Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Worldline is a French payments processor whose share price has taken a dive over the past few years under a weakening revenue outlook and media allegations that it turned a blind eye to fraud.

The spin-off from Atos has hired an external firm to audit its portfolio of risky clients, while the Brussels public prosecutor has opened a money-laundering probe into its Belgian unit. It remains one of Europe’s most crowded shorts and is a long way below its peak market cap of almost €23bn in 2021.

Worldline has said that over the past few years it “has strengthened its merchant risk framework to ensure full compliance with laws and regulations” and has terminated commercial relationships deemed “non-compliant” with those standards. It also cited reports that show “Worldline’s fraud ratio is below the industry average”.

As the audits and investigations play out, Worldline has sought to reassure investors by maintaining a healthy balance sheet with reasonable debt levels and a comfortable liquidity cushion.

A few aspects of its balance sheet are curious, however, including a surprisingly small uptick in its group-wide overdraft.

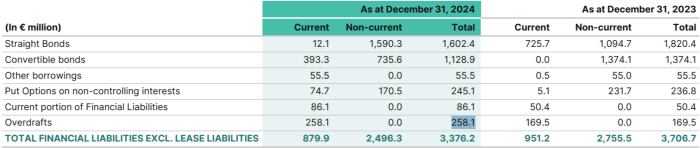

The payment processor’s consolidated accounts — the primary reference for most retail investors and even the bulk of professionals — show an overdraft that has grown from just under €50mn in 2022 to €258mn in 2024 (high-res).

Readers might think that there’s nothing underwhelming about an overdraft that has increased by 400 per cent, but it’s as nothing compared with what’s going on at Worldline’s holding company.

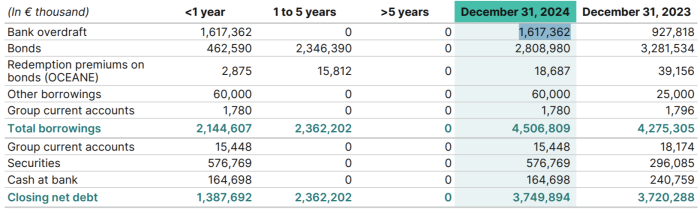

At the top of its capital structure, the borrowings of parent company Worldline S.A. are much larger. That entity has taken out a massive €1.6bn overdraft, which has increased rapidly from around €900mn in 2023 and 2022. Before that, the parent company overdraft was just €250mn (high-res).

When the balance sheets of all of the group’s entities are combined and distributed to investors in the form of consolidated accounts, the entirety of the €1.6bn in parent company short-term debt is nowhere to be seen, and the group manages to report a consolidated overdraft figure of just €258mn.

What’s going on? When an analyst asked the question on the company’s H1 earnings call at the end of last month, Worldline’s group CFO Grégory Lambertie explained that it was a complex and largely unobservable accounting technique:

So, in terms of our [overdraft] position at the end of June, it was €1.6bn. There is an overall cash pool that is held with BMG, Bank Mendes Gans, a subsidiary of ING. The way it works is subsidiaries put their cash on a BMG account and the liquidity is being used at the HoldCo to offset. That’s the overdraft you’re seeing, and the HoldCo, Worldline SA, effectively defines the investment policy in short term deposits and so on. And if you look at the balance sheet of the HoldCo, you will have around about €1bn that is invested in short term deposits.

So, effectively, what you have is a cash pooling that has around about €200mn net amount, with negative position at HoldCo, positive positions in subsidiaries, and the rest of the liquidity is held through the short term deposits and some investments, so the €1bn short term deposits, and the cash that we have in the subsidiaries. So, that’s the set-up.

Simply put, Alphaville understands that the €1.6bn figure is offset by available cash that Worldline says is pooled from subsidiaries and other money locked up in short-term deposits and investments. The line of credit that it says is provided by Bank Mendes Gans, a subsidiary of ING, allows the company to consolidate cash and investments that it says are scattered across a sprawling web of subsidiaries.

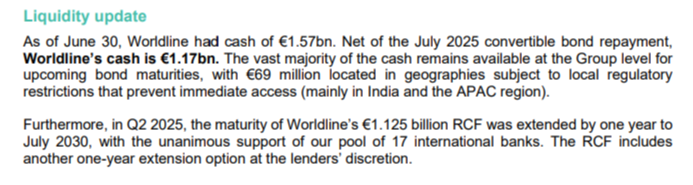

On top of all that available cash, Worldline also said in a liquidity update posted in July that it has another €1.17bn in excess cash, although the vast majority “remains available at the Group level for upcoming bond maturities”.

Worldline’s healthy cash position raises its own questions.

For a company that reports around €1.17bn in total available liquidity, taking out a €1.6bn overdraft — offset by cash at various subsidiaries — struck Alphaville as an odd thing to do, particularly when Worldline also has a €1.125bn revolving credit facility backed by 17 banks that was completely undrawn as of December 2024.

Unlike publicly traded bonds, and most other credit facilities, a bank overdraft can be cancelled at short notice or not renewed at the end of its term, which in Worldline’s case is just one year. This would seem to present a sizeable risk. There’s not much to stop the lender pulling the plug if, for example, the result of an ongoing investigation into alleged money-laundering activities doesn’t go the way the company wants.

And that's not all. Worldline has engaged in a few other practices that don’t seem to chime with its strong liquidity position. Factoring €10.9mn of tax receivables is one. Factoring €44mn of other receivables is another.

We have so far been unable to independently verify the €1.6bn figure given by Worldline. ING and its subsidiary BMG, the bank that Worldline says is providing the overdraft, declined to comment.

Worldline declined to comment on its capital structure, or on any other point raised in this post. The company said in a public statement last month: “Worldline’s Top Management and Board of Directors are fully committed to strict compliance with regulations and risk prevention standards.”