Shares in Nvidia (NVDA) popped 3.5% in pre-market trading on Tuesday, after the company said that it would resume sales of its H20 artificial intelligence (AI) chips in China.

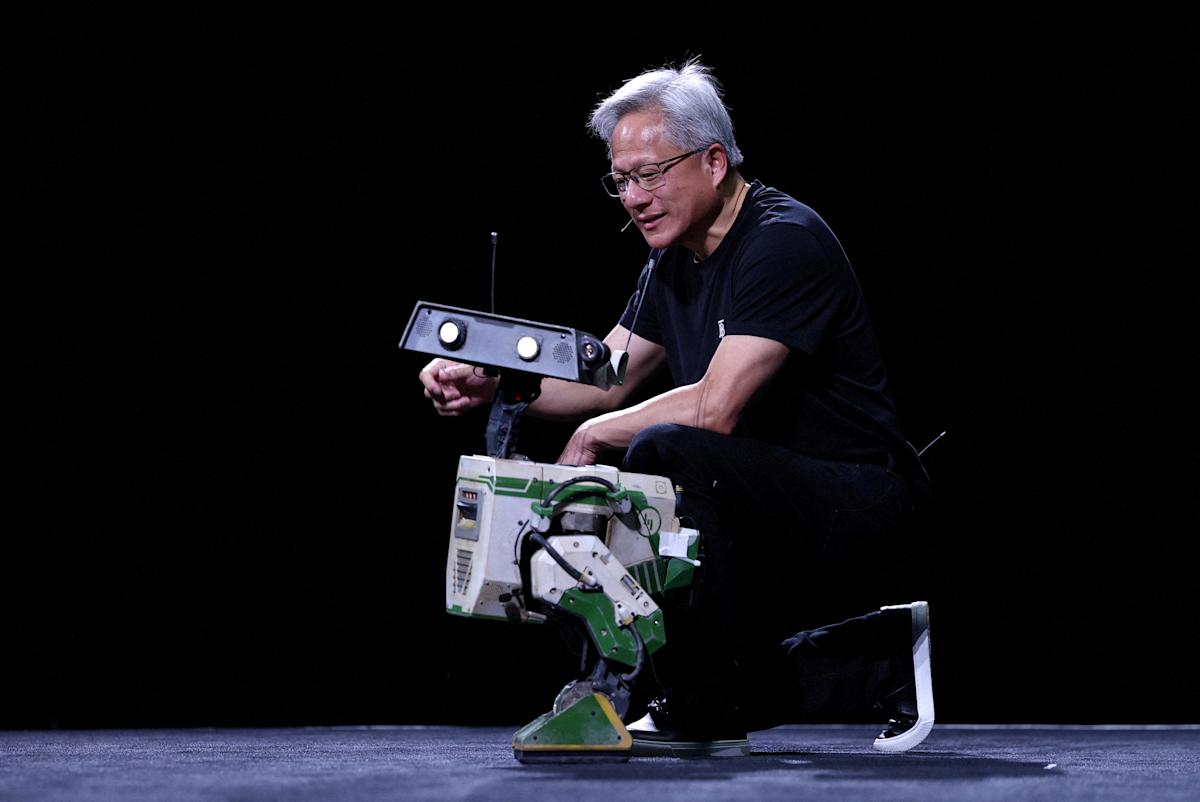

In a blog post on Monday, the company said Nvidia (NVDA) CEO Jensen Huang had told customers during a trip to Beijing that the chipmaker was filing applications to resume selling its H20 graphic processing unit (GPU).

Nvidia (NVDA) said that the US government had assured the company that licences will be granted, with the chipmaker adding that it hoped to start deliveries soon. This would mark a reversal of curbs on sales of Nvidia's (NVDA) key AI chips in China, which was imposed by US president Donald Trump's administration in April.

Read more: London heads near all-time highs as EU readies for US tariffs

The US Department of Commerce had not responded to Yahoo Finance UK‘s request for comment at the time of writing.

Matt Britzman, senior equity analyst at Hargreaves Lansdown, said: “This is a major catalyst for Nvidia (NVDA) shares, as many had written off the chance of any meaningful revenue coming from China after the White House blocked the sale of Nvidia’s (NVDA) weaker H20 chips a few months ago.

“Not only does this represent incremental upside to future revenue, to the tune of $15bn (£11bn) – 20bn this year, depending on when approval is granted and how quick deliveries can ramp back up,” he said. “But there’s also a chance Nvidia (NVDA) can reverse some, or all, of the $5.5bn impairment charge taken in the first quarter, providing a double boost for earnings.”

Software company Palantir (PLTR) rose nearly 5% on Monday to close at a fresh high of $149.15, with the stock now up 97% year-to-date.

Wedbush Securities managing director and global head of technology research Dan Ives, who has an “outperform” rating on the stock, told Yahoo Finance on Monday that he believed Palantir (PLTR) is going to be “one of the core players” in AI.

Read more: Oil prices down as Trump's deadline for Russia eases supply fears

“I'm seeing it as a trillion dollar company next two to three years,” he said of Palantir (PLTR), which currently has a market capitalisation of nearly $352bn.

Ives said he viewed Palantir (PLTR), which provides data analytics technology, as “one of the best AI plays in the world”.

Shares in The Trade Desk (TTD) surged nearly 15% in pre-market trading on Tuesday, after it was announced that the digital advertising company would join the S&P 500 (^GSPC).