Published on July 17th, 2025 by Aristofanis Papadatos

Dynacor Group (DNGDF) has two appealing investment characteristics:

#1: It is offering an above-average dividend yield of 3.6%, which is triple the average dividend yield of the S&P 500.

#2: It pays dividends monthly instead of quarterly.

Related: List of monthly dividend stocks

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yields and payout ratios) by clicking on the link below:

The combination of an above-average dividend yield and a monthly dividend makes Dynacor an attractive option for individual investors.

But there’s more to the company than just these factors. Keep reading this article to learn more about Dynacor.

Business Overview

Dynacor is an industrial gold processor with core operations in Peru, where it purchases ore from artisanal and small-scale miners and processes it at its wholly owned Veta Dorada plant in Chala.

The facility has a nameplate capacity of 430 tons per day and is optimized for continuous, high-efficiency throughput. The company was founded in 1996 and is headquartered in Montreal, Canada.

The business model of Dynacor is unique in that it does not engage in exploration or mining; instead the company operates an extensive ore-purchasing network across Peru to source high-grade feedstock.

Dynacor operates a strong logistics network for collecting ore, runs its own labs for analysis, and handles gold exports with secure, reliable systems. Dynacor also reinvests in expanding its supply network and enhancing plant capacity, while maintaining a lean cost structure and consistent production flow.

Dynacor has greatly benefited from the highly inflationary environment that has prevailed since 2022. The unprecedented fiscal stimulus packages offered by most governments during the coronavirus crisis led to a surge of inflation to a 40-year high in 2022.

During inflationary periods, investors rush to buy gold, as the precious metal has always provided great protection against inflation. As a result, the price of gold has nearly doubled, from approximately $1,700 in early 2022 to an all-time high of $3,330 right now.

The rally of the price of gold has been clearly reflected in the business results of Dynacor. The company nearly tripled its earnings per share, from $0.11 in 2020 to $0.30 in 2021 and posted all-time high earnings per share of $0.46 last year.

In the first quarter of this year, Dynacor grew its revenue 18% over the prior year’s quarter, to a new all-time high of $80.0 million, despite a 15% decline in gold sales volumes due to lower ore grades. The average selling price of gold surged 39%, from $2,075 per ounce to $2,878 per ounce, thus easily offsetting the effect of lower volumes.

Operating margin shrank from 13.5% to 11.2% due to increased selling and administrative expenses and earnings per share remained flat at $0.13. For the full year, we expect earnings per share of approximately $0.40.

Growth Prospects

The performance of Dynacor over the past decade reflects a slow-building but ultimately sharp improvement in profitability, underpinned by operational discipline, plant optimization, and favorable gold market conditions.

From 2015 to 2019, earnings per share rose incrementally from $0.09 to $0.13, reflecting slow but steady progress as the company ramped up the throughput at its Veta Dorada plant and expanded its ore purchasing network in Peru.

These years saw operational discipline, but earnings growth was limited by moderate gold prices and the early-stage scale of the business. However, as mentioned above, growth of earnings per share has greatly accelerated in the last few years.

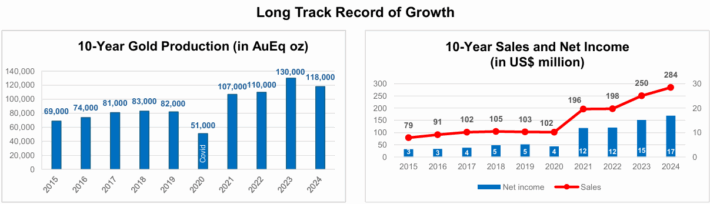

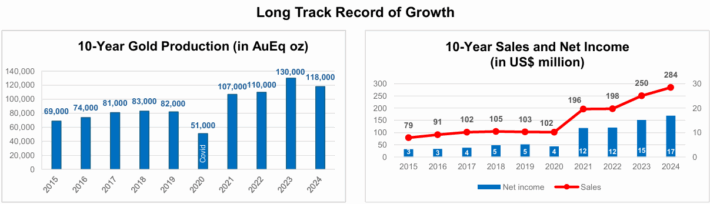

It is also important to note that the company has consistently grown its production over the last decade.

Source: Fact Sheet

More precisely, Dynacor has grown its production by 6.1% per year on average over the last decade.

We expect the company to continue growing its output significantly over the next five years. As we also expect strong gold prices to remain in place for the foreseeable future, we expect Dynacor to grow its earnings per share at an 8% average annual rate over the next five years.

Thanks to its blowout earnings in recent years, Dynacor has a rock-solid balance sheet. To be sure, it is one of the very few companies that does not pay any interest expense, as its interest income exceeds its interest expense. Moreover, the company does not have any debt; instead it has a net cash position of $57 million.

As the net cash position is 40% of the market capitalization of the stock, it is certainly excessive. Overall, the rock-solid financial position of Dynacor is a testament to the strength of its business model.

Dividend & Valuation Analysis

Dynacor is currently offering an above-average dividend yield of 3.6%, which is triple the 1.2% yield of the S&P 500. The stock is an interesting candidate for income investors, but they should be aware that the dividend is not entirely safe due to the cycles of the price of gold.

Dynacor has a reasonable payout ratio of 39%, which provides a decent margin of safety for the dividend. Moreover, thanks to the promising growth prospects and the pristine balance sheet of the company, its dividend should be considered safe in the absence of a major downturn.

In reference to the valuation, Dynacor is currently trading for 8.3 times its expected earnings per share this year. We assume a fair price-to-earnings ratio of 11.0 for this stock.

Therefore, the current earnings multiple is lower than our assumed fair price-to-earnings ratio. If the stock trades at its fair valuation level in five years, it will enjoy a 5.9% annualized gain in its returns.

Taking into account 8% expected growth of earnings per share over the next five years, the 3.6% current dividend yield and a 5.9% annualized tailwind of valuation level, Dynacor could offer a 16.9% average annual total return over the next five years. The expected total return indicates that the stock is highly attractive right now.

Final Thoughts

Dynacor has promising growth prospects thanks to production growth and potentially higher gold prices in the upcoming years. The stock is offering an above-average dividend yield of 3.6% and it appears cheaply valued. As a result, it appears attractive right now.

On the other hand, the company has proven highly vulnerable to the cycles of the price of gold. As a result, it is suitable only for patient investors, who can endure high stock price volatility .

Additional Reading

Don’t miss the resources below for more monthly dividend stock investing research.

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.