Introduction

Alternative investments accounted for $13 trillion in assets under management (AUM) in 2021, nearly twice what it was 2015. By 2026, that figure is expected to reach more than $23 trillion, according to Preqin research. Boom times are here for venture capitalists, private equity (PE), and hedge fund managers.

Although 2022 hasn’t been kind to venture capital, among other alternatives, some fund managers are faring better than others. Why? Because they can finesse their investments’ valuations. PE funds have no daily mark-to-market accounting, so they can smooth losses out across several quarters.

The ingenuity of this practice is that even though they have similar risk exposure PE returns appear uncorrelated to equities. On paper, everything looks great.

Correlations are the hallmark of alternative investments. Generating uncorrelated returns in a year when the traditional 60/40 equity-bond portfolio has posted double digit losses is a quick way to capture investor interest and capital. However, correlations are like icebergs floating in the sea, there is a lot hiding beneath the surface.

So just what are the pitfalls of using correlations to choose alternative strategies?

The Alternative Champions

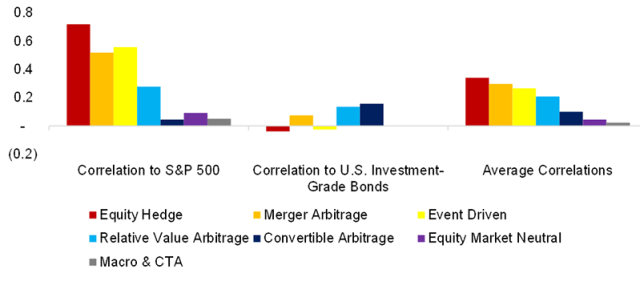

To find out, we selected seven well-known strategies from the hedge fund universe that have attracted billions from capital allocators. Our data is sourced from HFRX, which has daily returns going back to 2003. This nearly 20-year period covers several market cycles when alternative strategies should have demonstrated their value by providing diversification benefits.

We calculated these hedge fund strategies’ correlations to traditional asset classes. Three of these strategies — equity hedge, merger arbitrage, and event-driven — have S&P 500 correlations in excess of 0.5. It wouldn’t make much sense to add these to an equity portfolio given their similar risk profiles.

However, three strategies demonstrated low stock market correlations without high correlations to US investment-grade bonds. This suggests they may offer some value for investors.

Hedge Fund Strategies: Correlations to Stocks and Bonds, 2003 to 2022

Quantifying Diversification’s Benefits

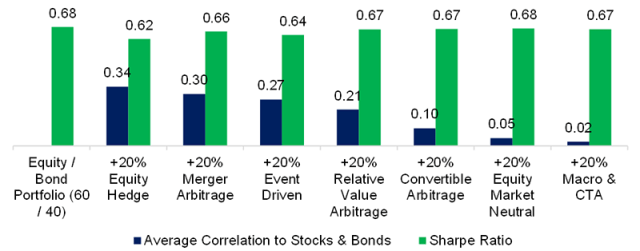

When presented with a range of alternative strategies, a capital allocator should select those with the lowest correlations to stocks and bonds since they demonstrate the highest diversification potential.

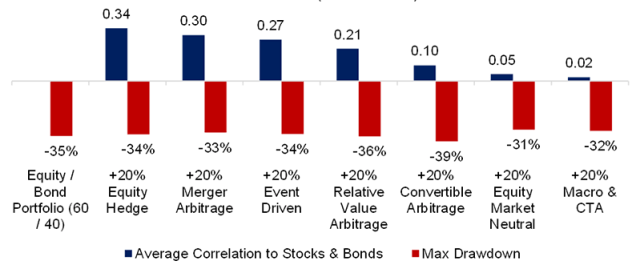

To test this hypothesis, we sorted the seven hedge fund strategies by their average correlations to stocks and bonds and ran simulations that added a 20% allocation to each strategy to a 60/40 equity-bond portfolio and then rebalanced on a quarterly basis.

Contrary to expectations, adding an alternative allocation did not improve the Sharpe ratios for the 2003 to 2022 period.

What’s even more unusual is that there does not seem to be any relationship among the correlations. For example, merger arbitrage had a higher average correlation to stocks and bonds than equity market neutral. Yet adding the latter to a traditional portfolio did not lead to a significantly higher Sharpe ratio.

