The market is a weird beast to figure out.

But one of our biggest challenge is helping our clients frame this weird beast in different ways. Most people would kind of thing that I know a lot of things and not many things will be quite unexpected to me.

But Today I am going to be open to talk a little about one of my blind spots.

Back during the Covid period, we thought that our wealth management business is going to be done for. Our bread and butter was to meet clients and we cannot even do that with social isolation.

Thankfully, we know it wasn’t so bad. Humans managed to make it work. Our CEO set a challenge to make 2020 our best year ever, and we did well. And we also did well in 2021 in terms of onboarding new clients.

I thought enough of what kind of markets would affect client’s emotions in investing. A lot of my thoughts centered around how those existing clients that were already onboard could be feeling and how to alleviate the uncertainty in their minds. Of course, there is also the emotions of those that have not vested and how to frame the volatility they just seen in the past six months or one year so that they are more comfortable to take the leap.

2021 was an easier year because the market just go up then dip, then go up then dip. Since we were past that all clear in August and September 2020, prospects were financially less emotional. The opportunity cost of not achieving their goals outweigh the emotional worry about the markets.

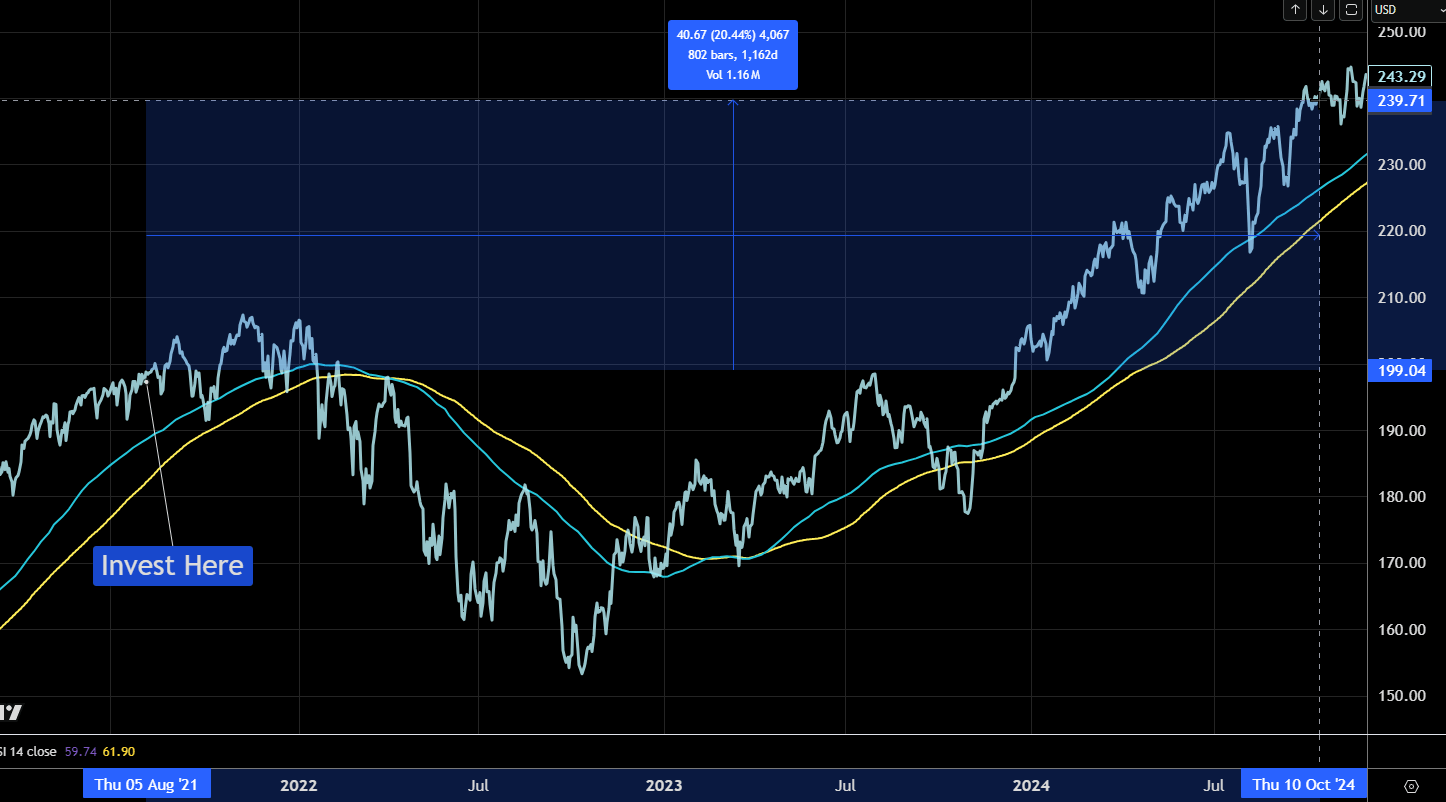

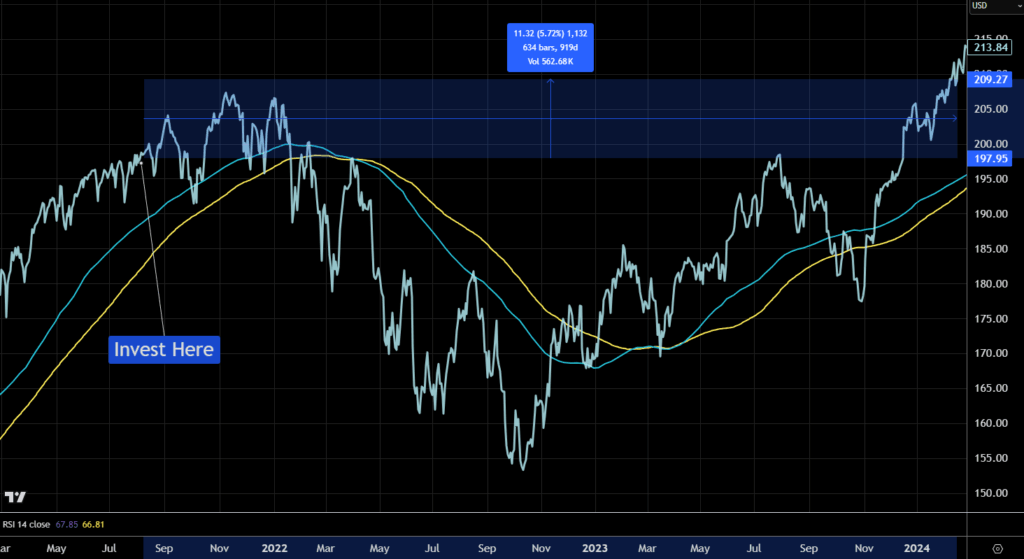

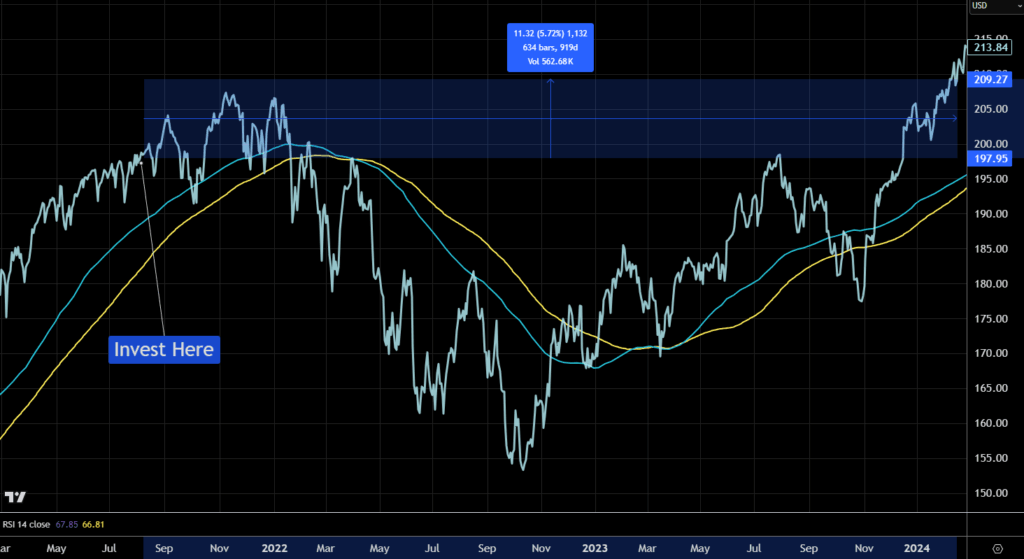

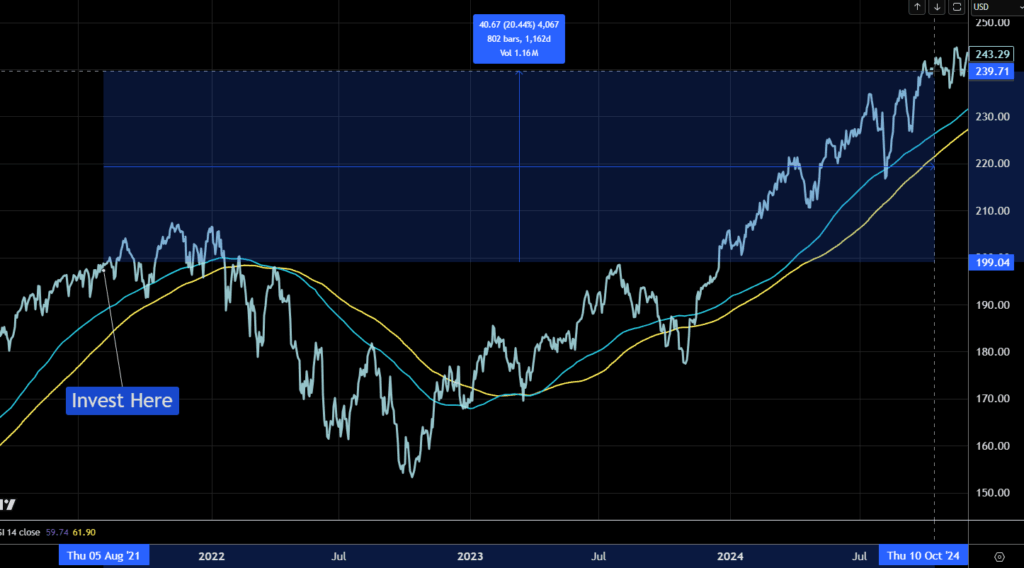

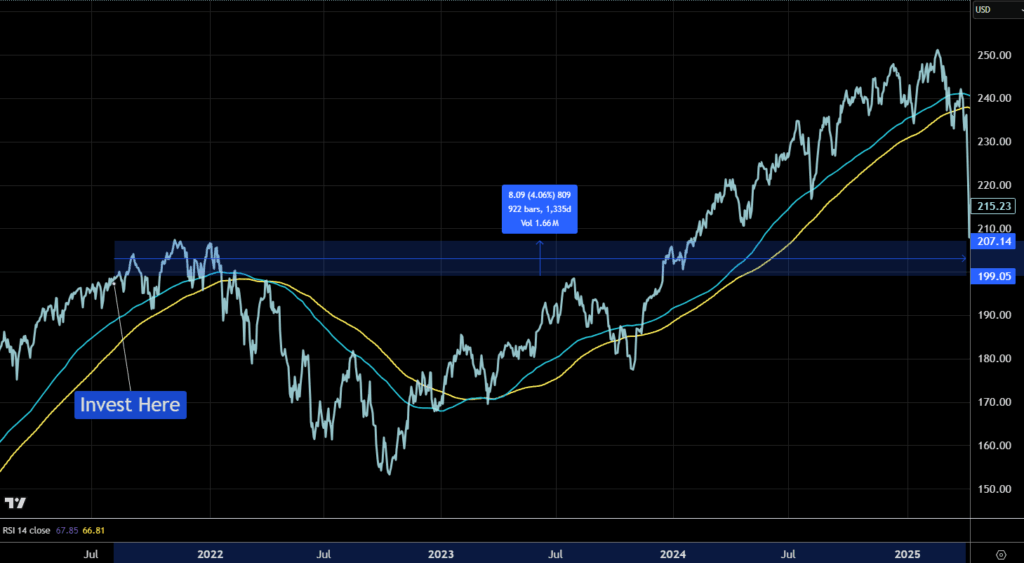

I will use a chart of the ETF IMID or the MSCI All Country World IMI ETF as an illustration:

If it is a good year for us means that we have many new clients that come onboard in late 2021.

My blind spot was not being aware that… if you have an easier time onboard clients… they might be onboarded right before volatility.

