Most homeowners believe their insurance policies will protect them when disaster strikes. But that illusion shattered for Natalia Migal.

Testifying before the U.S. Senate, she recalled how Hurricane Helene ravaged her Georgia home, only for her insurer Allstate to offer a mere $46,000 for repairs, despite independent assessments putting the damage closer to $500,000.

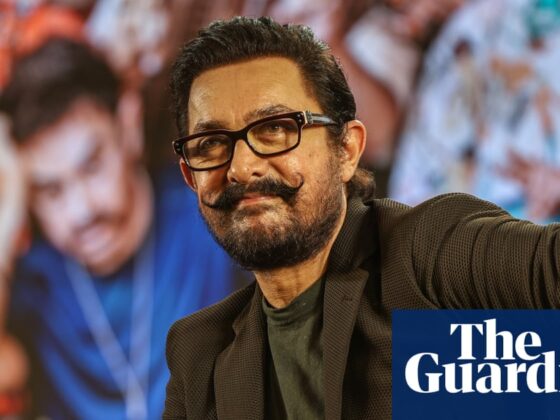

Digging into Allstate’s recent financial statements, Senator Josh Hawley questioned the company’s decision to reward the C-suite after boosting revenue and profits while policyholders like Migal struggled to get compensated for their losses.

“CEO Tom Wilson was paid $26 million,” he said during the hearing.

“Ms.Miguel can't get her claim paid out but Tom, whoever he is, gets $26 million. Why is his salary a priority but Ms.Miguel isn't?”

Unfortunately, Migal’s case isn’t an outlier. As evidence from policymakers and industry insiders piles up, lawmakers are ramping up their scrutiny of the $1 trillion property insurance industry.

It wasn’t just policyholders who testified before Congress on May 13 but also claims adjusters, industry professionals who assess damages and estimate losses. Two of these adjusters testified that they faced pressure to lower their initial estimates, which alarmed the committee.

“We’ve just heard testimony here, sworn testimony from multiple adjusters, that your company ordered them to delete or alter damage estimates to reduce payouts and to make you profits,” Hawley told Michael Fiato, Allstate executive vice-president and chief claims officer, during the hearing.

“It sounds to me like you’re running a system of institutionalized fraud.”

Fiato pushed back on this accusation by highlighting the fact that insurance companies like Allstate were handling more claims because of changing weather patterns and higher frequency of natural disasters in recent years.

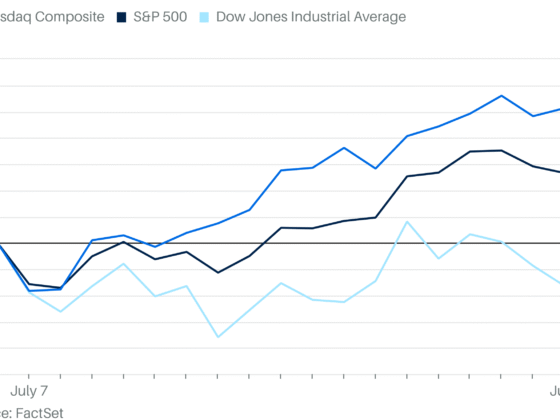

However, Hawley pointed out that this added risk wasn’t being reflected in the company’s financials.

“I have to notice that your profits have never been better, they’re really quite extraordinary,” he said. “Fiscal year ’24, Allstate had $64 billion in revenue; that’s 12% above the previous year.”