60/40 Portfolio Plus 20% Alternative Allocation: Sharpe Ratios, 2003 to 2022

We next calculated the maximum drawdowns for all the portfolios. These all occurred during the global financial crisis (GFC) in 2009. Both stocks and bonds fell, much like they have this year.

Our equity-bond portfolio plunged 35%, while our diversified portfolios all declined between 31% and 39%. Such risk reduction is not particularly impressive.

But as with our earlier Sharpe ratio analysis, the maximum drawdowns did not fall further when more diversifying alternative strategies were added.

We would expect a linear relationship between decreasing correlations and drawdowns, at least until correlations reach zero. If they become too negative, as with a tail risk strategy, then diversification benefits deteriorate again. We’re expecting an unhappy smile, but no one is smiling.

So, are correlations failing investors in their efforts to identify useful alternative strategies?

60/40 Portfolio Plus 20% Alternative Allocation: Max Drawdowns, 2003 to 2022

Fair Weather Correlations

One partial explanation for our results is that correlations are deceiving. Even if they are close to zero on average, there still may be periods of high correlation. Unfortunately, correlations often spike exactly when investors require uncorrelated returns.

Take merger arbitrage as an example. The strategy is typically uncorrelated to equities, but when stock markets crash, mergers fall apart. A portfolio with long positions in acquirable companies and short positions in acquiring firms can be constructed beta-neutral. But that does not negate economic cycle risk, which is also inherent in stocks.

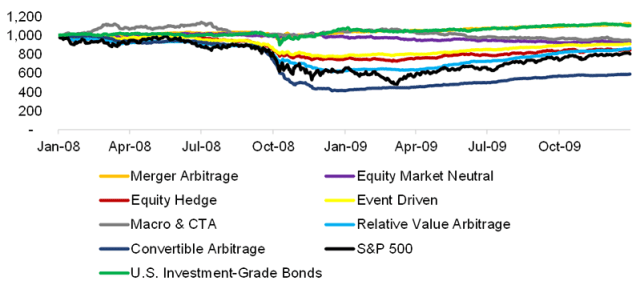

All our seven alternative strategies lost money during the global financial crisis between 2008 and 2009. Convertible arbitrage lost even more than equities. That’s quite an accomplishment since the S&P 500 declined by 53%.

Hedge Fund Strategy Performance during the Global Financial Crisis (GFC), 2008 and 2009

Why else have alternatives failed to improve Sharpe ratios and reduce drawdowns? Because, frankly, they’re terrible at making money. They may generate attractive returns before fees, but their net returns for investors have been poor over the last 19 years.

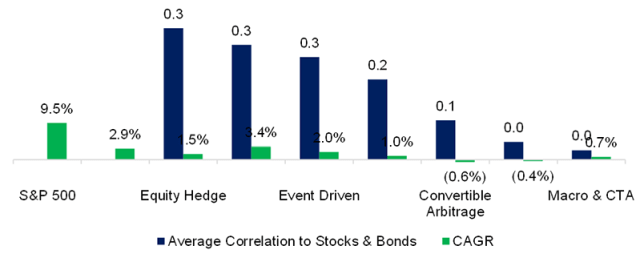

The S&P 500 produced a CAGR of 9.5% for the 2003 to 2022 period, but that isn’t the right benchmark for hedge fund strategies. Beating bonds is a more reasonable goal, and only merger arbitrage achieved it. And that strategy is too strongly correlated to equities to offer much in the way of diversification.

Inflation was roughly 2% for this period, so CAGRs below that imply negative real returns. Inflation is much higher today, so the goalposts for these strategies have moved much further away.

Hedge Fund Strategy Performance: CAGRS and Correlations, 2003 to 2022

Further Thoughts

Correlations alone are not enough to identify alternative strategies. A more nuanced approach is required. Specifically, investors should measure correlations when stocks are falling. This will weed out merger arbitrage and other strategies that have inherent economic risk.

If calculated correctly, this should reveal that most private asset classes — PE, VC, and real estate — provide the same risk. They therefore offer limited diversification benefits. We need better tools to measure the diversification potential of alternative strategies.

Of course, this does not change the underlying issue: Many strategies no longer generate positive returns. The average equity market neutral fund, for example, lost 0.4% per year since 2003.

The case for uncorrelated negative returns is not a strong one.

For more insights from Nicolas Rabener and the Finominal team, sign up for their research reports.

If you liked this post, don’t forget to subscribe to Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / maybefalse

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.