Another day, another round of goodies for AI’s finest.

It seems like the AI Santa isn’t done stuffing Nvidia’s (NVDA) and AMD’s (AMD) proverbial stockings just yet.

💵💰Don't miss the move: Subscribe to TheStreet's free daily newsletter💰💵

Over the past few years, high-margin AI accelerators have been flying out the door, cementing Nvidia stock’s near-monopoly while positioning AMD stock as a top contender.

Many felt the boom was done, but think again as Europe flexes its muscles to push for tech independence.

That means big factories, billions in chips, and Nvidia and AMD riding right at the heart of the AI cash train, as recent moves show.

How Nvidia and AMD keep pushing the AI revolution forward

Though often grouped together, Nvidia and AMD play two distinct roles in the AI-accelerator spectrum.

When it comes to market share, Nvidia sits firmly at the top.

Its powerful GPUs run nine out of 10 AI deployments (90% market share), thanks to big bets in high-performance chips and its powerhouse CUDA software playbook.

Related: Veteran analyst offers eye-popping Nvidia, Microsoft stock prediction

On the flip side, AMD accounts for roughly 10% to 20% of the market, up substantially from around the 5% mark last year.

Nvidia’s latest Blackwell GPUs are also slicing through AI workloads like a knife.

Its cutting-edge new GPUs effectively slash the chips needed to train massive language models like ChatGPT, Gemini, and Grok.

More AI Stock News:

- Veteran analyst issues big Broadcom call, shakes up AI stock race

- Veteran analyst drops bold new call on Nvidia stock

- Gemini, ChatGPT may lose the AI war to deep-pocketed rival

Moreover, booming demand numbers suggest that Nvidia will keep riding this wave well into the next decade.

Meanwhile, AMD, under Lisa Su’s dynamic leadership, is refusing to sit on the sidelines. The tech giant has a two-pronged approach, targeting sharper hardware and a stronger open-source software stack.

The MI300 chips kicked things off in 2023, but it’s the MI350s that investors are salivating over, boosting performance by up to 35×.

Also, AMD’s software improvements and its move to buy ZT Systems show it’s dead serious about offering full-stack AI solutions.

So while Nvidia sets the bar high, AMD’s pricing and open ecosystem keep the race mighty interesting.

Europe’s $23 billion gigafactory plan boosts Nvidia and AMD stock prospects

Plans for European gigafactories to crank out AI hardware are picking up in a big way.

The European Commission has already received submissions calling for at least 3 million next-generation GPUs.

Henna Virkkunen, in charge of tech sovereignty and security for the EU, confirmed that the region is looking to lock in those chips to build its supply-chain muscle.

Currently, companies operating inside or outside Europe have pitched 76 factory projects across 16 member states at 60 sites.

In March, Brussels pledged $23 billion to back four flagship AI gigafactories.

The final call on plant locations is expected by year-end to substantially reduce dependence on overseas suppliers and protect Europe’s chip supply from future shocks.

This development puts a big spotlight on Nvidia and AMD, the two giants in the AI accelerator game.

Naturally, for both chip giants, Europe’s mega orders spell billions in fresh sales and tighter market control.

Related: Veteran analyst drops jaw-dropping Tesla stock target

Europe’s big push for AI gigafactories has everything to do with taking control of its tech future.

Reports suggest that the EU uses about 20% of the world’s chips, while producing just 9%, leaving it exposed to supply shocks and global tensions.

By locking in orders for at least 3 million next-gen GPUs, the goal is to bring more AI hardware production back home.

Nvidia and AMD are front and center in this mega plan.

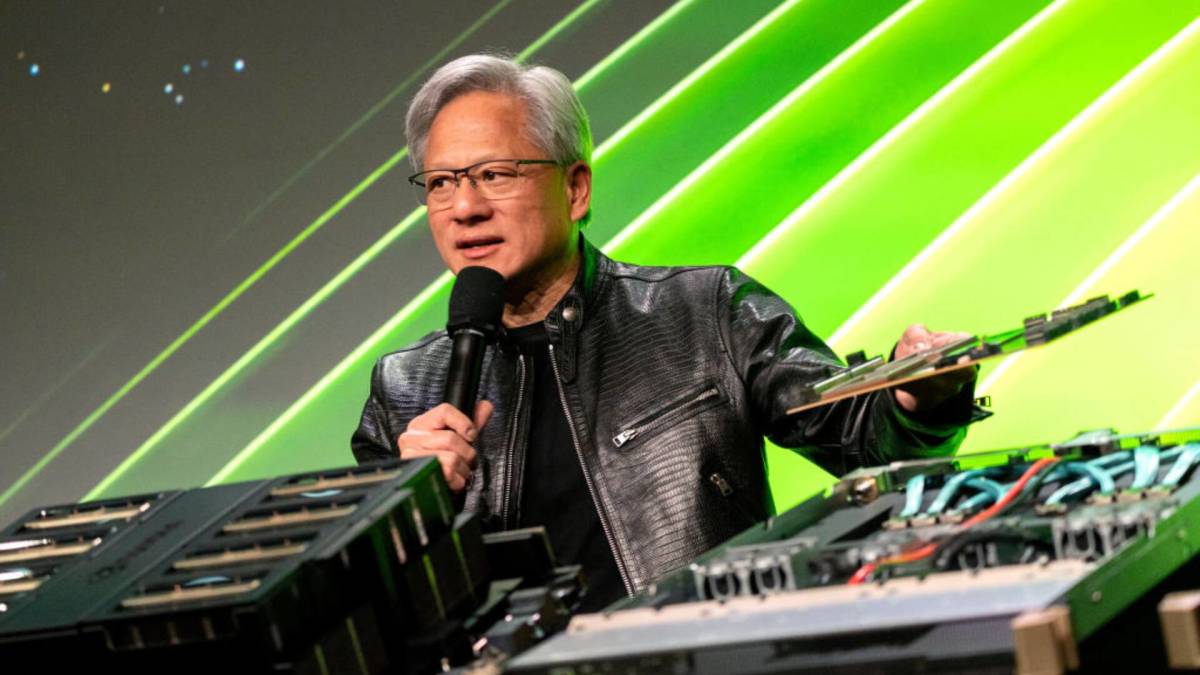

Nvidia’s CEO, Jensen Huang, is all-in on Europe, inking massive sovereign AI deals all across the region.

Putting things in perspective, analysts expect the global sovereign-AI market to hit $1.5 trillion by 2030, with Europe accounting for 8% of that.

AMD’s Lisa Su is equally bullish.

She feels the AI accelerator chip market could surge to $500 billion by 2028, on the back of European data-center expansion and massive AI rollouts.

The AI-chip market is already on fire, and experts predict a massive jump from $31.6 billion in 2025 to nearly $850 billion by 2035.

Related: Analyst reboots AMD stock price target on chip update