Traditional investment approaches assume investors have equal access to market information and make rational, emotionless decisions. Behavioral finance, championed by Richard Thaler, Daniel Kahneman, and Amos Tversky, challenges this assumption by recognizing the role emotions play.

But the ability to quantify and manage these emotions eludes many investors. They struggle to maintain their investment exposures through the ups and downs of market cycles.

In this post, I introduce a holistic asset allocation process intended to manage the phenomenon of regret risk by considering each client’s willingness to maintain an investment strategy through market cycles. I also evaluate the suitability of a client’s expectations to determine if a strategy is a good match and is likely to be sustained. The upshot is a case for equally weighted investment strategies.

The Importance of Maintaining an Investment Strategy

Investors must maintain their strategy over a long period of time if they are to achieve the expected results. This requires rebalancing their portfolios periodically to maintain exposure in each segment of the strategy, especially across periods of high volatility. Investors whose emotions lead them to deviate from the strategy are effectively timing the market by making predictions about future returns. These actions present their own form of risk, adding to the existing risk of unpredictable markets.

The Role of Knowledge

We must acknowledge that we can’t predict the future with any certainty. Despite having data, analysis, and expert opinions, our forward-looking decisions are educated guesses. To manage the uncertainty of this knowledge gap, we must plan for the outcomes that may occur by holding investments that capitalize on favorable outcomes, combining these with other investments that mitigate the unfavorable ones. The investor can reasonably expect more stable returns from this more intuitive diversification approach.

I evaluated my results using nearly a century of market data that cover the US economy across many of its market cycles and through times of both peace and extreme geopolitical stress. This analysis includes the types of regret-inducing events investors are likely to encounter.

The Nature of Regret

Regret is an emotional reaction to extreme events, whether the events produce losses or gains. When regret drives an investor to abandon an investment strategy, this adds the risk of a whipsaw effect: being wrong on both the exit from and re-entry into the investment markets.

Over the past 95 years, the S&P 500 has returned 9.6% annually. Missing out on the 10 best years would have lowered that return to only 6%. However, avoiding the worst 10 years would have boosted the return to 13.4%. The investment markets provide ample opportunities for regret. This makes guarding against regret critical to helping investors maintain their investment strategies.

Asset Allocation Through the Lens of Regret

Harry Markowitz is called the father of Modern Portfolio Theory for his work in quantifying the benefits of diversification. Yet, in his own portfolio he divided his money equally between stocks and bonds, since he did not know which was likely to do better in any given year.

This demonstrates the wisdom of splitting assets equally across investments. The case for equally weighted strategies is based on avoiding risk concentrations and equalizing each asset’s marginal contribution to return and risk. This is a fundamental driver of efficiency. We see many examples of equally weighted indexes outperforming their capitalization-weighted counterparts.

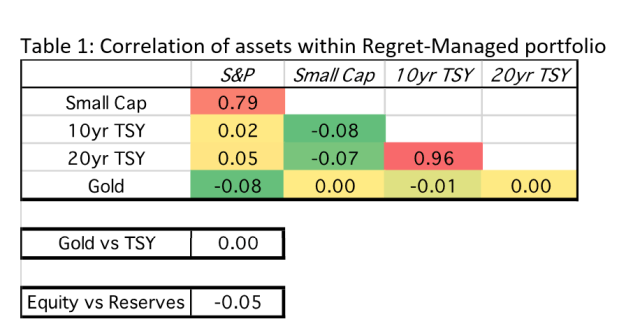

We used a 70/30 mix of large-cap and small-cap stocks for the US equity market, and a 50/50 mix of 10-year and 20-year Treasuries for the bond market. We expect these investments to have complementary, if not opposite reactions to market conditions, making them ideal diversifiers.

