, there are a couple of general points:

- The users is not growing. They have no moat. When Apple Pay, Google Pay develops, no one will use PayPal anymore.

- Stable coins and blockchain technology is a game changer because they will reduce the 3% fees a company like PayPal earns to a fraction of that.

Both of these are valid points for not just Pypl but also most of the competitors here.

The answer is somewhere in the middle. These firms (PyPl, Affirm, Block, Rely) sought to disrupt Visa and Mastercard for the longest time. Visa and Mastercard’s quest is to disrupt physical cash payments. And so if you have Apple Pay, Google Pay, who are they disrupting?

Companies that leverage on the Ethereum, Solana or whichever network has lower fees but one of the reason why we still stick with this platform is the authorization, authentication & security, settlement and funding and reporting. Can stable coins and block chain technology make it more seamless and lower cost? Yes.

Does that mean the traditional banks, Wise, Remitly, Block, PayPal cannot enjoy those advantages?

They can also enjoy.

What will happen if their margins increase, but we have more competitors? Hard to say but there is a path way to still keeping a reasonable business.

In order to have the same degree of trust, the new firms on the blockchain will have to scale up and deal with the same things these firms are dealing with.

I think the US is unique in that they don’t have a national system like our PayNow.

So what they deal with is the Zelle, Venmo.

Perhaps the newest one is FedNow, which was launched in July 2023. FedNow is the Federal Reserve’s new instant payments infrastructure which is aim to be the nationwide backbone for instant transfers, available to all banks. It is still rolling out and not widely adopted.

I think before talk about stable coins disruption, let’s see how Block and PayPal deal with something like this first. They will definitely take some hit. Logically, PayPal can integrate FedNow into their instant bank transfers which will make it faster, HyperWallet which handles the payouts to gig workers and market place. They can build it into their processing to be faster.

Why would they do this if it reduces their fees? They don’t really have a choice. If they do it earlier, there is greater adoption, more usage and thus more transactions that results in more fees.

We would be able to see it unfold.

Victaurs put out a few interesting Tweets:

The last three is probably about PyPl specifically and it deals with what people want to see but cannot see the changing story. If you consider that the growth of some of these firms are slow, and for some the bar is low, how difficult is for them to surprise on the upside.

Reasons to be Optimistic about PayPal

Thomas at Steady Compounding has the best detail about PayPal’s 2nd quarter results.

We can break the views into two groups, the metrics that show the state of current growth and in the second group where is the future potential.

State of current growth:

- Total payment transactions is negative. This is the headline number that most will grab at but it has to be put into context that the management is trying to rationalize the business at Braintree. If we exclude those rationalization and concentrate on what it should have been had we not had those less profitable Braintree transactions, then there is mid single digit growth.

- Transaction margin dollars that excludes customer balance is growing high single digits.

- Braintree total payment volume is now flat and they are expecting growth in Q3 and Q4 (this came as a surprise to Thomas)

More usage & new growth initiatives:

- Branded experiences total payment volume (those with PayPal or Venmo checkout as an example) is growing 8% year on year.

- BNPL total payment volume has 20% growth with 80% higher average order value.

- Users who first adopted PayPal debit card transacted six times more and generate two times average revenue per account.

- Venmo total payment volume is up 45% year on year.

- Monthly active accounts with pay with Venmo is up 25% year on year.

- Instead of competing based on fees for the unbranded checkout (Braintree), management have sought to make it less commoditized by adding Payouts via HyperWallet (paying gig workers), fraud protection and multi-channel integration.

- PayPal World which will try and integrate various payment wallets such as Mercado Pago (in Latin Amercia), Tenpay Global (China) and UPI (India) together.

