Premier Foods has continued its M&A efforts with another deal for a UK brand.

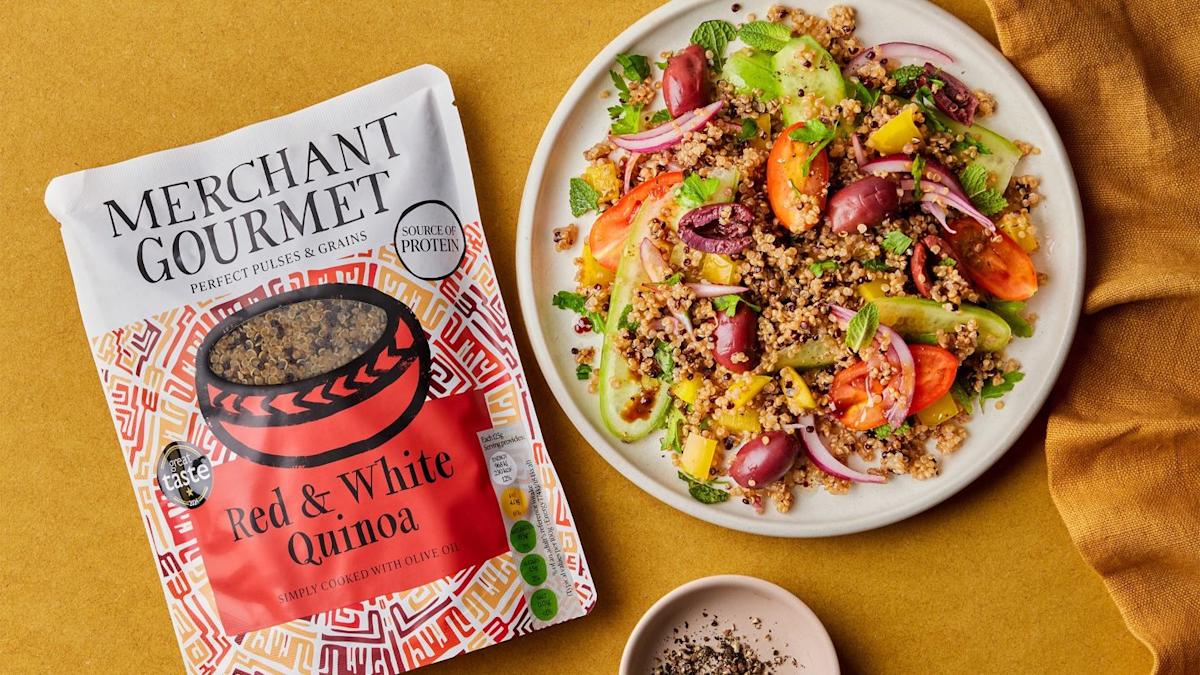

The Sharwood’s sauces manufacturer has snapped up Merchant Gourmet, a convenient-meals business offering microwaveable pulses, grains and rice.

It’s a deal seen in the City as similar to (even if bigger than) Premier’s moves for meal-kits firm The Spice Tailor in 2022 (its first acquisition in more than a decade) and breakfast-and-snacks business Fuel10K a year later.

Both those transactions have been viewed by analysts as a success and Premier’s latest move has been received positively. “The acquisition of Merchant Gourmet reflects the acquisition of a brand in high growth, that is well suited to [Premier’s] branded growth model, at a very attractive multiple,” Berenberg’s Matt Abraham said last week.

Over at RBC Capital Markets, James Edwardes Jones said the move for Merchant Gourmet is “strategically sensible”, though he adds: “The price paid seems high – an enterprise value of £48m ($64.7m) amounts to 1.7 times prospective revenues to a high-single-digit EV/EBITDA multiple for 2025, post expected synergies.”

He added: “The plan seems to be to follow the template of the Spice Tailor and Fuel10K acquisitions, expanding retail distribution, launching new products and investing behind the brand.”

Spot on. Moreover, Premier’s latest piece of M&A is above all, like the Fuel10K deal, a move to give the Mr Kipling cakes maker more exposure to the healthier parts of the store.

There’s no question Premier’s so-called “branded growth model” has paid off for the Ambrosia and Bisto maker in recent years.

It’s a long time since Premier was derided in the UK investment community as something of a “zombie” company weighed down by debt and a pension deficit and therefore unable to invest enough in its brands.

The group has enjoyed four consecutive financial years of rising revenue and profits. Premier’s headline revenue (which excludes exchange rates and its exits from frozen pizza and powdered desserts and drinks) grew 3.5% in the year to 29 March to £1.15bn. Premier said its headline branded revenue increased more than 5% to just over £1bn.

The UK remains the bulk of the business. Premier’s stated “five-pillar strategy” has “continue to grow the UK business” at the top of the list. UK branded sales were up more than 4% in the company’s last financial year.

However, Premier has also been able to regularly invest in growing its business outside the UK to the extent it has doubled in size over the last five years.

“Premier has more than shown, to date, the reward of its branded growth model across its portfolio,” Shore Capital analyst Clive Black says.