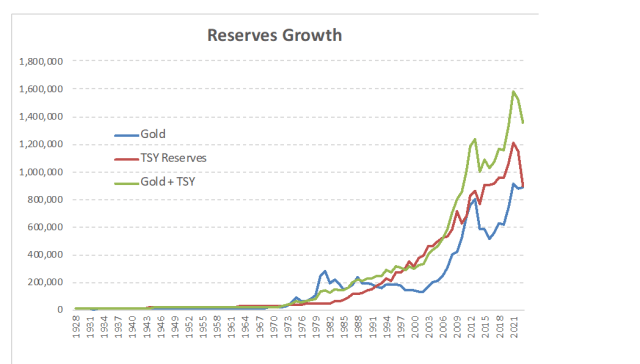

We also prepared for a third scenario — the most stressful and regret-inducing — the likelihood of intense geopolitical turmoil. When markets become unsettled, economies are distressed, and currencies lose much of their value. During these times, investors turn to real assets as a more secure store of wealth and liquidity. We created a category of reserves comprising gold and Treasury bonds. Following our naïve diversification approach, we split the reserves allocation equally between bonds and gold.

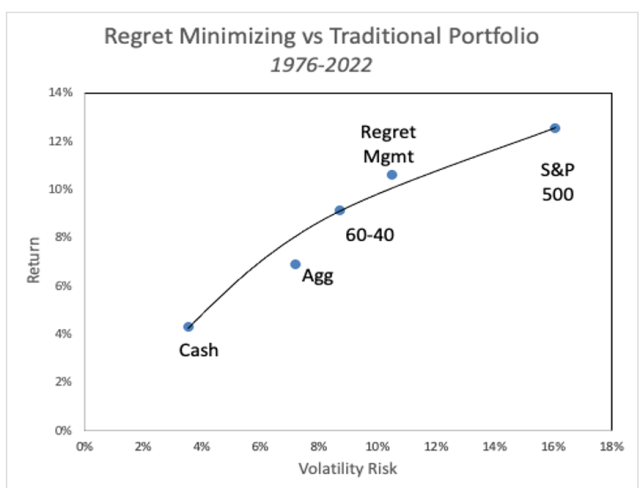

Figure 1: Regret-managed strategy

Evaluating the Diversification of the Regret-Managed Strategy Over 95 Years

We found that equities, bonds, and reserves were uncorrelated with each other. Within reserves, the gold and Treasuries were also uncorrelated to each other. While gold and Treasuries earned the same return, their combination earned a significantly higher return.

Table 1: Correlation of assets within regret-managed portfolio

Figure 2: Growth of reserves portfolio

Performance Results

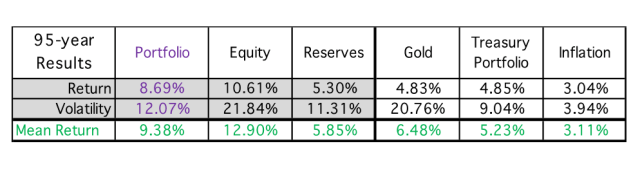

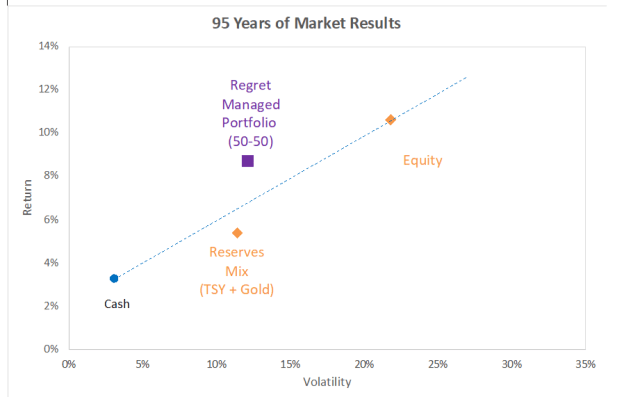

Our goal was to minimize regret and the likelihood of abandoning the asset allocation. I found that the regret-managed portfolio performed well in the context of traditional efficiency. The portfolio return is higher than the average of its components, and its risk is nearly as low as its lower-volatility reserves.

