Will the son of a billionaire perpetuate his inherited wealth? Apparently not, if history is any guide.

In fact, there is strong evidence that most “rich families” will be poorer after several generations. Some of the reasons for this are systemic. Taxes, for example, chip away at a family’s wealth. But most factors that diminish a family’s wealth over generations are the choices that heirs make. These include how they invest their inheritance, how many children they have, whether they get divorced, and other lifestyle choices.

Figure 1. The 10 richest people in the world in 2013 and 2023.

Source: Forbes

As Figure 1 illustrates, six of the 10 richest people in the world were “created” in 10 years. And these were all men, which is why I use the term “patriarch” throughout this blog. Of course, this is too small a sample to be statistically significant. But at first glance, the Forbes Top10 List shows that capitalism has the capacity to create new billionaires and generate wealth. Another way to look at it is that capitalism replaces billionaires who either failed to increase their fortunes as quickly as others or lost it somehow.

This raises an intriguing set of questions: what does it take for someone who was yesterday’s TOP10 billionaire to not be today’s TOP10 billionaire? Are the causes applicable to other affluent investors? If there is no single formula for getting rich, is there a single formula for losing a family’s wealth? When it comes to generational wealth, does the apple fall far from the tree?

A Model to Explain Accumulation Capacity of an Affluent

To test the capacity of an affluent person to perpetuate his or her wealth for the next five generations, we created a mathematical model that explains accumulation capacity in seven variables:

- Amount of heritage received (H)

- Number of heirs to split the wealth (Q)

- (i)

- Number of years of accumulation (N)

- Annual affluent’s expenditure, as a % of his family income (G)

- Divorce rate among affluents and, therefore, wealth split in the process (D)

- Wealth tax (T)

Considering these variables, the future value that a patriarch will transmit to the second generation of their family will be:

FV= [(H x (1+i)N) + ((H x i) x (1-G)/Q) x ((1+i)N – 1)/i)] x (1-T)

And this cycle continues, from the second to the third generation, from the third to the fourth, and henceforth. Three factors in the accumulation process stand out: inheriting a lot of money, having more time in the accumulation phase, and realizing a higher return on investments. Conversely, four out of seven variables constrain accumulation: having more kids, spending too much, getting divorced, and living in a country with a high wealth tax.

We test this question: Can an affluent family accumulate wealth for several generations, even if it has more kids, lives a lavish lifestyle, splits wealth in a divorce, and pays a wealth tax?

You will notice that the variable “divorce” is not present in the basic formula. This is because it is random and binary. To test this effect in dynamic scenarios, we ran a Monte Carlo Simulation, considering 10,000 scenarios. We considered the following values and probability distributions:

Amount of Inheritance received

We begin at US$1 billion. This number was arbitrarily chosen and assumes that the family’s patriarch left $1 billion upon death and left all of it to his relatives (no philanthropy, no further donations, no relative denial nor exclusion of an heir). And consequently, we can determine the amount that his son would accumulate upon his death, the amount his grandson would inherit, and henceforth, until the family’s fifth generation.

We acknowledge that each person will have his own propensity for leaving an inheritance, and that it varies according to cultural norms. It is not solely dependent on great wealth accumulation during a lifetime. The propensity to leave this inheritance also varies according to the type of heritage. Heritage can be tangible (buildings, cars, boats) or intangible (human values, personal branding, political power).

We also know that a billionaire’s propensity to leave an inheritance doesn’t correlate with his wealth. Jeff Bezos and Elon Musk donate less than 1% of their wealth, and the more they enrich, the less they donate, in percentage terms.

Number of heirs to split the wealth

How many children does a billionaire have? Is it significantly different from an ordinary middle-class person? Elon Musk, for example, has nine children (when this article went to press) with three different women. According to Forbes, Elon Musk is an outlier, as the 700 richest people in America have on average of 2.3 kids, and only 22 of those 700 billionaires have seven or more children. Interpolating this and assuming a normal distribution, we reach a 2.39 standard deviation.

Affluent’s annual net return

This is probably the hardest variable to model. What is the average annual return of a billionaire? High returns are the variable that made Elon Musk go from anonymity to the top of the billionaire’s list in less than 10 years and Carlos Slim to fall from the top of the list to below number 20.

In practice, we see that a billionaire’s return is volatile. First, many have leveraged returns. They own businesses that take on debt and some even leverage their own estates. Second, many of them allocate their wealth to private equities and venture capital, assets that may produce high returns or perform dismally. Using the Dimson-Marsh-Staunton database (2017), returns from 1900 to 2017 for the wealthiest segment of the population averaged 4.8% per annum with a 15.1% standard deviation.

