The landmark US GENIUS Act could serve as a major catalyst for stablecoin adoption both domestically and abroad. But rather than simply boosting demand for dollar-backed digital currencies, it may unintentionally push capital into the tokenization market as investors seek yield on their holdings.

That was one of the key takeaways from a recent interview with Will Beeson, a former Standard Chartered executive and now founder and CEO of Uniform Labs, a developer of institutional liquidity solutions for tokenized financial markets.

A central provision of the GENIUS Act is its blanket ban on yield-bearing stablecoins, which prevents holders from earning interest on their digital dollar balances. According to Beeson, this restriction will accelerate the flow of capital into tokenized real-world assets (RWAs).

“With yield-bearing stablecoins off the table, institutions need a compliant way to earn yield while staying liquid,” Beeson told Cointelegraph. “Capital is already shifting.”

He noted that trillions of dollars in non-interest-bearing stablecoins are poised to enter digital finance. “Institutional holders aren’t going to sit on idle, depreciating assets. They’ll demand yield — and infrastructure that makes accessing it […] compliant,” he said, adding:

“The next phase isn’t about holding idle stablecoins. It’s about programmatic access to risk-free yield, and the ability to move between cash and high-quality assets at will.”

Beeson’s view is shared by Aptos Labs’ Solomon Tesfaye, who told Cointelegraph that the GENIUS Act will benefit tokenization as much as it does stablecoins.

To meet this need, Beeson’s Uniform Labs is building Multiliquid, an institutional liquidity layer for tokenized markets that enables programmable, real-time conversion between tokenized assets, such as US Treasurys and money market funds, and stablecoins.

Multiliquid’s open-architecture design allows compliant issuers to integrate without commercial agreements.

While declining to name partners, Beeson confirmed that Uniform Labs is “working with a number of leading institutions, fintechs, and stablecoin issuers” ahead of its production launch later this year.

Before launching Uniform Labs, Beeson served as chief product officer at Libeara, a tokenization platform incubated by Standard Chartered’s SC Ventures.

Related: Tokenized money market funds emerge as Wall Street’s answer to stablecoins

Tokenization surge to broaden beyond private credit, government bonds

Although the GENIUS Act gives newfound legitimacy to stablecoins — and to digital currencies more broadly — “the next phase of digital assets is focused on asset tokenization,” wrote Sandra Waliczek, a member of the World Economic Forum’s blockchain and digital asset division.

Waliczek highlighted tokenization’s potential to level the investing playing field for asset classes like real estate and private equity, which have historically been restricted to wealthier investors.

“Tokenization changes this by enabling asset fractionalization, breaking assets into smaller, more affordable units,” she wrote.

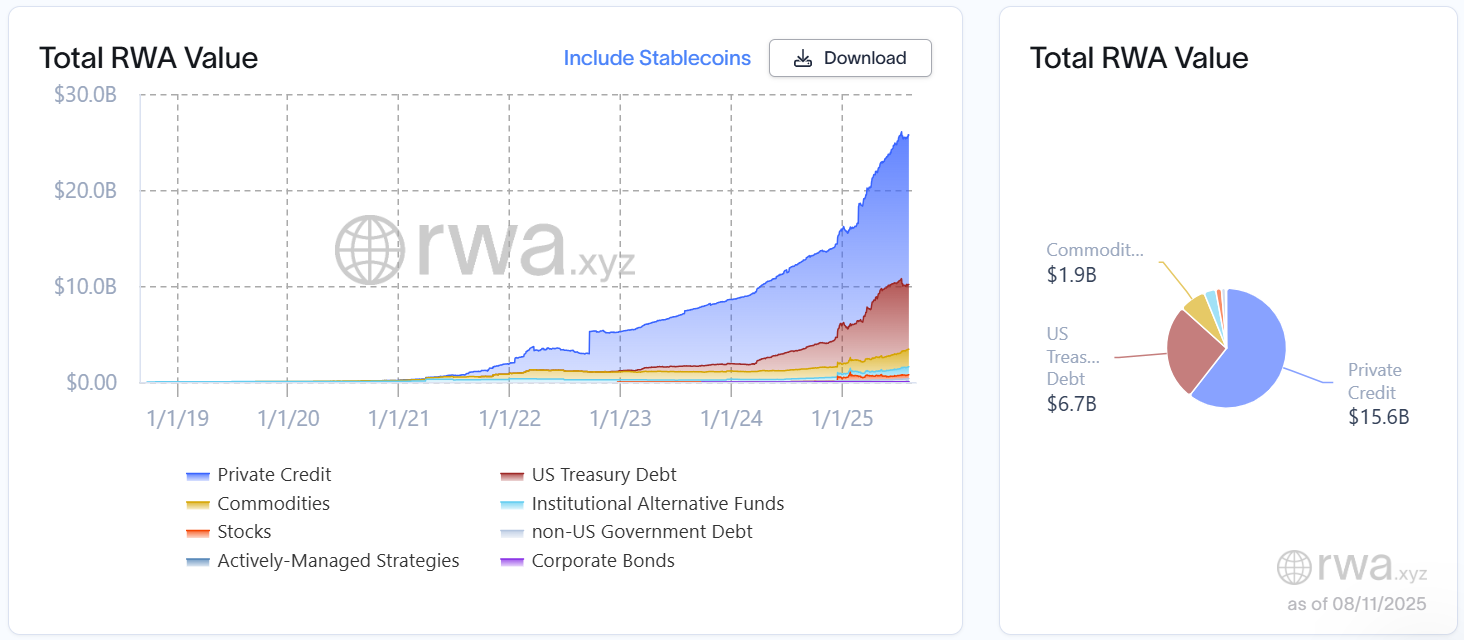

So far, the nearly $26 billion tokenization market has largely centered on private credit and government bonds. But as Beeson noted, the disruption will extend far beyond those segments, encompassing “corporate bonds, credit and credit funds, commodities, equities, real estate funds, private equity funds, and ultimately private equity and real estate assets themselves.”

Related: GENIUS Act scrutinized for stablecoin yield ban as TradFi tokenization gains steam