Does gold hedge inflation? On average the answer is no, empirically speaking. But gold’s relationship with inflation is complicated, making any blanket statement about its role in portfolio construction unwise.

In this blog post I offer evidence against the claim that gold is a reliable inflation hedge. But I don’t test and thus don’t dismiss gold’s potential value as a diversifier for other reasons.

Gold Rush

Gold’s recent surge has sent its real (Consumer Price Index-deflated) price to its highest levels since July of 2020 — almost $740 per ounce as of April 2024 — though still below its early 1980 peak of approximately $840 (Exhibit 1).

Exhibit 1.

This recent high has heightened interest in gold as a portfolio diversifier generally and presumably as an inflation hedge specifically. This blog examines gold’s inflation-hedging properties visually and empirically. Full results and R code can be found in the online R supplement.

What an Inflation Hedge Should Do, and What Gold Doesn’t Do

An inflation hedge should move with inflation. When inflation goes up, so should the hedge. The claim that gold hedges inflation is therefore testable.

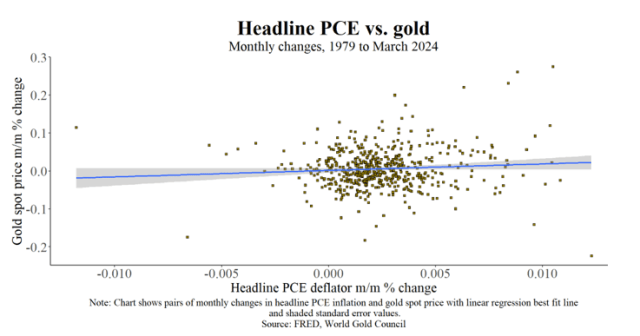

To start with, the scatterplot in Exhibit 2 shows the month-over-month change in the headline (that is, “all items”) personal consumption expenditures (PCE) deflator inflation measure versus the spot price of gold from 1979 to 2024, the longest publicly available series for gold prices.

Exhibit 2.

As evidenced by the random scatter of points in Exhibit 2, changes in headline PCE inflation are not meaningfully correlated with changes in the spot price of gold, on average (correlation coefficient confidence interval = -0.004 to 0.162). And the best-fit line (blue) is flat, statistically. Results are robust to using the Consumer Price Index is used for inflation, though in this case the lower end of the confidence interval is just barely positive—as shown in the online R supplement.

The relationship between gold and inflation, however, isn’t stable. There are times when gold’s relationship with inflation is positive, and times when it’s negative.

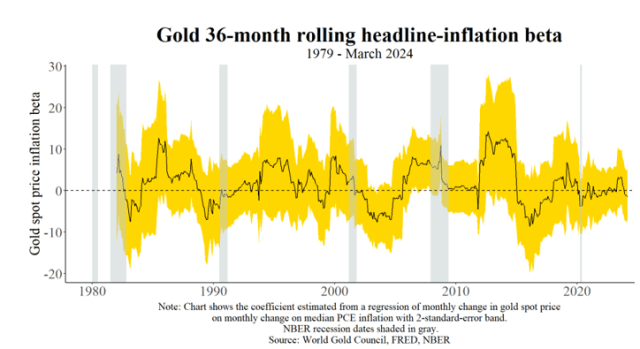

Exhibit 3 shows the rolling 36-month “inflation beta” estimated by regressing the gold spot-price monthly change on the monthly change in headline inflation over a moving 36-month window.

Exhibit 3.

Sign changes — where the series crosses the dotted horizontal line in the chart above — and large errors indicated by the expansive confidence-interval (two-standard-error) ribbon, which includes zero at just about every point make general statements about the relationship impossible.

At the very least, the idea that gold spot price changes move dependably with inflation isn’t supported by this evidence. But there are periods, some protracted, when it does.

Casual inspection suggests that the gold-inflation “relationship,” such as it is, is stronger during expansions — the periods between the gray recession bars — except for the Great Recession of 2007 to 2009. Perhaps this is because impulse for inflation matters to its relationship with gold. I look at this possibility next.

Decomposing Inflation Using Economic Theory

Inflation can be decomposed into temporary and persistent parts, as embodied in Phillips curve models of the inflation process used by economists (Romer 2019). The persistent component is underlying or trend inflation. The temporary part is due to transitory shocks (think oil-price spikes), the impact of which usually fades.

What might truly be of interest to practitioners is how gold responds to a rise in underlying inflation resulting, for example, from too much demand or from rising inflation expectations. This kind of inflation can be stubborn and costly (economically) to contain. We can test this response.

