Investment Portfolios Updates (29 August 2025) – Net Investment of S$813K and Projected Annualised Passive Income of S$48K.

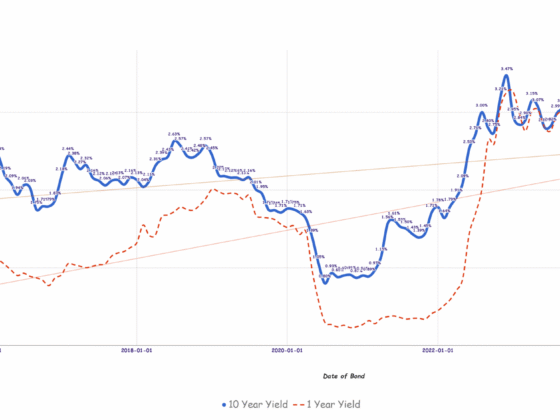

Hi Folks, welcome back to my bi-monthly investment portfolios update. With the anticipation of the long awaited lowering of US interest rates finally having a high chance of materialising after Powell's recent speech, REITs' rally became more sustainable from the expected higher distributable income from much lower financing cost. Let's keep our fingers crossed that the September 2025 first rate cut of 25 basis points happen as per anticipation- I really have enough of the roller costal ride over the past year. With the recent strong rally from REITs, my overall gross portfolios hits S$1.08Mil while net portfolios after leverage hits S$820K. This is a drastic improvement of almost +S$80K in just 2 months from the market recovery. As a mainly dividend focused strategy investor, it is not this capital gain that excites me but rather the upcoming additional cashflow expected from the lower interest rate effect on my various investment portfolios and additionally, the significant savings from my margin loan….