Table 2: Returns over 95 years

Figure 3: Efficiency of regret-managed strategy

Regret-Managed Strategy Versus Classic 60-40 Benchmark

The regret-managed strategy outperformed the familiar 60-40 benchmark (S&P 500 + Aggregate bonds) since the benchmark’s inception nearly 50 years ago. This shows that my efforts to minimize regret did not come at the cost of efficiency. The 60-40 investor also experienced greater severity and frequency of regret.

Figure 4: Regret-managed strategy vs 60-40 strategy

Quantifying Regret

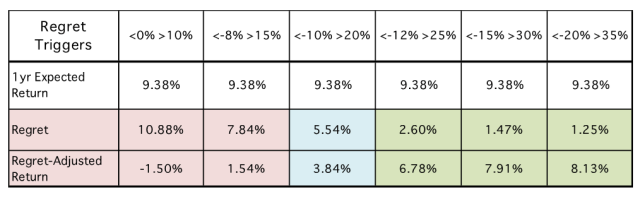

The first step in measuring regret is to assign a limit to the returns that qualify as regret-inducing.

Perceptions of regret are unique to each client, recognizing that investors respond more strongly to losses than to gains. Some suggest that the response to losses is twice that of similar-sized gains. We developed our upside and downside regret targets with negative values at about half the positive target. Our base case sets the targets at -12% and 25%. Any returns beyond this range are regret-inducing.

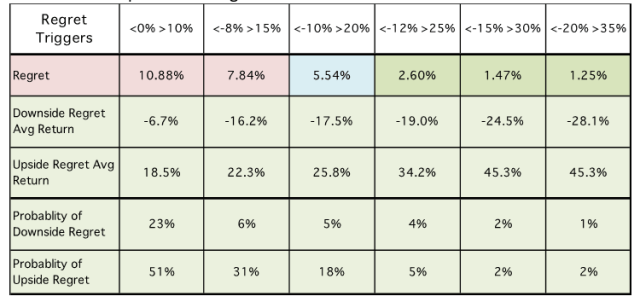

The next step is to determine the magnitude and the likelihood of upside and downside regret experiences.

We calculated the average of the returns exceeding the regret targets, along with their percentage occurrence. These produce an expected regret penalty in the same units as the expected return.

We subtract expected regret from expected return to produce the regret-adjusted return.

Regret in the Equity Portfolio Versus the Diversified Portfolio

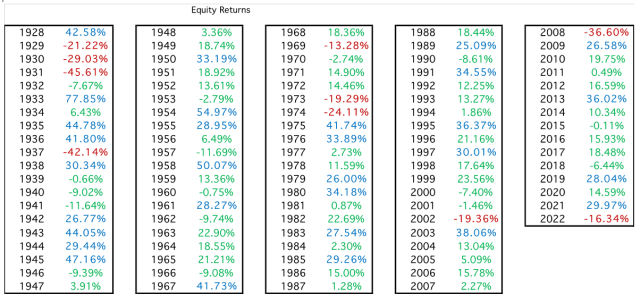

We analyzed the regret in our equity portfolio using our regret target range at -12% and 25%. Negative-regret returns are in red, positive-regret returns are in blue, and non-regret returns are green. Of the 95 annual returns listed, 55 do not induce regret, 30 induce upside regret, and 10 induce regret from losses.

Table 3: Equity returns color-coded by regret

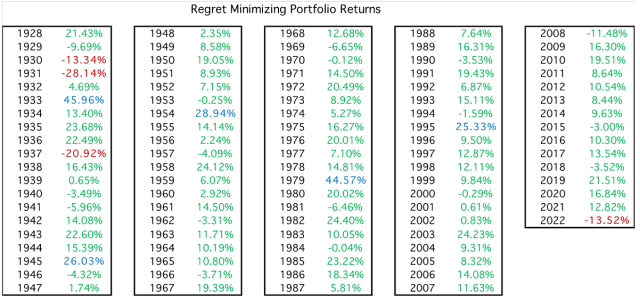

Regret in the Diversified, Regret-Managed Strategy

The regret diversification approach had only nine regretful returns (five upside and four downside.)