To do so, we need a measure of underlying inflation. There is a strong theoretical and empirical basis for using an outlier-excluding statistic like the median as a proxy for underlying inflation (see for example Ball et al 2022). The Federal Reserve Bank of Cleveland calculates median PCE and CPI inflation every month, and I use the former measure here, though results are robust to using the latter measure as shown in the online R supplement.

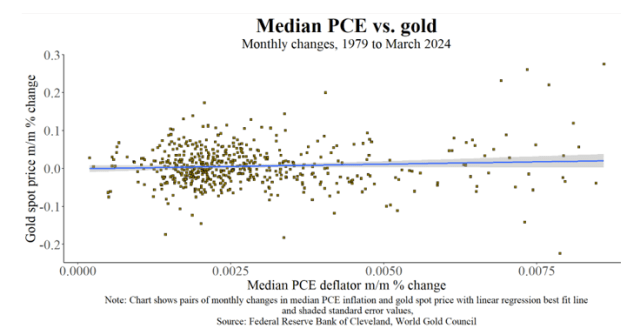

A regression of the monthly change in gold on the change in median PCE results in the rejection of any relationship at the usual levels of significance (t -value = 1.61). This is suggested by the shapeless cloud of points in the scatterplot with best fit line (in blue) shown in Exhibit 4.

Exhibit 4.

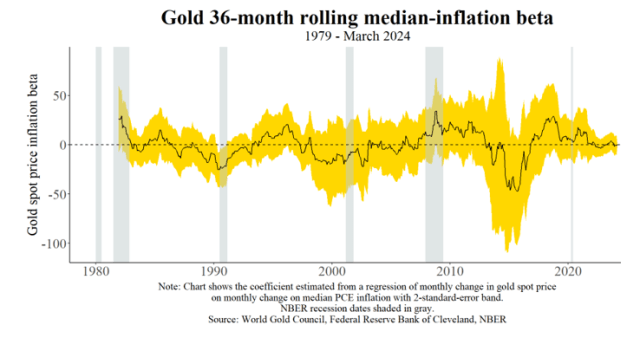

Rolling 36-month regressions of gold on median inflation yield results like those for headline inflation. The relationship is unstable and variable (Exhibit 5).

Exhibit 5.

Interestingly, gold’s median-inflation beta is far more volatile — the standard deviation is about three times larger — and less persistent (as measured by autocorrelation) than headline inflation. That is, gold’s relationship to underlying inflation appears weaker than to headline inflation (regressions confirm this, too — see online R supplement.)

One possible explanation is that gold may hedge the difference between headline and median inflation — sometimes called “headline shocks” — more reliably than underlying inflation. That is a point I don’t explore further in this blog post, though I did test the idea briefly in the online R supplement and found no evidence for it.

If underlying inflation captures economic forces of excess demand and rising inflation expectations as embodied in Phillips curve-type models, gold doesn’t appear to hedge the price pressure they can cause.

To check the relationship between gold and an overheating economy, I test one more, simple model. Using quarterly real gross domestic product (GDP) and potential GDP estimated by the Congressional Budget Office, I regress gold’s spot-price change on the difference between actual over potential GDP as a measure of economic slack or lack thereof. That is, I regress gold on the GDP “gap.”

A priori, if gold were a hedge against the “demand pull” inflation that can result from an economy speeding up or growing too fast, it should be positively related to the change in the gap. But I find no evidence for this, as shown in the online R supplement.

Gold and Inflation: An Unstable Relationship

An inflation hedge should respond positively to inflation. On average, gold doesn’t. I can’t reject that its “inflation beta” is zero, whether inflation is measured by headline inflation (excluding food and energy) or outlier-excluding median inflation. Also, I find no relationship between gold and economic overheating. But gold’s relationship with these economic forces is unstable. There are periods when gold hedged inflation quite well.

Consequently, I don’t interpret these findings to mean that gold won’t hedge inflation in some circumstances, or that it isn’t a diversifier in a more general sense. Rather, I read this evidence as a warning against blanket claims.

Just as bonds don’t always hedge stocks, gold hasn’t — and probably won’t — reliably hedge inflation.

References

Ball, L., Leigh, D., & Mishra, P. (2022). Understanding U.S. Inflation During the COVID Era. Brookings Papers on Economic Activity, BPEA Conference Drafts, September 8-9.

Romer, D. (2019). Advanced Macroeconomics. McGraw-Hill Education.

The author is a Registered Investment Advisor representative of Armstrong Advisory Group – SEC Registered Investment Adviser. The information contained herein represents Fandetti’s independent view or research and does not represent solicitation, advertising, or research from Armstrong Advisory Group. It has been obtained from or is based upon sources believed to be reliable, but its accuracy and completeness are not guaranteed. This is not intended to be an offer to buy, sell, or hold any securities.