Copenhagen-listed shares in pharmaceuticals giant Novo Nordisk (NOVO-B.CO) rose nearly 4% on Monday morning, after the company announced that its blockbuster weight-loss drug Wegovy had been approved in the US to treat a form of liver disease.

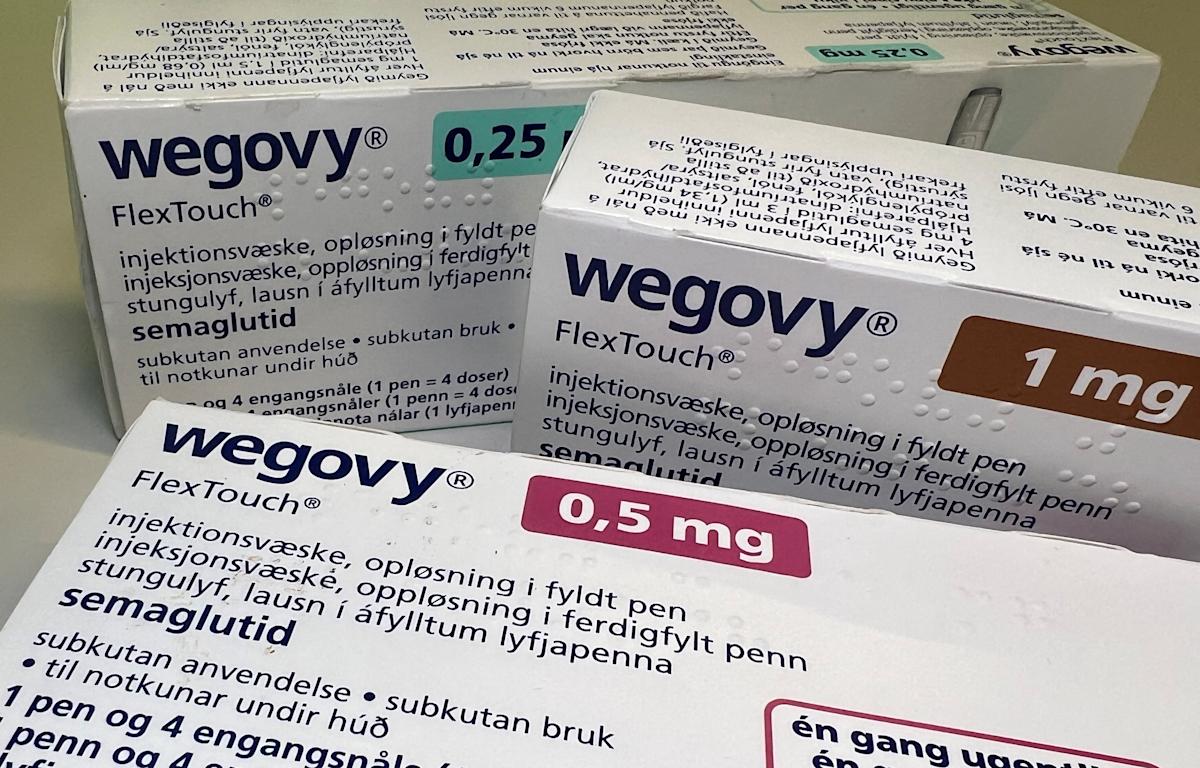

Novo (NOVO-B.CO) said in an announcement on Friday that the US Food and Drug Administration (FDA) had approved Wegovy for the treatment of noncirrhotic metabolic dysfunction-associated steatohepatitis (MASH) in adults with moderate to advanced liver fibrosis, in combination with a reduced calorie diet and increased physical activity.

Read more: Markets mixed as Zelensky and European leaders head to Washington for war talks

The company said that accelerated approval is based on part one of a trial, in which Wegovy, demonstrated a statistically significant and superior improvement in liver fibrosis with no worsening of steatohepatitis, as well as resolution of steatohepatitis with no worsening of liver fibrosis compared to a placebo.

The news offers a boost to Novo Nordisk (NOVO-B.CO), which has been facing increasing competition in the weight-loss market, with shares in company currently down nearly 46% year-to-date.

Martin Holst Lange, executive vice president, chief scientific officer and head of research and development at Novo (NOVO-B.CO), said: “Wegovy is now uniquely positioned as the first and only GLP-1 treatment approved for MASH, complementing the already proven weight loss, cardiovascular benefits and extensive body of evidence linked to semaglutide.”

Shares in Palo Alto Networks (PANW) hovered just above the flatline in pre-market trading on Monday morning, ahead of the US cybersecurity company reporting its fourth quarter earnings later in the day.

The company had guided to revenue for the quarter in the range of $2.49bn (£1.83bn) to $2.51bn, which would represent year-over-year growth of between 14% and 15%.

Shares in the Palo Alto (PANW) came under pressure following the release of its third quarter earnings in May, as the results failed to impress investors.

The cybersecurity company's third quarter revenue came in at $2.3bn, just above expectations, while adjusted earnings per share (EPS) were $0.80.

Shares in Walmart (WMT) were also trending on Monday, ahead of the company reporting its second quarter earnings on Thursday. Walmart's results are closely watched by investors as it is the largest retailer in the US, so it is considered to act as a barometer for consumer sentiment.