Table 4: Regret-managed strategy returns

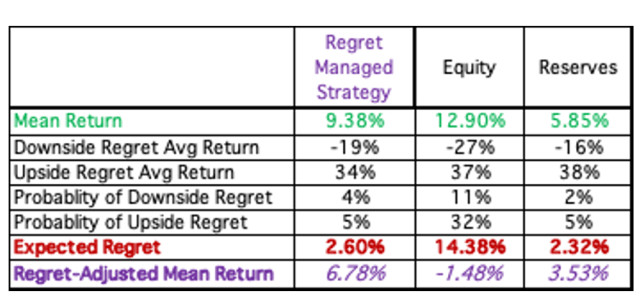

Calculating Regret for Our Base Case Scenario

Our measure of regret is the expected value of returns that exceed the client’s regret targets.

Regret = [Average upside regret return x % Likelihood] + [(Average loss return * -1) x % Likelihood]

Regret is a penalty that is subtracted from the expected return. This produces a regret-adjusted return.

Using our initial regret target range of -12% and 25%, we examine the regret portfolio and its components. This confirms the strong regret diversification value of our intuitively based approach.

Table 5: Expected regret results from 95-year sample returns of regret-managed strategy

Classifying Clients by Their Propensity for Regret

The more sensitive clients are to regret, the more likely they are to experience it, and the more severe that regret will be. High levels of regret result in low regret-adjusted returns and a greater likelihood of abandoning the asset allocation target.

Managing regret is really an exercise in setting realistic return expectations with our clients.

Firms frequently use questionnaires to assign clients to risk categories and fixed asset allocations. These have proven unsatisfactory, since we frequently see studies showing client personal account returns that are significantly lower than the returns on the assets in their portfolios. Client-directed tactical trading that was emotionally based and ill-timed is the driver of these results.

This failure rests with investment firms asking generalized questions that encourage “middle of the road” responses from clients who span a variety of risk and regret tolerances. Clients with vastly different regret sensitivities are assigned to similar strategies, leading to these disappointing results.

Dialing in Client Expectations

We must ask our clients questions that focus on regret. For example:

“What size loss feels gut-wrenching, and how often could you stand having this happen?”

“How large a gain would make you feel that you missed out on a once-in-a-lifetime opportunity?”

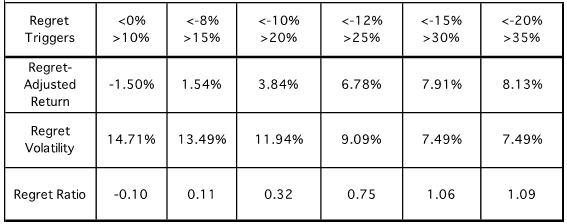

We must present clients with a set of regret triggers that cover a set of regret tolerances. Using our base case investment strategy, we evaluated the regret outcomes for a set of regret tolerances:

Table 6: Return triggers and expected regret results

Our most regretful client is ready to abandon the strategy if any money is lost and may feel they missed the boat with returns only slightly above expectation. The regret this client would experience exceeds the strategy’s expected return, producing a negative regret-adjusted return.

The next scenario flips the regret-adjusted return from negative to positive, as we adjust expectations to a modest loss that retains 92% of the portfolio value, and an upside threshold 50% higher than the expected return.

The third scenario more than doubles the regret-adjusted return, while the fourth scenario has even greater benefit, cutting regret by more than half — again, doubling the regret-adjusted return. Our last two scenarios show regret leveling off, as we reach the outer ranges of extreme returns. These are the most regret-tolerant clients of all.

