Until recently, emerging market (EM) equities were among the darlings of the investing world. And why not? To most investors, a potentially diversifying asset class with prospects for high returns looks like a gift. For active managers, EM equities represent the chance to invest in a less-efficient segment of the market and thereby demonstrate their investment skill.

Over the last five years or so, however, the promise of EM equity as an asset class has faded somewhat. This is due to the significantly poorer performance of EM equities versus their developed peers.

EM Equity Performance vs. US Equity Performance

Annualized Five-Year Returns

| MSCI EM Index | 1.31% |

| S&P 500 | 11.34% |

Not all EM equity strategies have disappointed, however. EM factor strategies — in particular multi-factor EM equity approaches — have done well in both absolute terms and relative to the broader EM equity universe. Here, we provide an overview of EM equity investing’s evolving landscape and describe a multi-factor investment process that has avoided the pitfalls of its EM equity peers.

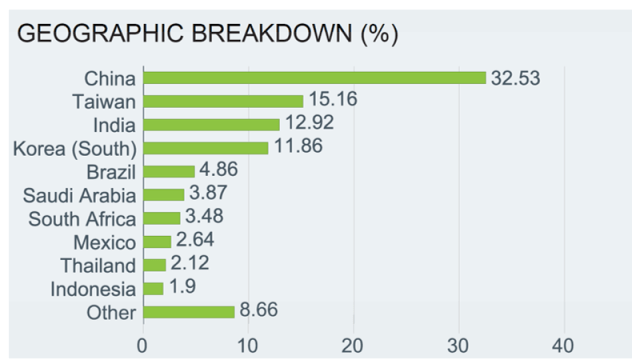

The Changing Emerging Market Landscape

Some emerging markets have not fulfilled their development potential in recent years. Others have succumbed to political or military strife. Turkey and Russia, for example, once featured prominently in the space but have since fallen out of favor and either receive much lower weights in the core indices or are excluded altogether. On the other hand, Saudi Arabia and Thailand, among other countries, have greatly increased their weights in the same indices.

EM investing has become more complicated, and consequently, managers need to adopt more sophisticated approaches to decipher and manage EM portfolios successfully. For example, expertise in Russia and Turkey is not as valuable as it once was, so managers must expand their knowledge of the newer entrants to the investable EM basket. Of course, such expertise is not achieved overnight. Those fundamental managers who do not depend on a quantitative process must develop the requisite skills to navigate the new EM landscape. This presents a daunting challenge.

MSCI EM Index: Market Weights as of 31 March 2023

How to Harvest Equity Factor Premia in EM Equities

The following chart presents EM equities and their performance numbers. Over the past three years, in particular, a multi-factor EM strategy built according to the process we describe below has outperformed the broad EM market, as represented by the MSCI EM Index, as well as standard EM equity factor strategies and active EM exchange-traded funds (ETFs) more generally.

The question is: How was this performance achieved?

EM Equity Performance: Absolute Returns

| MSCI Emerging Markets Index | Robust EM Multi-Factor Strategy | MSCI Emerging Markets Diversified Multi-Factor Index | Active EM ETF Aggregate | EM Multi-Factor ETF Aggregate | |

| YTD (31 December 2022 to 30 June 2023) |

5.10% | 9.18% | 4.33% | 6.04% | 4.53% |

| One Year | 2.22% | 11.76% | 4.27% | 2.78% | 3.29% |

| Three Year | 2.71% | 8.08% | 6.61% | 2.78% | 4.65% |

| Five Year | 1.31% | 2.33% | 2.22% | 1.96% | 0.68% |

How to Build a Robust EM Equity Factor Strategy

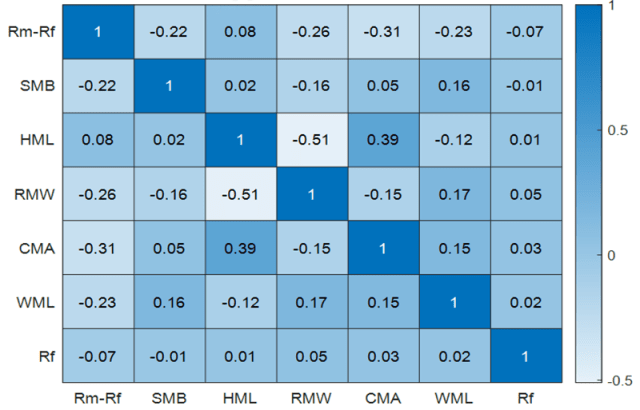

These results are the product of a four-step investment process. Core to our method are six equity factors that have been validated by dozens of researchers over the years: Value, Momentum, Size, Low Volatility, Profitability, and Low Investment. These factors not only have clear economic interpretations but also have provided reliable and well-documented systematic premia across various geographies and market environments. This is due, in part, to their low correlation with one another, as shown in the illustration below.

