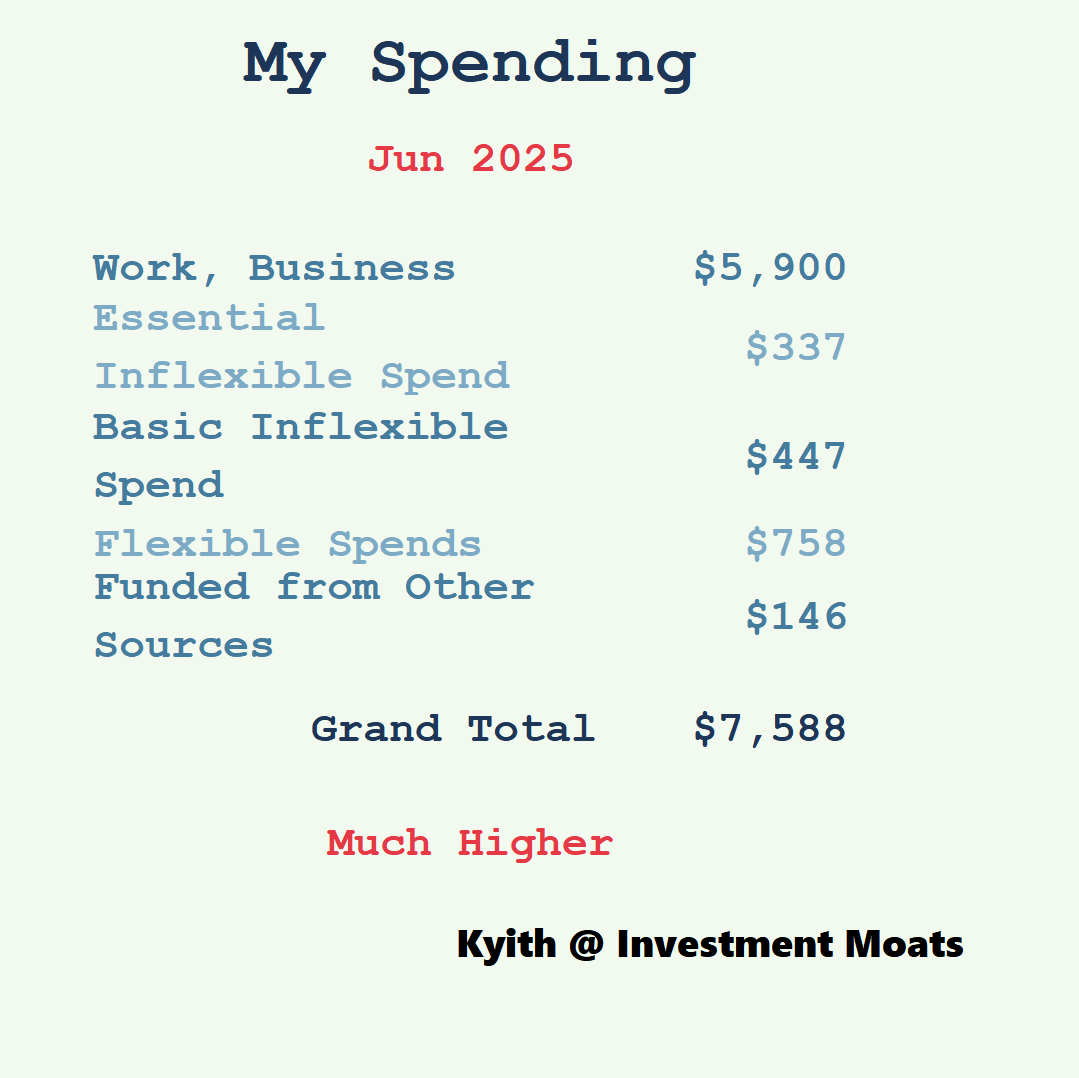

I decided to update readers about my spending here on my blog. I think most might not realized that since Apr 2023, I been publishing my monthly spending on my Instagram page here.

My Instagram is probably the medium with the least traffic so I was more comfortable to share it there. But with the dwindling readership of Investment Moats, I think I am more comfortable to publish it there.

You can review my past spending logs by going to the personal notes section of investment moats here in the future.

How I Group My Spending.

One of the reasons for publishing the spending is to show people just how spending should be. Some would wonder if it is consistent or erratic, high or low. If you are interested, you see it, and you form your own tale about it.

You will be able to tune in to a spending profile of someone who is single, older, a fully paid up home. If you spend more than this, then you can ponder why is that and what you think about it. If you spend less than this, then you can ponder why and what do you think about it.

I group my spending based around a few technical grouping:

- Flexible or Inflexible: There are some spending that we can be more flexible with. The spending tends to fluctuate over time. There are some spending that is more inflexible. The impact of this is felt more if you are retrench from work, wish to take a hard pivot in your life or career, planning for financial security or future retirement. A more inflexible spending would require your planned income stream to be more conservative while you can take some more risk if you have flexibility in your spending.

