Morgan Stanley’s new (NVDA) call turns heads, to say the least.

It's not just about a shiny new price target; it’s about modeling AI demand, margin power, and supply-chain hiccups.

💵💰Don't miss the move: Subscribe to TheStreet's free daily newsletter💰💵

That confidence in an AI-powered tech giant doesn’t come lightly, especially when the bar’s already set remarkably high. Behind that move is an AI stack that’s already running hot and straining the limits of current supply.

Needless to say, the stakes just got higher, and so did Wall Street’s expectations.

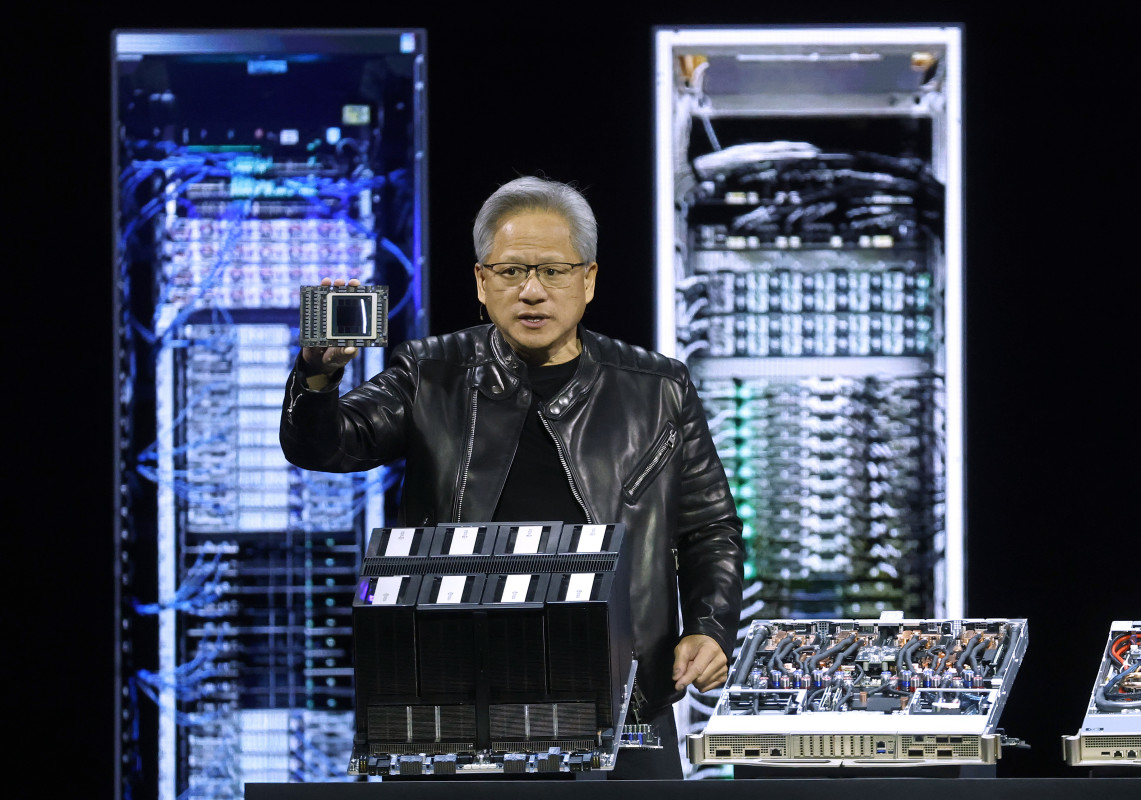

Blackwell demand surges as Nvidia ramps next-gen dominance

It’s no secret that Nvidia’s Blackwell GPUs have been killing it, as enterprise and cloud players shift from older chips while locking in forward capacity.

Even with AMD recently raising MI350 prices to flex confidence, Nvidia’s still dominating the GPU debate.

TrendForce data projects that Blackwell could potentially represent a whopping 80% of Nvidia’s high-end GPU shipments this year.

Related: Leaked data shows Nvidia taking page from Zuckerberg's playbook

That marks a massive ramp beginning in Q2 and continuing through the close of the year.

It's a huge swing in terms of product mix, while underscoring just how fast adoption is moving.