Low Factor Correlations Mean Smoother Cyclicality

Long-Short Factor Correlations

Step 1

We first build portfolios for each individual factor, selecting our stocks from the broader EM universe. In the first stage of our process, we filter stocks based on their singular exposure to a given factor — Value, for example.

Step 2

We next evaluate the remaining stocks for their individual exposure to the specific factor portfolio in question as well as their exposure to other factors. The goal of this step is to further refine the portfolio stocks based on their overall “factor intensity,” or the sum of their individual exposures (betas) to the broad set of factors. By doing so, each individual factor portfolio maintains a strong tilt to its desired factor and positive exposure to other factors, without sacrificing exposure to its target. This is particularly useful in a multi-factor context since investors want exposure to all rewarded factors.

Low Factor Correlations Allow Multi-Factor Investors to Smooth Cyclicality

| 31 December 1970 to 31 December 2022 |

Low Volatility |

Small Size |

Value | High Momentum |

High Profitability |

Low Investment |

| Single Factor Sleeves without Factor Intensity Filter | ||||||

| Exposure to Desired Factor Tilt |

0.17 | 0.26 | 0.26 | 0.15 | 0.23 | 0.30 |

| Factor Intensity | 0.31 | 0.40 | 0.51 | 0.31 | 0.41 | 0.45 |

| Single Factor Sleeves with Factor Intensity Filter | ||||||

| Exposure to Desired Factor Tilt |

0.16 | 0.24 | 0.26 | 0.17 | 0.25 | 0.26 |

| Factor Intensity | 0.47 | 0.71 | 0.72 | 0.58 | 0.58 | 0.60 |

Step 3

After selecting the stocks in our portfolio, we generate portfolio weights for each using four optimization schemes — Maximum Deconcentration, Diversified Risk Weighted, Maximum Decorrelation, and Maximum Sharpe Ratio.

There are two reasons for this. First, we want to remove any remnant of idiosyncratic, stock-specific risk from our factor portfolios. Our goal is to harvest factor premia, not trade “names.” Second, since no modeling methodology is flawless, we also want to mitigate any latent model risk in any one optimization model.

Step 4

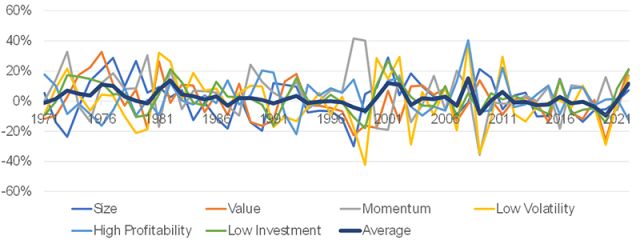

Finally, we weight each individual factor portfolio equally to build a final multi-factor EM strategy. Why an equally weighted allocation across risk factors? Because it avoids estimation risks and allows investors to harvest the benefits of decorrelation and the cyclicality of their premium, as the figure below demonstrates.

Equal Weighting Maximizes Benefit from Factors Decorrelation

Annual Returns of Long-Short Reward Factors

Conclusion

Many EM equity strategies have experienced poor absolute and relative performance over the last few years largely because of the shifting nature of the investable EM universe. Several previous EM leaders have sputtered in their development or succumbed to political volatility, and many fundamentally driven active managers have failed to adapt.

Our quantitative, multi-factor strategy offers an antidote to the challenges of EM equity investing. It has performed well compared with emerging markets more broadly and with active managers in the space. Why? Because it emphasizes diversification, risk control, and harvesting factor premia over stock picking.

So, there is hope for investors seeking a robust emerging market equity strategy to complement their other equity investments.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author(s). As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / Dar1930

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.