In hindsight, this was so stupid of me mentally because one of the big things I know is about sequence of return. If you manage to reach close to financial independence because of a very good markets… what comes next is…. perhaps a poor starting sequence… which is potentially that negative sequence that may kill an income stream prematurely.

I kind of know this better than a lot of people.

But the problem is like many, we have too much things to think about and it just didn’t occur to me that what affected financial independence income planning can affect the business side of the work we do in wealth advisory.

And so that batch of clients endure one year of 26% drawdown in the market.

Then if we revisit this in year 2 anniversary, the returns is a cumulative 5.7%. That is an annualize 2.8% p.a.

Some clients struggle to understand this. In some of their minds, equity does at least 7% if not 12% p.a. in the long run. So to see this after two long years, they would start wonder if they make the wrong decisions, especially if they have trusted us and invested the majority of their net wealth.

More and more, I see the high level, evergreen problem as an expectations versus reality problem.

You set unrealistic, or misinformed expectations, you will have to manage that big gap between reality when it happens.

In talking with investors, I see this “the long term average return of equities is X% p.a. I want to start investing because I think that gives me a chance to hit my goal.” too much.

If they see average interest rate to be 1%, 1%, 1%, 1% every year, they will see equity return to be 7%, 7%, 7%, 7% every year.

The mismatch is sometimes not the performance of the return but their original expectations mentally. (in actual fact, bank interest is also not 1%, 1%, 1%, 1% every year!)

The reality is the market is just a volatile beast.

The sooner you accept that to get that 7% p.a. long term return, you got to feel like shit sometimes.

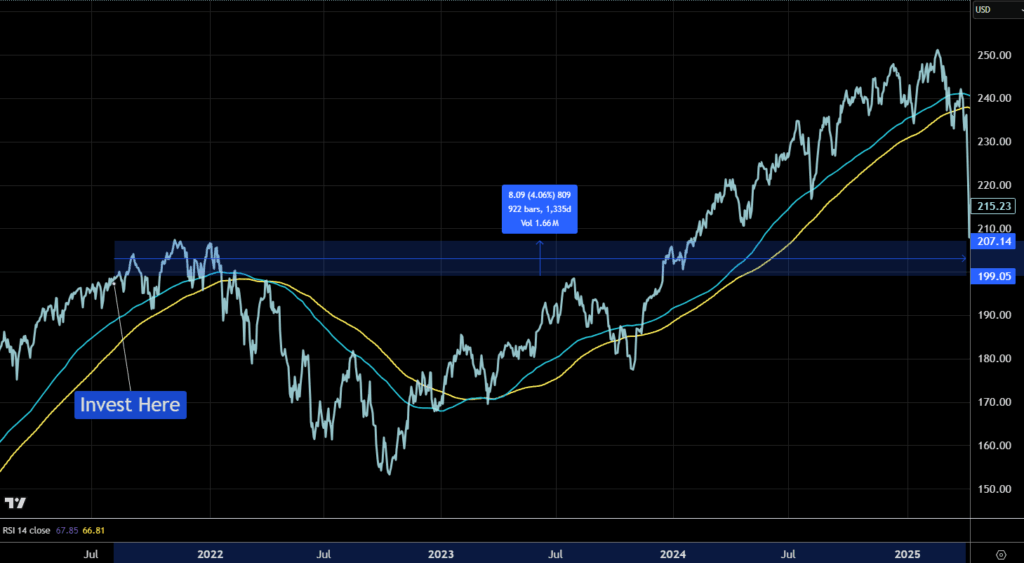

We can just move forward the time to a few months later in October 2024:

The cumulative for 3 years would be 20%. The annualized return becomes 6.4% p.a.

But then you forward about six months later:

Your cumulative returns is 4%!

That is an annualized return of 1.1% p.a. over 3.5 years!

I think some would wonder when Trump decided to kill the market, together with a falling USD if they made a mistake being in equities.

