Shares in Nvidia (NVDA) hovered around the flatline in pre-market trading on Wednesday morning, as investors awaited the release of the chipmaker's first quarter earnings after the US market close.

Nvidia's earnings announcement is the most-anticipated of the season, as investor expectations have become increasingly high around the company, given its role as an enabler of artificial intelligence (AI) technology.

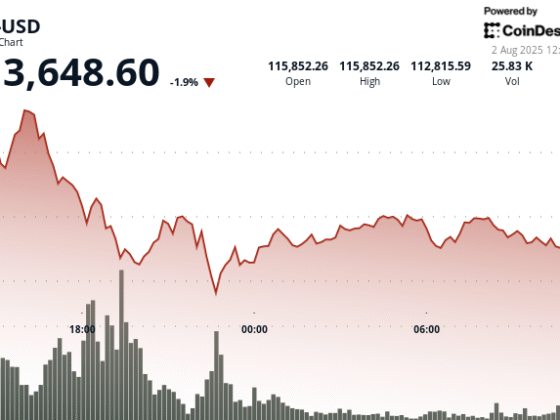

Trading has been choppy for the stock since the start of the year, leaving it up less than 1% year-to-date. The company has faced headwinds ranging from the release of a lower-cost AI model by Chinese startup DeepSeek to the Trump administration's ban on shipments of its H20 chips bound for China, as well as concerns related to expected semiconductor tariffs.

Ahead of the release of its latest earnings, CEO Jensen Huang showcased the company's new technologies at the Computex tradeshow in Taiwan last week, including its developments in humanoid robotics and custom AI infrastructure.

Read more: FTSE 100 LIVE: Stocks edge up as optimism over US-EU trade deal grows

For the first quarter, Nvidia is expected to report adjusted earnings per share (EPS) of $0.88 on revenue of $43.3bn (£32.05bn), according to Bloomberg analyst consensus data. In the same period last year, the company posted adjusted EPS of $0.61 on revenue of $26bn.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said: “All eyes will be drawn to Nvidia’s results due out later, and given the trade tariff turmoil which struck in April, there’s an expectation that the numbers and guidance might not be as stellar as investors have become used to.

“Nevertheless, Nvidia is still expected to rack up impressive sales growth of around 65% for the first quarter, year on year.

“There is an expectation that the outlook for Q2 will be slightly weaker than previously forecast, but there could well be a surprise on the upside. Updates from Nvidia’s mighty customers like Amazon, Alphabet, Microsoft and Meta show there is still hunger to develop AI products and services, which are reliant on the chip giant’s technology.”

Shares in Tesla surged nearly 7% on Tuesday but slipped slightly in pre-market trading on Wednesday morning, after CEO Elon Musk pledged to spend more time at the electric vehicle (EV) company and his other businesses.

Musk said in a post on his social media platform X on Saturday that he was back to “spending 24/7 at work” and “must be super focused on X/aAI and Tesla”.