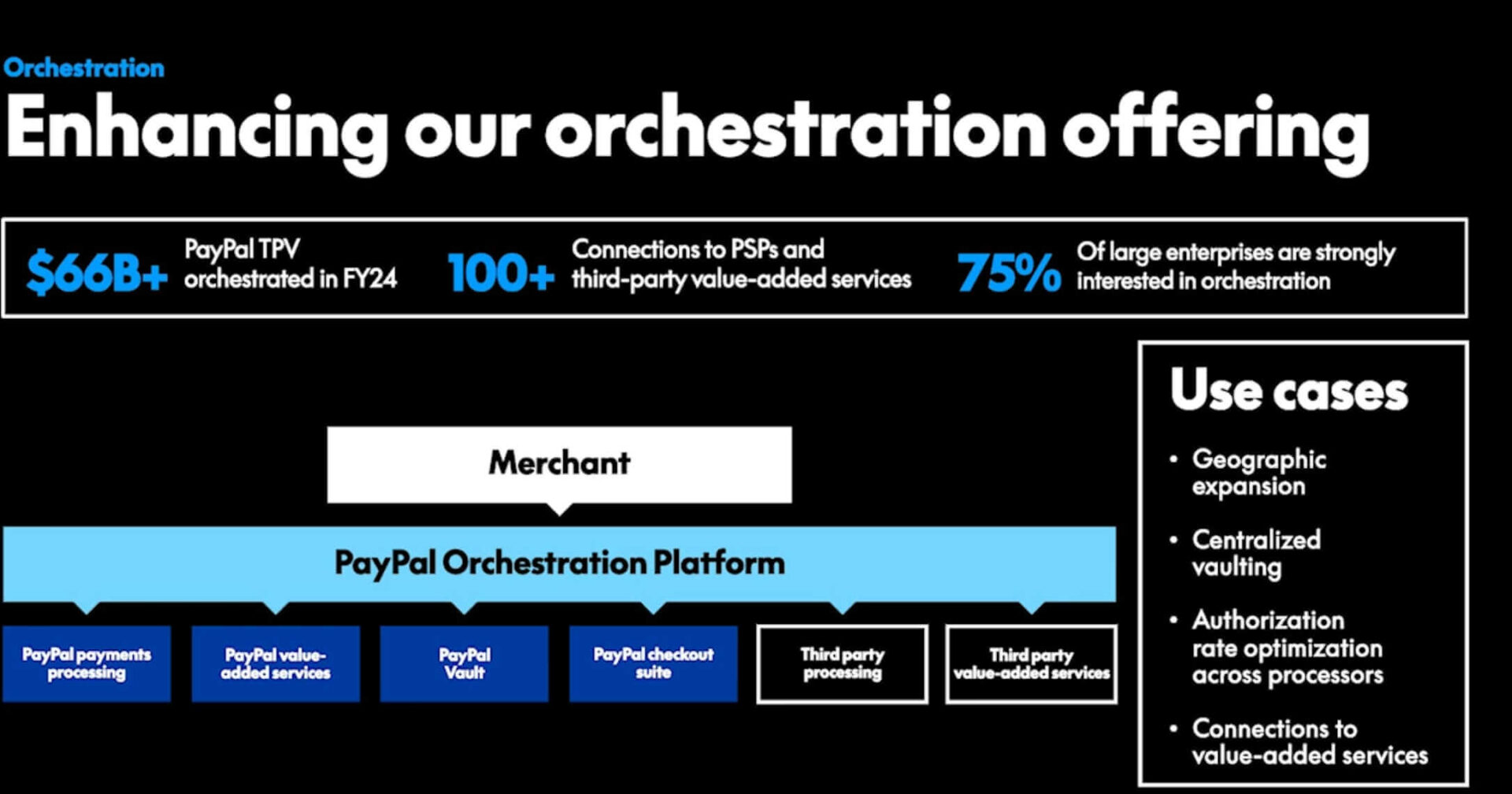

- Partnering with Perplexity, Anthropic, and Salesforce to enable AI agents to help customer find products then checkout.

- Advertising on platforms.

- What they can do with stablecoins and crypto

I think generally the feeling you should get at this point is that it is not downright dying in terms of revenue and earnings, and there might be some call options that would provide some upside. At the very least, these are the initiatives that keep the business going for longer.

I think PayPal makes people hopeful mainly also because of CEO Alex Chriss. Alex has been the CEO of PayPal since September 2023. He was with Intuit (INTU) for 19 years. If you don’t know Intuit, personal finance folks will remember the personal finance app Quicken. They are known more for QuickBooks which is an application that help small business manage their accounting (which is a big deal in US).

Alex has front row seats to see how to craft a business around a main product whose main customer is small businesses at Intuit. They would probably need to create income streams with a rather sticky product (Quickbooks). Alex led the U$12 billion acquisition of Mailchimp. Mailchimp may be something some of you remember as the one that provide you mailing list management.

Alex replaced a lot of the management. In the second video in the resources section, they have discussion regarding the compensation structure of the management (at 52 min). Every member of the team is measured on two metrics. The first is transaction margin dollars, and the second is free cash flow per share. The new CFO, who used to work in GE and IBM, has incentive to keep operating cost low and improve revenue to free cash flow conversion. A significant part of her compensation is in stock options that she can only get in 2027 and only if the 3 year total shareholder return beat the S&P 500. This is the same for the rest of the management team and they are incentivize to make it perform for these 3 years.

Since end 2023, we can witness Alex’s execution and so far it has been okay. Instead of choose to make some big acquisition, they decide to work with what they got, improving the customer experience, forging partners.

I think Dr. Mark Grether might also be an interesting hire as well. He joins PayPal as the general manager for PayPal ads, from Uber Advertising. He was:

- Ceo of Sizmek an advertising platform acquired by Amazon in 2019

- Director of Product Strategy at Amazon Ads.

- General manager of Uber Advertising.

He grew Uber’s annual revenue to $1 billion. That is less than 2% of Uber’s revenue but I think its tough to extrapolate that. Mark has front row seats to two businesses that not too long ago grew an advertising segment from nothing.

You would at least want someone with that kind of experience in if you want to grow it.

I think like what Thomas say, lets see what they are able to do.

The margin of safety for PayPal in my opinion is not much. You would hope that without much earning growth it trades at more than 10% earnings yield. At this price, it is a good deal if we are quietly confident that some of these call options would worked out.

Payments companies, aside from PayPal have not done well during this quarter’s financial results as well. If you view this as a general business cycle thingy, this might be a better time than buying when the business cycle is hot.

The lower expectations might also help those who have not invested because any positive earnings surprise might create a big enough effect for the timers. (but it also works the other way)

I used to think that PayPal is a company with more operating leverage (high fixed cost but if you can increase revenue, the incremental revenue will flow to earnings). But PayPal’s earnings look relatively stable despite the volatility in revenue. But I think the operating leverage might come in the future if the current manpower find incremental improvements in customer usage, or create complementary segments.

If you are looking for clear growth, and paying fair value for this, I am not sure PayPal is for you.

Additional Resources.

Here are some resources that shape my perspectives on PayPal aside from Thomas’ post (he seldom share things outside his paywall so you should have a read!)

This video between three person who has been observing PayPal for a while is 1.5 hours long (3 weeks ago):

The Investor’s podcast got interested in PayPal and this is 1 hour long (1 month ago):

Payments industry 101, 102 and beyond

9 Things The Stablecoin People Are Getting Wrong

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.