Though inflation is a headline story, it takes a back seat to an ominous warning for stocks.

Over the last century, the stock market has been a surefire moneymaker for patient, long-term-minded investors. Although other asset classes have increased in value over extended periods, including real estate, Treasury bonds, and commodities like gold, silver, and oil, none have come close to matching the annualized return of stocks.

But just because the stock market offers a lengthy track record of making long-term investors richer doesn't mean Wall Street is free of volatility. Since the curtain opened for 2025, the benchmark S&P 500 (^GSPC -0.33%) and growth-focused Nasdaq Composite (^IXIC -0.22%) have both hit new highs. Additionally, the iconic Dow Jones Industrial Average (^DJI -0.63%) and S&P 500 fell into correction territory, with the Nasdaq Composite enduring a short-lived bear market.

Volatility tends to be driven by investor uncertainty and emotions. Though there's clear uncertainty at the moment concerning the prevailing rate of inflation and how rising prices might adversely impact stocks moving forward, a strong argument can be made that there's a much bigger threat to Wall Street than inflation.

President Donald Trump discussing auto tariffs. Image source: Official White House photo.

Inflationary fears are mounting on Wall Street

Let me preface this discussion by noting that a modest level of inflation is normal, healthy, and expected. When the U.S. economy is firing on all cylinders and expanding, it's expected that businesses will possess some level of pricing power that allows them to charge more for their goods and services. Historically, the Federal Reserve has targeted a prevailing rate of inflation of 2%.

What has professional and everyday investors concerned is the potential for two variables to significantly increase the domestic inflation rate, which can have adverse consequences on corporate America, the U.S. economy, and the stock market.

The first of these issues is President Donald Trump's tariff and trade policy. Following the close of trading on April 2, Trump unveiled his grandiose plan, which included a 10% sweeping global tariff, as well as higher “reciprocal tariff rates” on dozens of countries that have historically run unfavorable trade imbalances with America. For what it's worth, Trump has paused reciprocal tariffs on most countries until Aug. 1.

The implementation of global tariffs comes with a host of potential problems, ranging from worsening trade relations with our allies to the possibility of foreign countries and/or consumers not buying American-made goods.

But arguably the biggest worry of all with tariffs is their inflationary impact. Whereas output tariffs are applied to finished products imported into the country, input tariffs are duties assigned to goods used to complete the manufacture of products in America. Input tariffs run the risk of making U.S. goods costlier, and Trump's tariff and trade policy doesn't do a very good job of differentiating between output and input tariffs.

An expected increase in the prevailing rate of inflation from Donald Trump's tariff and trade policy has even resulted in something of a “Trump bump” in Social Security's 2026 cost-of-living adjustment (COLA) forecast.

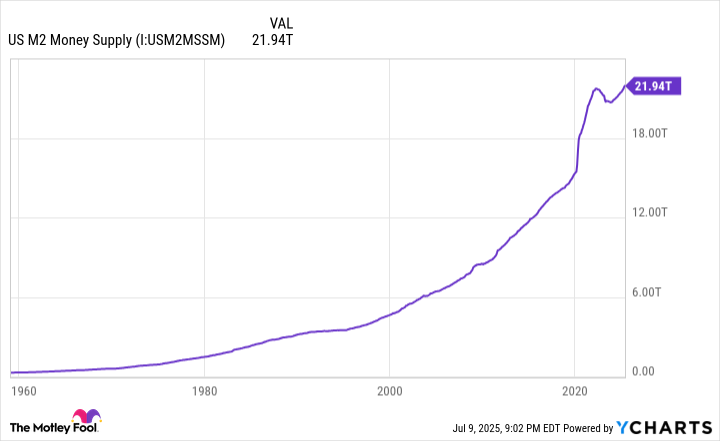

M2 money supply is expanding at its fastest pace in three years. US M2 Money Supply data by YCharts.

The second variable that can cause the inflation rate to accelerate and remain well above the Fed's 2% target is the expansion of U.S. money supply.

Similar to the prevailing rate of inflation, money supply is something we want to see growing at a modest rate. Expanding economies require added capital to facilitate transactions. Steady growth in money supply is one of the key markers of a healthy economy.

