Basic Profile & Key Statistics

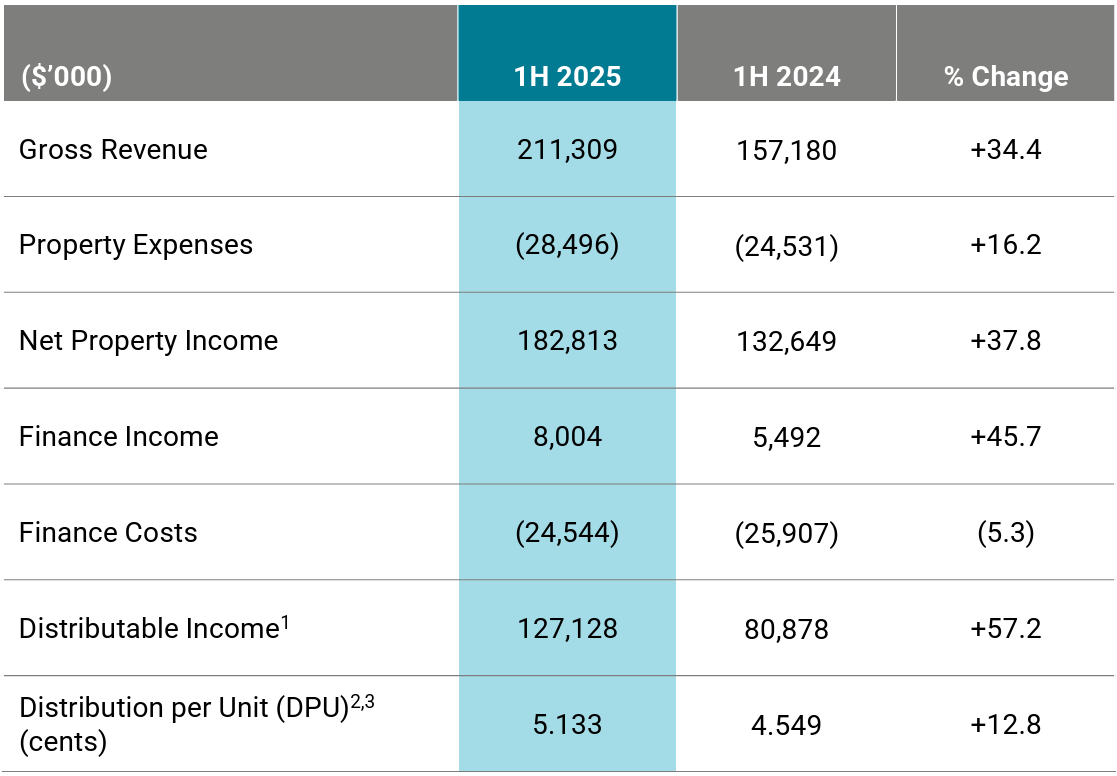

Performance Highlight

Gross revenue and NPI posted strong YoY growth, driven by contributions from:

Acquisitions of Keppel DC Singapore 7 & 8 and Tokyo Data Centre 1Higher variable rents from contract renewals and rental escalations

Finance income also rose, mainly from the Australia Data Centre Note, while finance costs declined due to lower interest rates and loan repayments. These factors led to a significant increase in distributable income. Albeit, DPU rose to a lesser extent (+12.8%) due to a larger unitholder base.

.

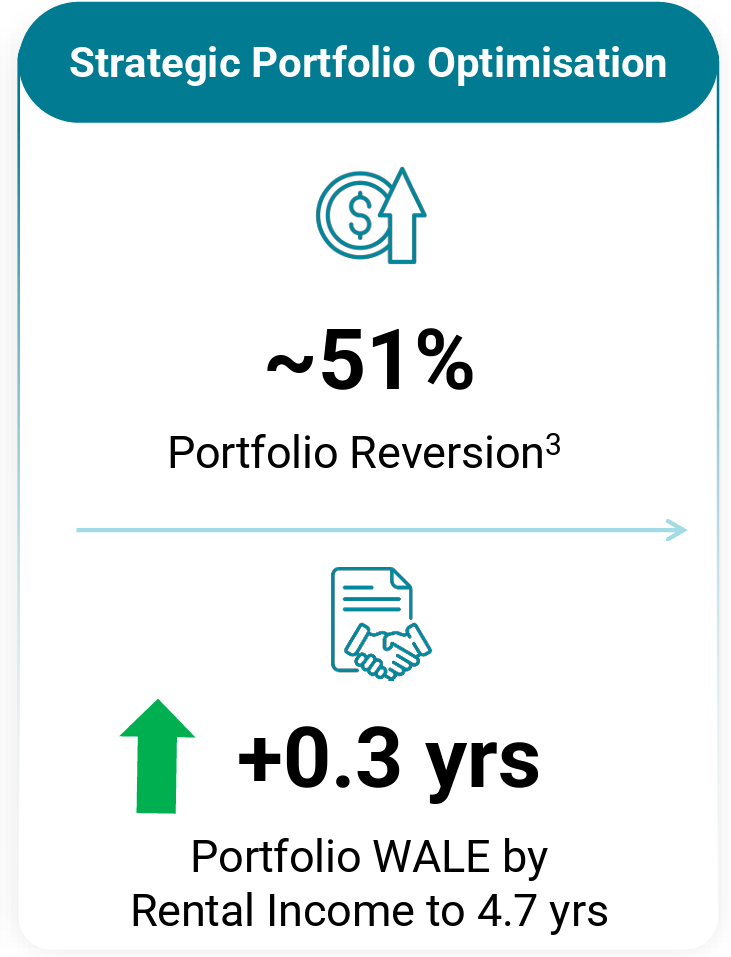

Rental Reversion

Keppel DC REIT recorded a strong portfolio rental reversion of ~51% for 1H 2025, largely due to major contract renewals.

Acquisition

KDC targets to acquire the remaining stake in Keppel DC Singapore 7 & 8 by 2H 2025. The trust currently owns 99.49% of both assets

Divestment

The divestment of Basis Bay Data Centre in Malaysia is expected to be completed in 3Q 2025.

Related Parties Shareholding

…