In golf, a hole-in-one is a remarkable feat. The odds? Roughly one in 850,000 from a distance of 150 yards – practically a statistical anomaly. Yet, the 2023 LPGA tour recorded 20 such occurrences. How can this be? Simple: a low probability doesn’t necessarily translate to low frequency. Hold on to that thought for a moment.

Now, let’s switch gears. Imagine two coin-toss games. In the first, the coin is fair, offering an equal chance of winning or losing. In the second, the coin is flawed: there’s a 60% chance of losing and only a 40% chance of winning. Both games, however, offer an expected return of 25%.

At first glance, most would claim that the flawed coin presents a higher risk. But consider this carefully. Both games are equally risky if we don’t know the outcome in advance –particularly when playing only once. The next flip could easily defy probability. Therefore, risk isn’t merely about the odds of winning. It’s about the severity of loss when things go wrong.

Let’s add a new layer. Suppose the fair coin offers a 150% return on a win but a 100% loss on failure. The flawed coin, meanwhile, offers a 135% return on success but only a 50% loss on failure. Both scenarios result in an expected return of around 25%, but the flawed coin lets you live to play again — a crucial factor in investing.

In investing, risk is not defined by probability or expected return. True risk is the likelihood of permanent capital loss when the odds turn against you. Risk, therefore, should always be viewed in absolute terms, not relative to return.

Simply put, as a minority equity investor, there is no return level worth the risk of a permanent loss of capital. Since the future is unpredictable, avoiding extreme payoffs is paramount. Rational investing doesn’t involve betting on binary outcomes, no matter how enticing the potential upside. While this sounds simple, in practice, it’s far more nuanced.

Theory to Practice

Consider a chemical company that has just completed a major capex cycle, funded primarily through significant debt. The management is optimistic that new capacity will triple cash flows, allowing the company to quickly repay its debt and become net cash-positive in two years. Additionally, the stock is trading at a deep discount relative to peers and its historical average.

Tempting, right? But the prudent investor focuses not on the potential upside but on the bankruptcy risk inherent in a commoditized, cyclical industry, especially one vulnerable to Chinese dumping.

Now consider another example. A branded consumer company with a historically strong cash-generating legacy business. Recently, the company has taken on debt to expand into new related products. If the new product flops, the company’s core portfolio will still generate enough cash flow to pay down debt. It would be a painful setback, but far less catastrophic. For a long-term investor, this investment might still result in a profitable outcome.

In both cases, the difference isn’t in the probability of success but in the severity of failure. The focus should always be on managing risk. Returns will follow naturally through the power of compounding.

Empirical Evidence: Leverage and Long-Term Returns

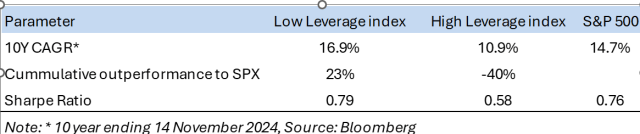

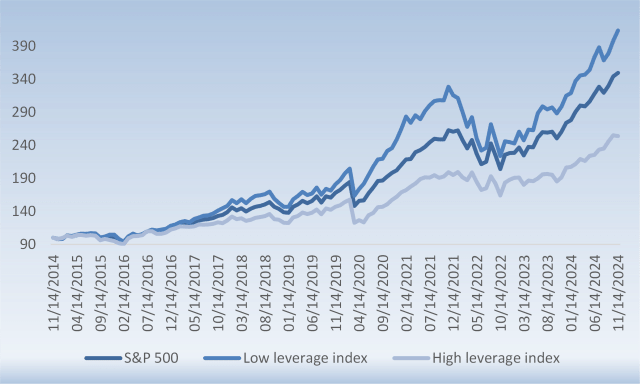

To reemphasize this principle, let’s turn to a more practical illustration. I analyzed the performance of US stocks over the past 10 years by creating two market-cap-weighted indices. The only distinguishing factor? The first index includes companies with net debt to equity below 30%. The second index comprises companies with net debt to equity above 70%.

Index 1.

The results speak for themselves. The low-leverage index outperformed the high-leverage index by 103% over the decade and surpassed the broader S&P 500 by 23%.

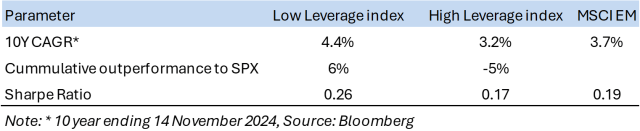

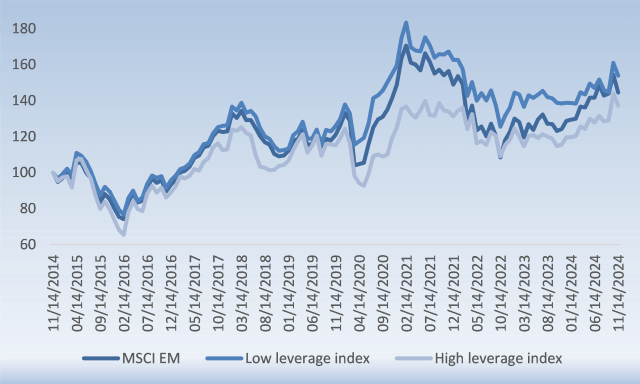

Repeating similar exercise for emerging markets (EM) highlights similar trends, albeit in a narrower range. The low-leverage index outperformed the high-leverage index by 12% over the decade and surpassed the broader MSCI EM by 6%.

These outcomes underscore a simple truth: companies with lower leverage — less risk of bankruptcy — are better equipped to weather downturns and compound returns over the long term.

Key Takeaway

Investing isn’t about chasing improbable victories or betting on binary outcomes with alluring upsides. It’s about safeguarding your capital from permanent loss and allowing it to grow steadily over time. By focusing on companies with strong balance sheets and low leverage, we minimize the severity of potential failures. This prudent approach enables us to weather market downturns and capitalize on the natural power of compounding returns. Remember, managing risk isn’t just a defensive strategy. It’s the cornerstone of sustainable, long-term investing success.