After experiencing a notable upward trend, surpassing major digital assets in the crypto market, Ethereum appears to have hit a roadblock, leading to a sudden pullback. ETH’s price may be facing bearish pressure and pulling back to key support levels, but many investors are still bullish on the leading altcoin and its short-term trajectory.

Dip Buying By Investors Dominates As Ethereum Cools Off

Ethereum has witnessed yet another bearish day, as its price continues to trade below the key $4,500 price level. In the midst of this waning price action, Glassnode, a leading financial and on-chain data analytics platform, has spotted a lingering positive sentiment among key ETH investors.

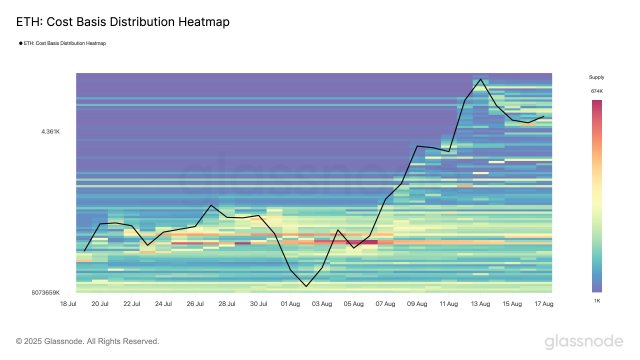

The popular on-chain platform identified the behavior from investors after examining the Ethereum Cost Basis Heatmap metric. Presently, the key metric is sending a clear signal of conviction among holders, even as the altcoin pulled back from the $4,700 price level.

Such a development suggests that market participants are demonstrating significant participation across institutional and retail channels by treating the drop as a strategic entry point rather than withdrawing. It also highlights ETH’s increasing allure as investors show faith in its long-term course despite recent turmoil.

As the leading altcoin lost the $4,700 mark, Glassnode highlighted that it was the notable accumulation observed around $4,400 that helped stabilize the downward move. In other words, this dense cluster of buying activity served as a crucial support against bearish pressures from sellers.

While significant accumulation was observed at around $4,400, the platform noted that part of the supply was quickly redistributed higher. According to the on-chain platform, this action signals a clear swing-trade dynamic across both retail and institutional channels.

ETH’s Surge Stopped At Key Active Realized Price

In another post on the X platform, Glassnode has offered insights into Ethereum’s recent performance using the ETH Realized Price-to-Liveliness Ratio (RPLR). Specifically, this crucial metric measures the fair value of ETH (Realized Price), with the spending and hoarding patterns of long-term investors (Liveliness).

Data from Glassnode shows that Ethereum’s ascent once again came to a standstill at the +1σ Active Realized Price of $4,700. It is worth noting that the last time ETH’s price visited this level was in March this year, during a broader bullish market wave.

According to the on-chain platform, this level is a critical area of overheated conditions and selling pressure because it has frequently acted as resistance in previous cycles.

At the time of writing, Ethereum was trading at $4,238, indicating an over 1% decrease in the last 24 hours. Data from CoinMarketCap shows that its trading volume has turned negative, exhibiting a 7% decrease in the past day. A decline in trading volume indicates waning investor sentiment toward the altcoin.

Featured image from Getty Images, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.