Number of years of accumulation

How many years are necessary to accumulate the first million dollars? And the first billion? According to the financial planners Brian Preston and Bo Hanson, it takes approximately 27 years for a person to accumulate her first million (5.3 million Americans) and 14 more years to hit a billion (700 Americans).

We know, however, that this probability of becoming a millionaire is not precisely random. Even though only 3% of the population made it to the million-dollar milestone, it is 12 times more likely that a person reaches this point after 60 years than before 30 years. We know that white people and Asians are four times more likely to make the million mark than black or Hispanic people. Post-graduate professionals are eight times more likely to reach the million mark than are people whose education ended at elementary school.

Interestingly, 59% of millionaires made their first million with entrepreneurship, 20% by inheritance, and 21% by working. And there is a 44.1% chance that a millionaire will end his life in poverty.

Affluent’s annual expenditure, as a percentage of his family’s income

A person’s spending habits is another extremely sensitive variable. In an extreme, but very enlightening example, Cornelius Vanderbilt’s family lost an estimated $400 billion (adjusted for inflation) in just three generations through lavish consumption.

According to the Bureau of Labor Statistics, the expenditure composition of an American family varies widely. Members of the lower economic classes spend 96% of their income on basic utilities and food. Affluents spend 85% on leisure.

Divorce rate among affluents

The divorce rate has been rising among affluent individuals. A mathematical model should consider this trend. We used the American Community Survey’s most recent data, which shows 44% of couples among the highest economic classes get divorced.

Wealth Tax

We measured the average wealth tax. It is surprising the level of disparity between countries’ wealth taxes. Australia, Canada, Israel, and Mexico have no wealth tax. Japan has eye opening 55%. In many other countries, wealth tax is defined by each state, and varies in its charging scheme. In São Paulo, for example, the rate is fixed at 4%. In Santa Catarina, also in Brazil, the rate varies from 1% to 8%. We used the OECD’s median 7% in our model.

Simulation results

The simulation tried to predict what would happen to 10,000 people who were born a billionaire’s child. We found that some would spend too much, make wrong investment bets, pay a lot of taxes on wealth transfer, and would lose the original billion dollars. The effect would magnify over subsequent generations. It is possible that the fifth generation of this affluent family would comprise middle-class workers who wake up early, get stuck in traffic jams, and struggle to pay the bills.

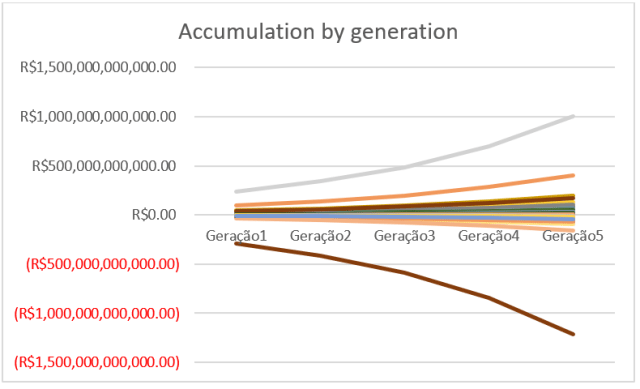

Figure 2. Generational wealth.

If a family made it to the fifth generation with more or equal to the patriarch’s original wealth of $1 billion, we considered it affluent, and in some cases the accumulated wealth was substantially higher than the amount inherited. If the fifth generation of the family had less than its patriarch left, however, it is possible that they let this wealth slip through the generations for some of the reasons modeled above, and we considered it a detractor.

Out of 10,000 simulations, 43% of the time the family was affluent in the fifth generation. Their accumulated average return was 5.008%. That means that in five generations, or about 120 years, the family’s wealth grew about 50 times in real terms.

In the majority of the cases (57%), the fifth generation of the family had less wealth than they inherited and had a -2000% average accumulated return. The simulation showed that affluent families enrich less in frequency, but more in absolute returns. Detractors lose more in frequency, with less pronounced losses.

All things considered, there is strong evidence that few rich families will be even richer after several generations.

Conclusion

The simulation shows that, despite concerns about wealth concentration, it is likely that an affluent family will diminish the patriarch’s heritage and that lifestyle and investment choices are to blame. While a financial adviser can help a family focus on asset allocation and tax planning, the adviser’s role includes affluence psychology and family governance. The transmission of sound values through the generations is what will guarantee perennialism and retention of an affluent family’s wealth.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.