Nvidia-backed stocks like CoreWeave and Dell recently confirmed that shift with the first large-scale commercial deployment of Blackwell Ultra.

On top of that, the performance jump is hard to miss.

Nvidia claims Blackwell offers a 40x jump in AI training and inference performance compared to Hopper.

The Ultra version takes things up a notch or two, boosting “AI factory” throughput by close to 50x, giving cloud builders a powerful new baseline in raw compute and execution.

Surprisingly, even mid-tier Blackwell systems, including the B200, have shown close to 57% quicker training speeds than the H100. Also, for self-hosters, they cut the cost per workload, which is a huge incentive amid tightening AI budgets.

That demand is already turning into real, tangible income.

Nvidia says Blackwell chip sales have outpaced Hopper’s peak, underscoring the immense strength of the cycle.

The combined effect is that Nvidia continues to tighten its grip on the AI stack.

By offering unmatched performance and superior price-to-output ratios, it cements Nvidia’s ecosystem dominance while allowing cloud providers access to more margin while undercutting rivals in the process.

Nvidia’s H20 chips get export window to China, triggering major upside potential

That said, perhaps the biggest recent shift for Nvidia is its go-ahead on resuming H20 chip exports to China.

For context, the H20 is a tailor-made version of Nvidia’s Hopper architecture, which effectively aligns with U.S. export controls.

At the same time, it still packs a punch in high-performance AI acceleration, though not as advanced as Blackwell.

Related: Morgan Stanley recalibrates its view on Apple stock ahead of earnings

Nevertheless, it fills a critical performance tier for China’s AI market, where domestic alternatives are still lagging.

The U.S. has allowed Nvidia to file licenses to kickstart H20 sales again, as part of the broader negotiations tied to rare-earth access.

Analysts have flagged it as a meaningful step toward easing tech tensions.

In capitalizing on the development, Nvidia placed a massive 300,000-unit H20 order with TSMC, a sign of the immediacy in demand.

However, the friction is tough to ignore as well.

China’s cybersecurity probe into H20 raises the stakes on a regulatory slowdown, while U.S. national-security voices are already compelling the White House to reconsider.

Still, no formal restrictions have been reimposed, and Nvidia’s early-mover position gives it its first crack at resurgent demand.

Yes, supply constraints remain, but that’s mostly a bullish signal.

Even capped output is being efficiently absorbed. While China’s cybersecurity probe into the H20 introduces noise, it's from being new.

More News:

- Amazon’s quiet pricing twist on tariffs stuns shoppers

- Nvidia avoids White House crackdown; Trump softens on AI giant

- Bank of America flags 3 breakout stocks to watch ahead of earnings

Importantly, no ban has been issued. Nvidia remains in-market, with the opportunity to deepen its foothold before domestic rivals scale up.

Pushback from Washington is expected, but so far, the policy is holding well, and Nvidia is the only AI chip supplier to benefit immediately.

Morgan Stanley hikes Nvidia target to $200 on surging Blackwell demand

Nvidia just got a major vote of confidence from Morgan Stanley, and it has everything to do with Blackwell.

Veteran analyst Joseph Moore reaffirmed his Overweight rating on the AI behemoth, raising his 12-month price target to $200 from $170.

The call, issued July 30, is based on what Moore describes as “exceptional” demand for Nvidia’s next-gen Blackwell AI chips.

Related: Veteran analyst drops 3-word verdict on Tesla post-earnings

That’s essentially demand, which continues to outstrip supply.

Moore’s team is quantifying that move by bumping their 2026 valuation multiple.

They’ve shifted from 28x to 33x earnings, applied to Nvidia’s mid-year EPS estimate of $6.02.

That math effectively locks in a superb $200 price target, while underscoring Nvidia’s position as Morgan Stanley’s top chip stock play.

The note points to healthy and clear compute needs across both inference and large-model AI workloads.

Client checks show burgeoning infrastructure investment from hyperscalers and large enterprise buyers, which continues pushing AI adoption faster and wider than expected.

Though current supply issues remain a headwind, Moore sees that changing quickly.

Production and logistics are expected to improve in the back half of this year, unlocking a massive step-function jump in throughput and earnings momentum.

That incredible dynamic is what Moore calls “convex earnings leverage.”

In short, if execution holds, the upside in Nvidia stock will compound quickly.