What's specifically worth noting about U.S. money supply is the expansion we're witnessing in M2. This measure of money supply includes cash and coins in circulation, demand deposits in a checking account, money market accounts, savings accounts, and certificates of deposit (CDs) under $100,000. It's money that can be spent, but requires a little effort to get to.

Over the trailing year, through May 2025, M2 money supply has increased by precisely 4%. It's the fastest year-over-year expansion in M2 since 2022 — likely a result of the Fed kicking off a rate-easing cycle and making borrowing rates more attractive — and it suggests a strong possibility of the U.S. inflation rate remaining stubbornly above 2%.

But there's a much bigger downside threat to the stock market than inflation.

Image source: Getty Images.

Earnings from Wall Street's most-influential businesses aren't all they're cracked up to be

The surface-scratching red flag for Wall Street is its valuation. When 2025 began, the S&P 500's Shiller price-to-earnings (P/E) Ratio, which is also known as the cyclically adjusted P/E Ratio (CAPE Ratio), was at its third-highest multiple when back-tested 154 years.

Based on what history tells us, the previous five times when the S&P 500's Shiller P/E Ratio surpassed 30 and held this multiple for at least two months were eventually followed by declines ranging from 20% to 89% in the Dow Jones Industrial Average, S&P 500, and/or Nasdaq Composite. In short, the stock market has a track record of struggling when valuation premiums become extended to the upside.

When stocks, collectively, trade at aggressive valuation premiums, it's often reflective of investor excitement over a next-big-thing innovation (e.g., artificial intelligence), as well as the result of strong earnings growth. But herein lies the real threat to Wall Street: Earnings growth has been a bit of a smoke-and-mirrors show for some of the stock market's leading businesses.

Don't get me wrong — some of Wall Street's most-influential businesses have blown the doors off of growth expectations with consistency for years. This includes Nvidia and Microsoft. But some of the stock market's top companies aren't nearly as operationally sound as they might appear — and that's a problem.

Electric vehicle (EV) maker Tesla (TSLA 1.15%) serves as a perfect example. On the surface, it's been profitable for five consecutive years and has relied on its first-mover advantages in the EV space, as well as its expansion into energy generation and storage, as a means to grow its sales and profits.

But you might be surprised to learn that more than half of Tesla's pre-tax income has consistently derived from unsustainable sources, not from selling EVs or energy generation and storage equipment.

In the March-ended quarter, Tesla reported $589 million in pre-tax income, of which $595 million came from selling regulatory automotive credits (which are given to it for free by federal governments) and $309 million in net interest income earned on its cash (less interest expenses). Without regulatory credits and interest earned on its cash, Tesla would have produced a $315 million pre-tax loss for the first quarter.

Worse yet, President Trump's One Big Beautiful Bill, which was signed into law on Independence Day (July 4), is getting rid of automotive regulatory credits for EVs. Tesla is about to lose a 100% gross margin line item, which further exposes how poor its earnings quality truly is.

Something similar can be said about Apple (AAPL -0.59%), but for different reasons. Apple's earnings quality comes under significant scrutiny if you back out the impact of its market-leading share buyback program.

Since 2013, Apple has repurchased an almost unfathomable $775 billion worth of its common stock and retired in excess of 43% of its outstanding shares. Dividing net income by a shrinking number of outstanding shares has pushed earnings per share (EPS) higher and made the stock more fundamentally attractive to value seekers.

But here's the issue: Apple's growth engine has stalled for years, and it's being completely masked by the company's outsized buyback program. In fiscal 2021 (ended Sept. 25, 2021), Apple delivered $94.7 billion in net income. For fiscal 2024 (ended Sept. 28, 2024), net income tallied $93.7 billion. Despite a $1 billion decline in net income over three years, Apple's EPS rose from $5.67 to $6.11, and its stock has rallied 44% since fiscal 2021 ended. In other words, the business has worsened from an income standpoint, but the company has added close to $750 billion in market value, which makes no sense.

Therefore, although inflation is a headline story, it's the earnings quality of Wall Street's most-influential businesses that's the unequivocal threat to the stock market.