The first two clients are unsuitable for our diversified strategy, given their extremely low tolerance for market volatility and regret. The last three are likely to sustain their strategies and garner the benefits that they expect. The middle investor should be encouraged to accept a slightly wider band of regret triggers.

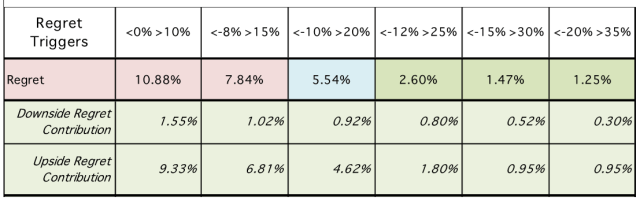

Performance Attribution of Expected Regret

Regret analysis can be applied to any asset strategy and to any actively managed portfolio. The regret driven by the active process can be isolated and analyzed. This regret methodology is broadly applicable to both forward-looking asset allocation functions and backward-looking performance evaluation.

The implications of this approach are substantial, given the lack of attention paid to this pervasive and harmful aspect of investor behavior.

We developed an attribution analysis of the regret, breaking out the upside versus the downside sources and measuring the magnitude and likelihood of that regret.

Table 7: Contribution to regret

Table 8: Decomposition of regret

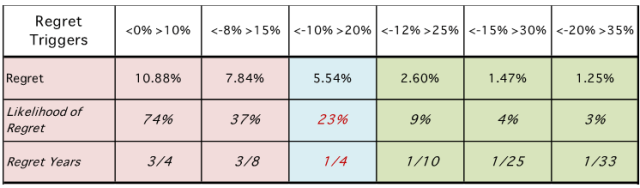

The main driver of clients abandoning their investment strategy is the probability of experiencing regret.

We summed the probabilities of downside and upside regret in this “client diagnostics” report, which focuses on the suitability of each client for the investment strategy.

Table 9: Client Diagnostics

The first two clients are the most sensitive to regret and are unlikely to sustain the asset allocation, since they experience regret so frequently. Yet it is likely that they answered most risk questionnaires as “willing to bear a reasonable degree of market volatility.” If they had been asked whether they would be happy with a strategy where they felt regret in three-out-of-four years, they would have responded with a “thumbs down.” The same is true for the second client for three-out-of-eight years. Regret may be only half as bad, but it is still a regret frequency that many would rather avoid.

The third set of regret triggers (-10% and +20%) is where sustainability of the strategy begins. This likelihood of experiencing regret is realistic and manageable. Beyond this set of regret triggers, the likelihood of regret goes from occasional to rare.

The Regret Ratio

For performance evaluation, we propose a Regret Ratio that evaluates the regret-adjusted reward versus its regret-related return volatility. Stated simply:

Regret Ratio = Regret-adjusted return / Regret Volatility

where:

- Regret-adjusted Return = Return minus Regret Penalty

- Regret Volatility = Standard Deviation of regretful returns

This statistic is similar to the Sortino Ratio because it focuses on contextual risk instead of total return variability.

Table 10: Regret ratio results

Regret Analysis as a Performance Evaluation Tool

Investors are more likely to meet their expectations if they sustain their asset allocation strategy across market cycles. This requires bearing short-term market volatility and rebalancing their portfolios periodically. This discipline can be undone by emotionally based trading that is driven by client regret after incurring losses or missing out on strong gains. We must discourage this strategy abandonment.

One benefit of this approach is a set of reasonable outcomes that an investment manager can use to initiate a realistic conversation with clients about their expectations.

As a performance evaluation tool, regret analysis relates clients’ perspectives to the results of their investment portfolios. It can also evaluate the sources of regret, separating the asset allocation decision from the portfolio’s active results. A performance report on the regret within an asset allocation and its active implementation is a new direction for the performance evaluation industry.

If you liked this post, don’t forget to subscribe to Enterprising Investor and the CFA Institute Research and Policy Center.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / Rudenkoi

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.