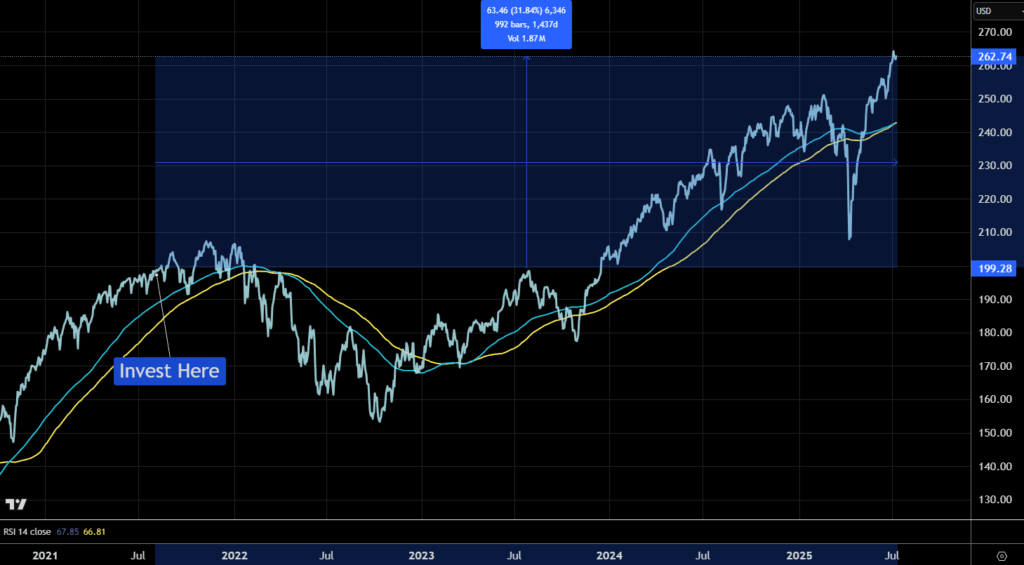

And here we are today:

The cumulative returns is about 31% and the annualized return over 4 years is about 7% p.a.

And I guess that is how the markets are.

There are some investors who wishes that they have invested earlier so that they don’t have to endure the “recent volatility”.

But I think that is a perception issue.