- Finite or Ongoing: There are some spending that will stop at some point but there are some spending that we don’t see it stopping objectively. Finite spending are insurance premiums, mortgage, allowance for kids, allowance for parents etc. Ongoing spending is a certain kind of transport spending.

- Role or Responsibility: What am I currently? Am I a worker? A husband? Or a Son? Some of the spending are group this way so that we are able to see just how much we are spending on something. Some of these responsibility will go away. For example, you spend on some travels, clothes, pay income tax because you are a worker. But if you are planning for a non-working phase of life, would you wish to know how much that you spend today can be peeled away.

In a way, this works for me because I always have an eye from the Financial Independence planning perspective. You might not, and you have your own reasons.

I hope that your way of grouping have some sensibility to it and helps you in your own way.

This is the spending for the month of June, not this month. Illustrations can be found on Instagram here.

June’s spending is higher than normal because of a health checkup and paying off income tax in one big shot.

The Essential Inflexible Spend

I wrote about my essential inflexible spend here in this note: What kind of lifestyle would I need to buy for myself?

I group and track this set of rather inflexible spending to be reflective about how realistic is the numbers as part of the notes written above. The income stream from my Daedalus Income Portfolio is meant to pay for this spending as well.

The most essential food is low because I have some CDC Supermarket voucher outstanding. If a pack of chicken for five days is $10, that CDC probably subsidize me for 2.5 months for the year.

Transport is rather high than normal because of a taxi ride.

Still below that $850/mth.

The Basic Inflexible Spending

The difference between the basic and the essential is that.. its less essential. You can probably think of something that you can at least be slightly more flexible… but actually not too flexible about that would make life more sane.

You want to renovate your place every 10 years or replace something right? You want to try and make life easier on an ongoing basis right? You want to take better care of your health right? Some of you will have strong opinions about some areas, more than others. To you the spending can be rather inflexible, but if you touch your heart, you know you can cut if the conditions are really bad.

If it fits those it ends up here.

This is also eventually what Daedalus Income Portfolio need to provide.

I describe this spending in this note: Aside from my most essential spending needs, I need $5,160 yearly for my basic needs. I would set aside $174,000 to provide income for it.

Almost all of this is made up of this health checkup written here.

The Flexible Spends

I would group most of my spending that are flexible into one big pot. Realistically, this is the spending that make life interesting.

Realistically, we can be more flexible with these spends as well.

I find this spending to be less important for long term retirement planning but you might hold a different opinion. I do think that if you wish to enjoy something, maybe you would also want to work for it. But there are some sub-accounts that allow me to tune in to them.

Providend Gifts will mainly be the spending in the office. I bought a few stuff in June. We tried the Test Kitchen a fair bit [$94 in total for the month]. For those who have been to some of our events, you might have tried them before. This is a recommendation by my friend Shaun.

This Unagi Cronigiri is a crowd favorite.

The thing about the stuff in Test Kitchen is that they are so presentable particularly for events.

Milo Dino is pretty good as well.

We were also pretty privilege to be close to Everton and so we have Mori Mori Yogashi close by. Mori Mori is open by Terrian Lim. Terrian used to work in a one star Michelin restaurant but that is beside point. He has pretty good Shio Pan, though now we think this is not as good as something else.

The Ham & Cheese, Signature Fujisawa Garlic Bread are some of the better stuff. [Total spending $44 for the month]

We also decide to buy some Stinky Bombs from 99 Old Trees, which is not too far at one of the Outram MRT Entrance. 5 of these cost $13.50. [Spent $40 for the month].

I paid for some white gold because my colleague’s dad passed away in June.

Also have the privilege of spending quality time with:

- Samantha

- Eileen

- Mike

- Samuel

- Stanley

You can find those under Premium Meals.

Spending Funded from Other Sources

These are spending that comes from sinking fund/saving groups that we capitalized.

This would be mainly for my real insurance protection needs. You can read more about them here: Cutting My F.I. Capital Needs for Insurance Premiums from $131,366 to $58,132 by Prepaying for It.

If I capitalized this spending, I take it out from my recurring spend. A few line items of my insurance are really finite. Term insurance is. My $50,000 Limited Whole Life is. My health insurance is in my inflexible essential spend above, which I have plan as part of my expenses even if I am not spending it today (so as to shore it up for the later years).

You will tend to see either $150 or $300. This is because one of my term insurance is paid on a quarterly basis, and once every quarter you will see this bumped up to $300.

Spending on Work

I don’t have a lot of responsibilities like a lot of other people. Spending on work is a way to track those spending that is directly attributed to work. If I stop working this goes away.

The majority of the spending here this month is due to the income tax paid. This is a mixture of work income and earnings from Investment Moats.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.