Basic Profile & Key Statistics

<

div class=”separator” style=”clear: both;”>

Performance Highlight

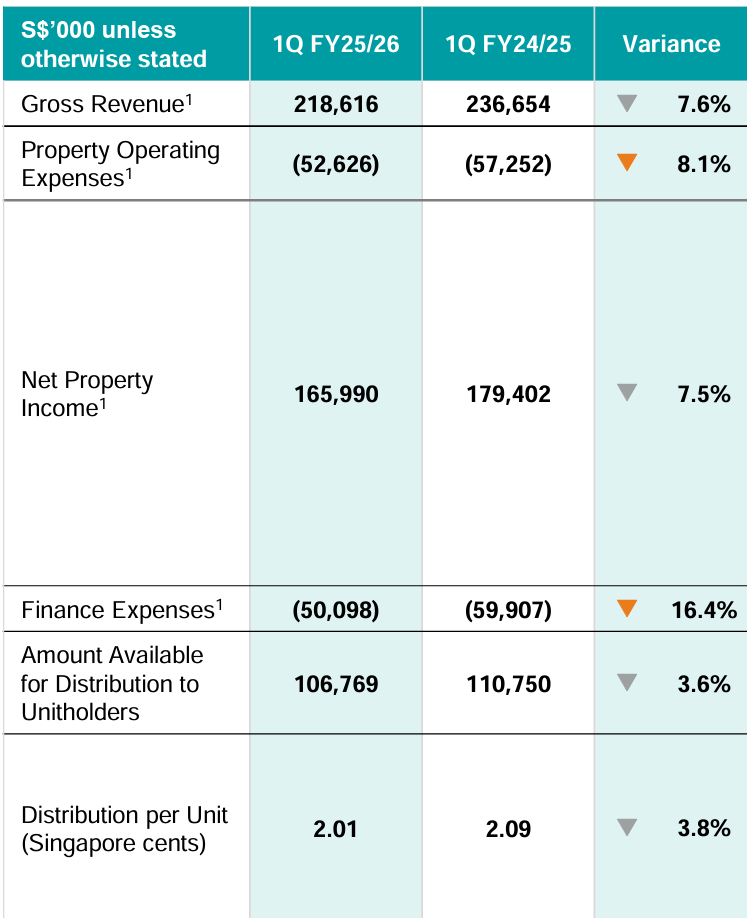

Gross revenue and NPI declined YoY, mainly due to the absence of contribution from Mapletree Anson, which was divested in July 2024, and weaker foreign currencies against SGD. Finance expenses declined as divestment proceeds were used to repay debt. As a result of lower income, the amount available for distribution and DPU declined YoY but this was partially cushioned by lower finance costs.