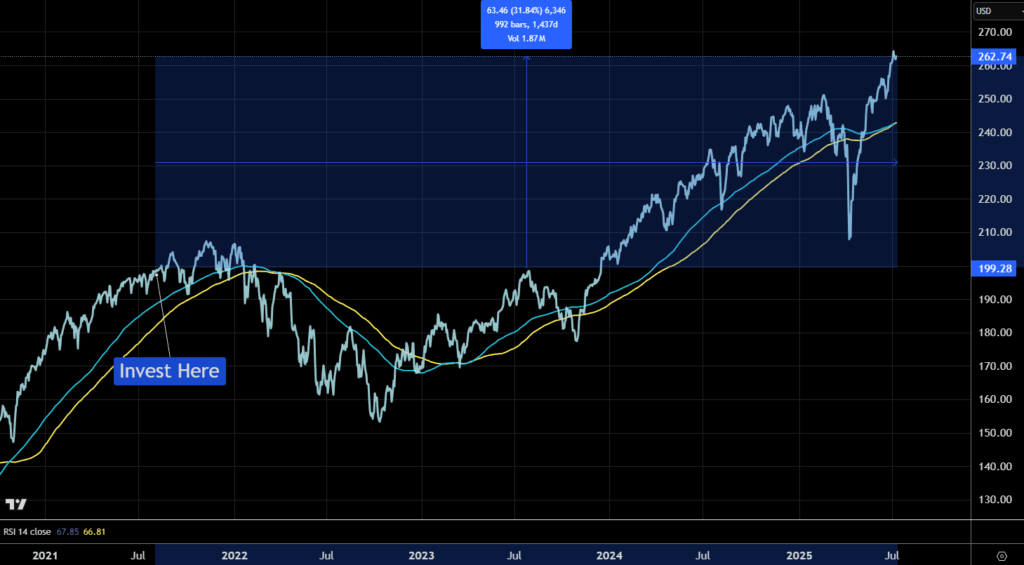

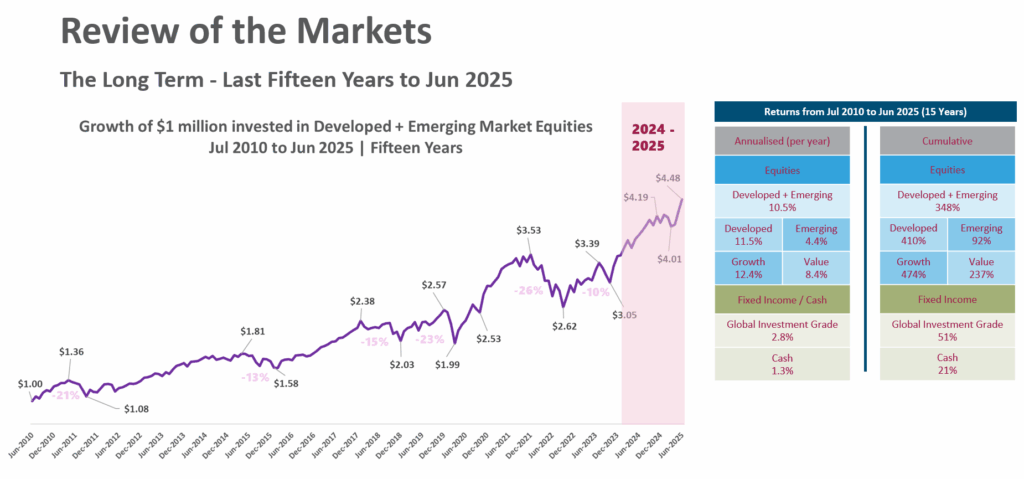

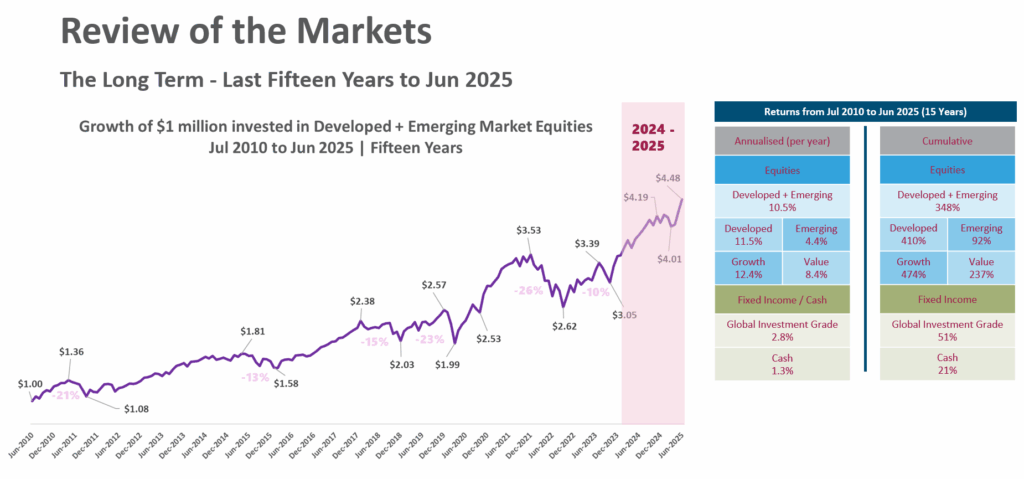

I crafted the following slides in something that our clients might get to see it if they come in to see their advisers:

It shows the same MSCI ACWI IMI over the past 15 years. Since ACWI IMI is Developed markets plus emerging markets large cap, mid cap and small caps, the annualized return is 10.5% and the cumulative return is 348%.

But the investor also eat a lot of shit the market throws at it along the way. The faint pink drawdowns show the evidence of that. And the folks that sit through it deserve the returns because they sat through those shit uncertainty the markets throw at them.

The evidence of a weaker emerging markets, of value shows that it is uncertain to always expect the markets to always do 10%, 10%, 10%, 10%, 10%.

What is also more underrated is whether developed, emerging, value, growth, small caps, fixed income investment grade, the critical part is whether you invest in any stuff at all. If you have you would be better than 15 years ago in aggregate.

You will only know in hindsight returns are this bad not when you live through it.

The advisory challenge is to shape the client’s perception to be closer to the reality. But if it is closer to reality it means another big challenge: Helping them to manage the emotional part when the market throws enough uncertainty shit at them.

What they will go through will be no different from you and I. The market does not identify that just because you are richer or poorer they should give some of us more money or take more from us. Both the high net worth and those with less can invest in the same fundamentally sound instruments. Their well implemented and fees are reasonable.

The real cost is not developing an understanding over them, and also bearing with the emotional & mental part.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.