With the global shift to electric vehicles (EVs) accelerating, China is cementing its dominance over the lithium supply chain by pouring investment into African mines, creating a new center of gravity for the battery metal.

Speaking at a recent industry conference, Claudia Cook of Benchmark Mineral Intelligence offered a sweeping assessment of how China is reshaping global lithium flows and why Africa will be crucial in the next decade.

Cook laid out in detail how China’s lithium strategy is evolving. As the world’s largest EV market, China needs a consistent, low-cost supply of lithium — but its domestic production is increasingly insufficient.

“China needs growing feedstock to supply its chemical demand,” Cook explained at Fastmarkets' Lithium Supply & Battery Raw Materials event, “and Africa is of growing importance in fulfilling this gap.”

Between 2025 and 2035, lithium production across Africa is projected to increase by a staggering 127 percent, driven by new mines in Zimbabwe, Mali, Ethiopia and Namibia. Cook highlighted that against that backdrop Africa’s share of global lithium supply will surge from a small fraction today to around 80 percent by 2030.

The motivation for China is clear: the Asian nation cannot meet demand by tapping domestic sources alone. China’s hard-rock lithium supply has a growing deficit that will multiply fivefold by 2035.

“That deficit is growing and is said to be a five times increase from 2020 to 2035,” Cook said, pointing to forecasts of rising chemical demand from Chinese battery producers. As a result, Chinese firms have aggressively invested in African lithium projects, locking up supply in countries with looser regulatory controls and cheaper production costs.

In Zimbabwe and Mali, Chinese ownership of lithium mines is expected to remain significant, even if the share of Chinese-owned production in Africa declines modestly from 79 percent in 2025 to 65 percent by 2035.

“In 2025, African output is set to have 79 percent of it being China owned, and that percentage reduces down to 65 percent in 2035,” Cook stated, adding that overall output will still nearly double.

As a result, total Chinese-controlled volumes will keep rising.

Zimbabwe’s rising role in the lithium sector

Zimbabwe in particular has positioned itself at the heart of Africa’s lithium expansion.

Under its Vision 2030 program, introduced in 2018, the country is aiming to transition to an upper- to middle-income economy by building more domestic value from its minerals. As part of this framework, authorities have prioritized increasing value addition and beneficiation of raw materials as a central pillar of economic growth

Zimbabwe's 2022 ban on raw lithium ore exports, coupled with a planned 2027 ban on concentrate exports, is designed to force local upgrading and refining. Chinese-backed operators have already responded to this move, investing in midstream processing facilities that convert lithium ore into more valuable chemicals.

Cook said there were no surprises in Zimbabwe’s 2027 concentrate ban because Zimbabwe’s largest lithium projects — Arcadia and Bikita — had already planned sulfate plants late last year.

Both projects are already dominated by Chinese investors. In fact, Cook said Zimbabwe could soon become the fifth-largest producer of mined lithium globally, with Chinese interests controlling as much as 90 percent of its output.

Slide from Cook showing Zimbabwe's future lithium supply dominance in Africa.

Image via Georgia Williams.

Despite this surge, Africa’s lithium boom is hardly risk-free. Cook flagged serious challenges in transport, electricity and worker conditions in her presentation at the Fastmarkets conference.

“Local workers often also tend to be within the lower skilled jobs, and unlike the Australian mines, a lot of that work is done manually, which can mean there is an increased risk to personal safety,” she said.

Road bottlenecks and port congestion in countries like South Africa hamper exports, while rolling blackouts push some miners to build their own power infrastructure. However, China’s Belt and Road Initiative is easing some of those pain points, upgrading key transport corridors to keep African lithium flowing.

China pushing to secure lithium supply

Domestically, China is also seeing a shift in how it sources lithium.

Benchmark Mineral Intelligence data shows that brine-based production, once a major source for China, is declining relative to hard rock. By 2035, hard rock will make up the majority of Chinese feedstock.

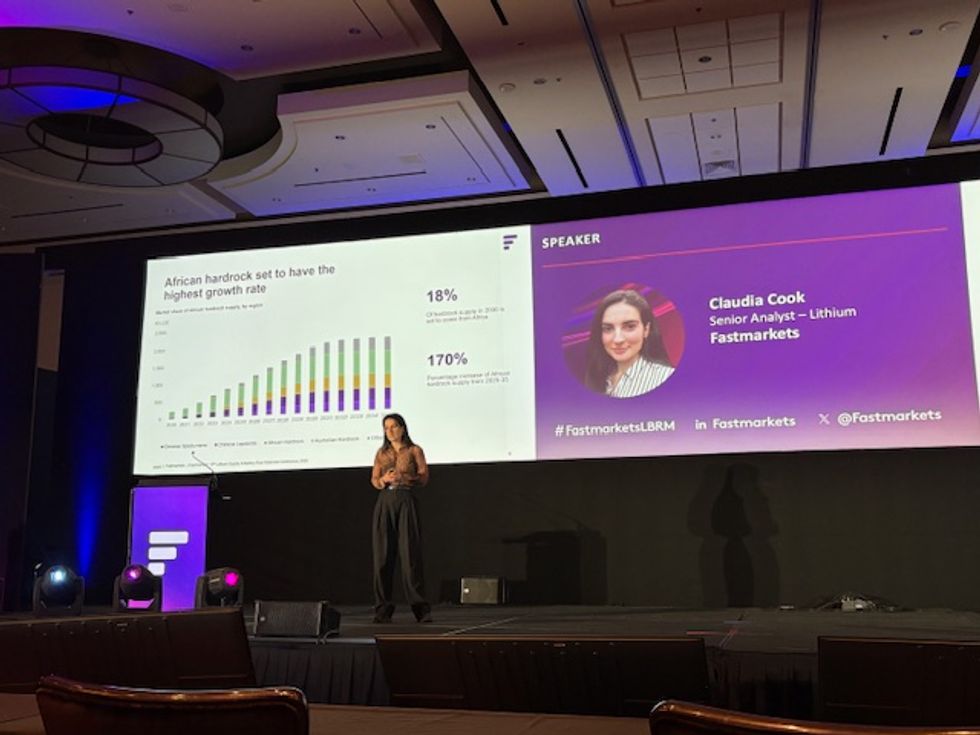

Cook speaks on stage at the Fastmarkets event.

Image via Georgia Williams.

While the reopening of CATL's (SZSE:300750,HKEX:3750) mine in Jiangxi province this year will help, Cook argued that China is still structurally dependent on Africa and other regions to fill the supply gap.

That dependence, she said, is at the heart of Beijing’s long-term lithium security push. “China is directly investing to secure supply, to get that hard-rock feedstock,” she commented.

Future regional lithium players in Africa

While Zimbabwe, along with Mali, is grabbing attention now, Cook forecast that new African lithium suppliers will emerge by 2035, including Ethiopia, Namibia and the Democratic Republic of Congo.

She also noted potential future lithium supply growth from Rwanda, Nigeria and Côte d'Ivoire, even though these countries are still years away from commercial production.

This potential dominance could come with price advantages too.

African lithium projects often have lower upfront costs compared to Australia because of their lower grades and cheaper labor, even though they may face higher impurities and weaker ESG oversight.

“It also means that in terms of pricing, we see that the spodumene price that's coming out of some of these projects is typically around US$20 to US$30 lower than the spot price that you'll see quoted by Newcastle,” Cook noted.

Still, quality issues and chronic underinvestment in African infrastructure could slow progress. Cook emphasized that transport, electricity reliability and governance will determine whether Africa can live up to its lithium promise.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

From Your Site Articles

Related Articles Around the Web