Rental Reversion

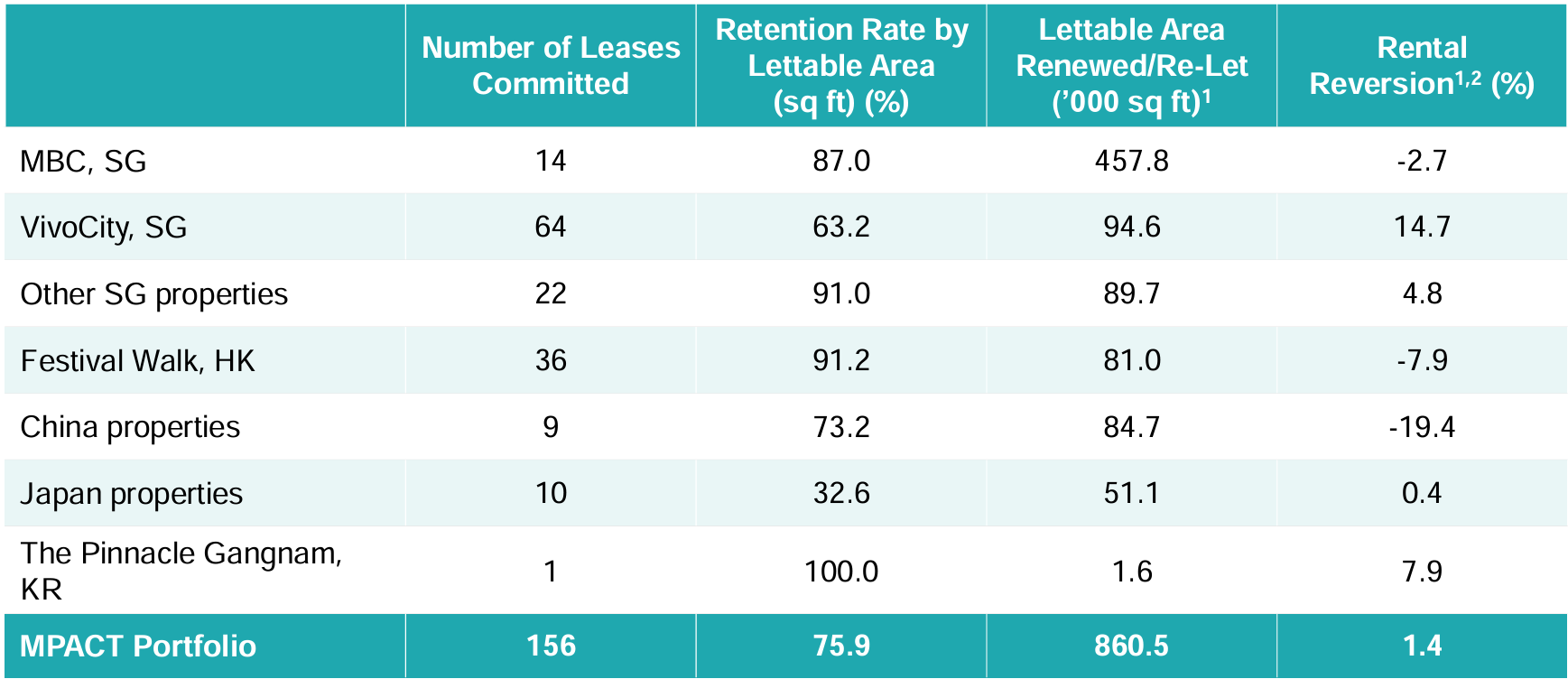

Portfolio rental reversion came in at 1.4%, supported by strong positive reversion from VivoCity. On the other hand, China, Hong Kong, and MBC Singapore recorded negative reversions.

