Developments around US trade relations and economic concerns continue to occupy much of investors' attention, but earnings from chipmaking giant Nvidia (NVDA), among others, will also be in the spotlight in the coming week.

There will be a quieter start to the week with US markets closed on Monday for the Memorial Day holiday. UK markets will also be closed on Monday for the late May bank holiday.

After traders return from the long weekend, the major focus will be on Nvidia (NVDA), which is due to release first quarter earnings on the Wednesday, as the last of the Magnificent 7 tech behemoths to report this earnings season.

Salesforce (CRM), which provides customer relationship management (CRM) software, is another key tech name reporting on Wednesday.

Computer maker Dell (DELL) is then set to report on Thursday, on the back of it unveiling new AI servers powered by Nvidia (NVDA) chips this week.

In the retail sector, investors will be looking at wholesale retailer Costco's (COST) latest results, to help gauge US consumer sentiment amid economic uncertainty.

On the London market, investors will be hoping that B&Q-owner Kingfisher (KGF.L) has benefitted from the UK's rise in retail sales, thanks to warmer weather in April.

Here's more on what to look out for:

Expectations have become increasingly high around Nvidia (NVDA) earnings, which was demonstrated in the market reaction to its full-year results in February.

Shares fell after the release of the results, despite the chipmaker beating estimates on the top and bottom line. Revenue of $39.3bn (£29.1bn) beat estimates of £38.2bn and earnings per share of $0.89 were also ahead of forecasts of $0.84. In addition, the company said it expected to generate revenue of $43bn for the first quarter, better than the $42.3bn expected.

However, Nvidia (NVDA) guided to gross profit margins of 70.6% to 71% in the first quarter, which would be down on the 73% it reported in the fourth quarter.

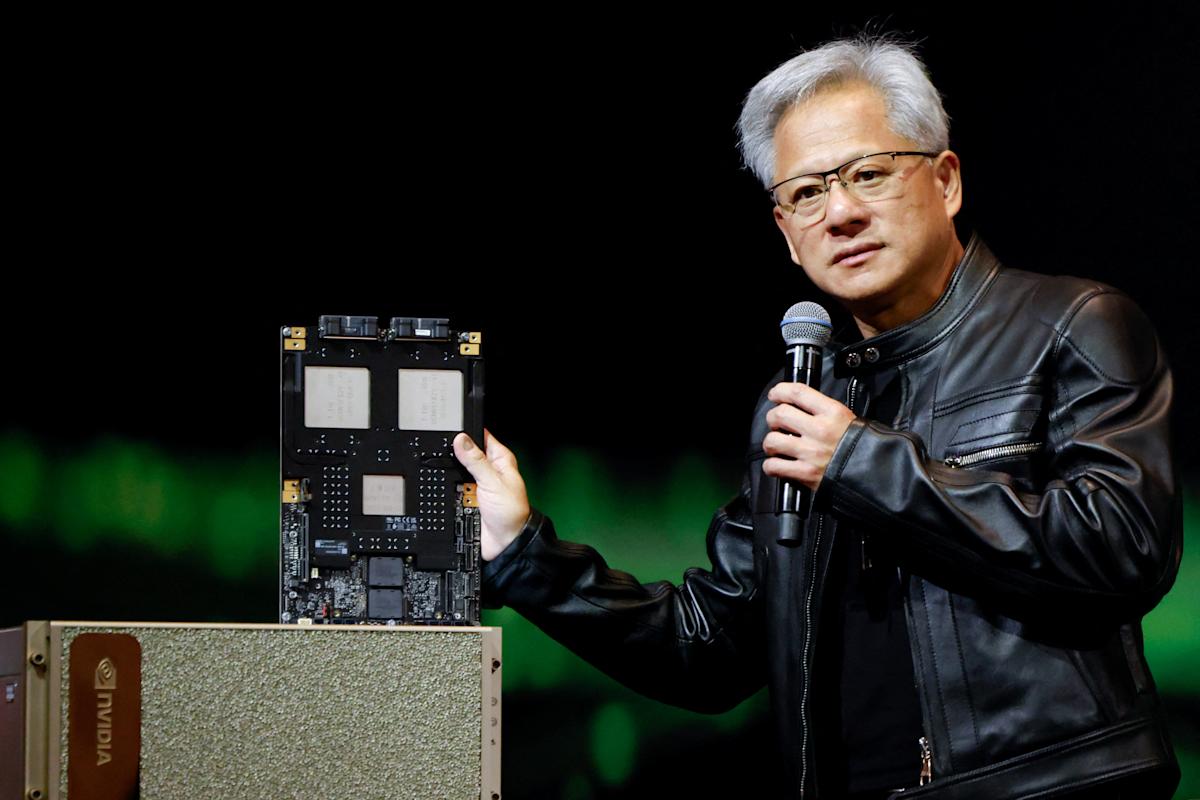

Ahead of its latest earnings, Nvidia (NVDA) made a flurry of announcements around new technologies at the start of this week, with CEO Jensen Huang revealing more details at the Computex tech expo in Taipei, Taiwan.

This included showcasing Nvidia's (NVDA) Isaac GR00T-Dreams, which the company described as a blueprint that helps generate large amounts of synthetic motion data that physical artificial intelligence (AI) developers can use to teach robots new behaviours.

Read more: Five ‘buy' rated European travel stocks