Shopper Traffic & Tenant Sales

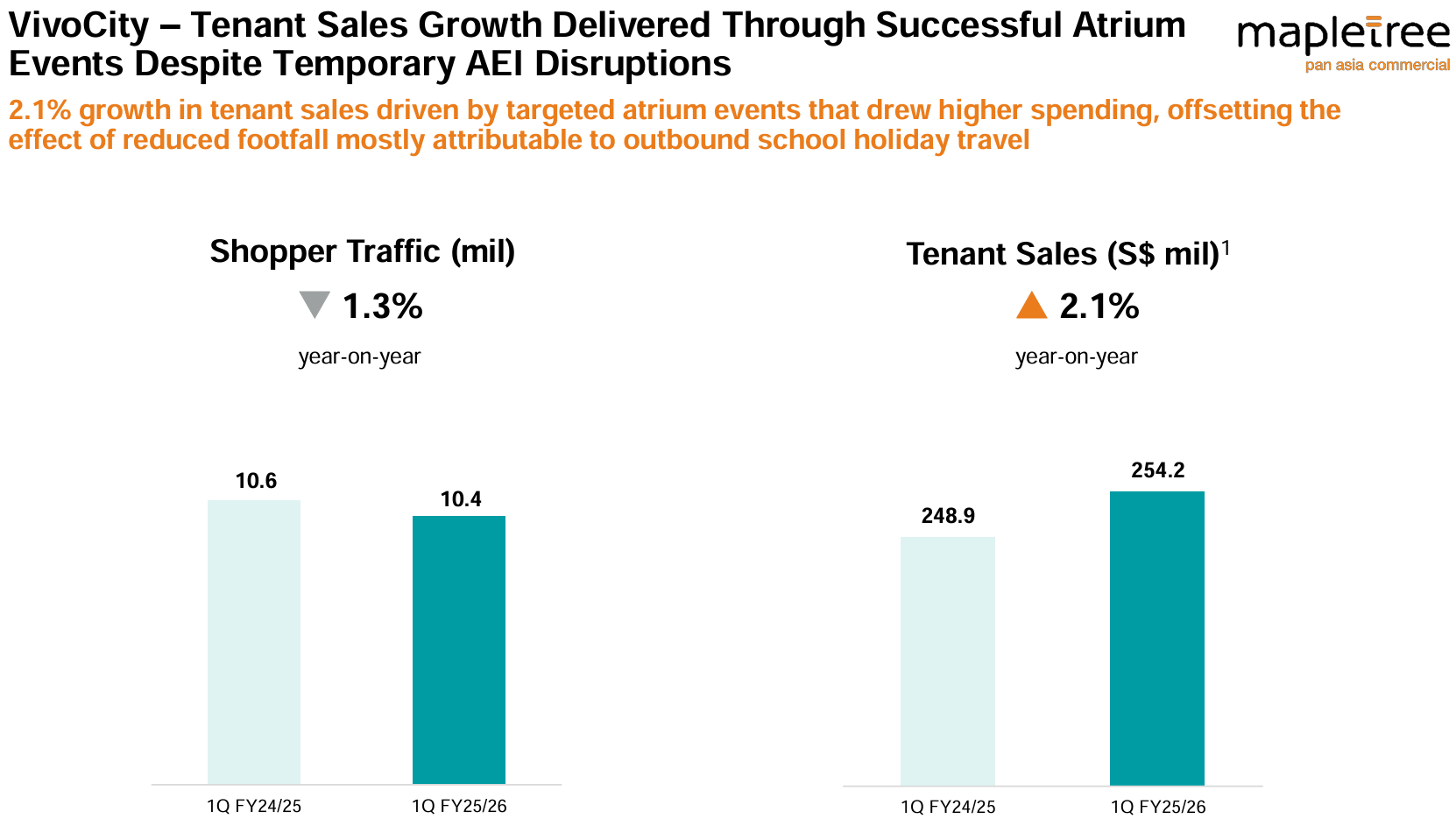

At VivoCity, tenant sales rose 2.1% year-on-year despite a slight decline in shopper traffic.

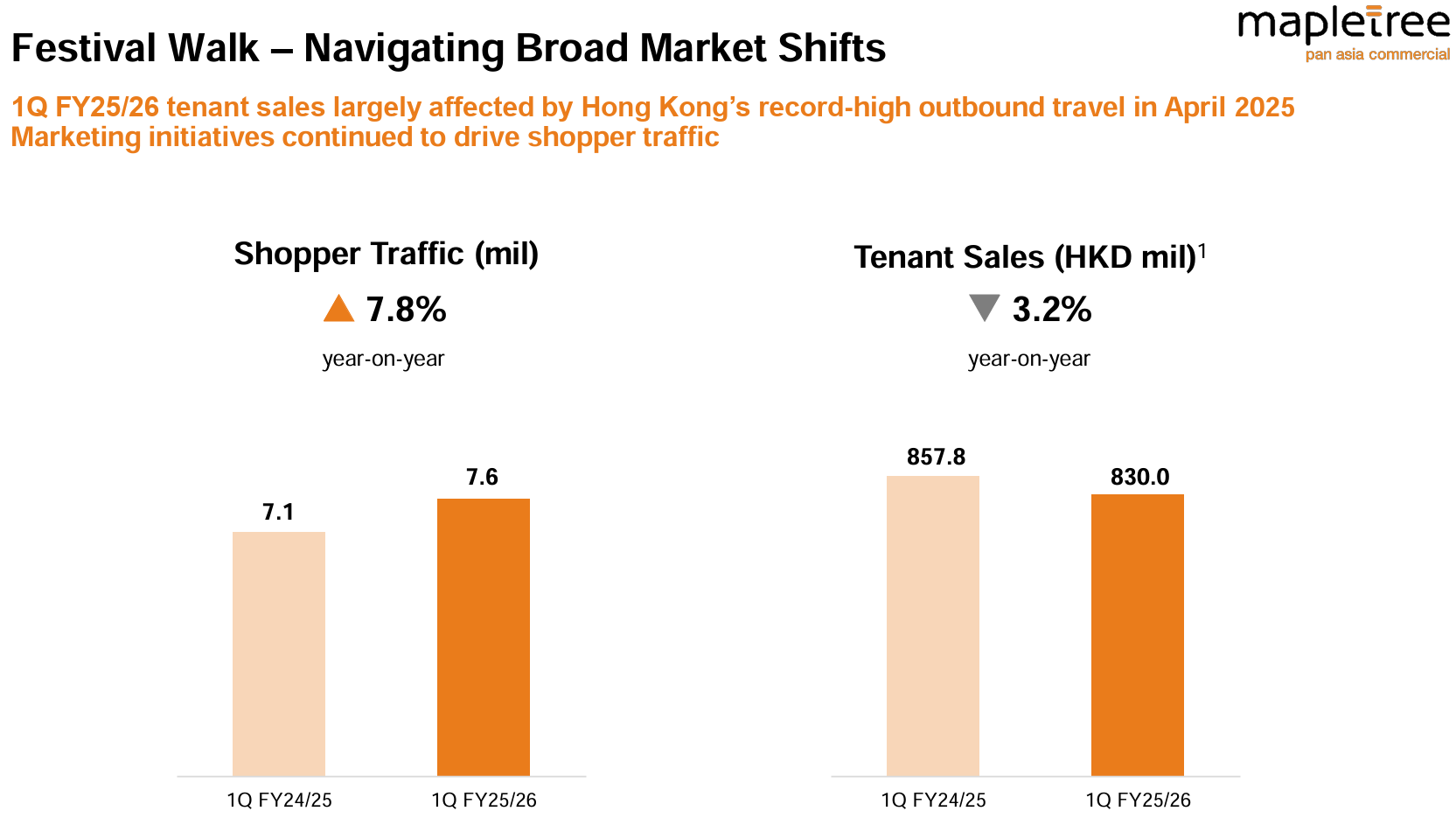

At Festival Walk, shopper traffic increased by 7.8%, while tenant sales declined by 3.2%.

…