Ethereum surged above the $4,300 mark just hours ago, reinforcing its bullish trend and putting it within striking distance of its all-time high. This breakout comes amid a wave of strong fundamentals, including rising network activity, growing institutional adoption, and record-low exchange reserves—signaling a tightening supply that could fuel further gains.

On-chain metrics continue to paint a bullish picture. Exchange reserves for ETH have dropped to unprecedented lows, indicating that more coins are being moved to long-term storage or staking, reducing the available liquidity for traders. This supply squeeze, combined with robust demand, sets the stage for potential price acceleration.

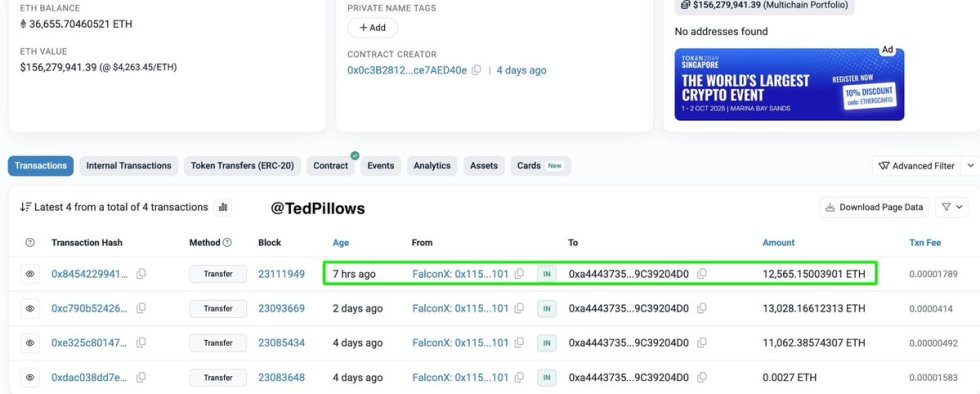

Adding to the momentum, top analyst Ted Pillows revealed that a mysterious institution made another massive accumulation move, purchasing $212 million worth of ETH. This follows a pattern of significant whale and institutional buys, further cementing Ethereum’s position as a favored asset in the crypto space.

Whale Accumulation Fuels Ethereum’s Next Potential Leg Higher

According to data shared by Pillows, whales have accumulated an astounding $946.6 million worth of Ethereum in the past week alone. This surge in large-scale buying activity underscores the growing confidence among deep-pocketed investors, who appear to be positioning themselves ahead of what many believe could be Ethereum’s next major breakout.

Institutional and corporate adoption continues to strengthen this bullish backdrop. Public companies like SharpLink Gaming have announced significant ETH acquisitions as part of their treasury strategy, signaling confidence in Ethereum’s long-term value proposition. These strategic moves not only reduce available supply but also legitimize Ethereum’s role as a store of value and a strategic asset for businesses.

This sustained accumulation has sparked renewed speculation on potential price targets. Conservative analysts, factoring in current market conditions and historical price action, see Ethereum potentially reaching $6,400 over the medium term. Meanwhile, more optimistic projections—driven by strong fundamentals, accelerating network adoption, and institutional inflows—place Ethereum’s potential upside above $10,000.

The scale of whale buying, coupled with corporate participation, suggests that the current rally is underpinned by more than short-term speculation. With exchange reserves at record lows, staking participation on the rise, and whale wallets growing, the supply side remains tight.

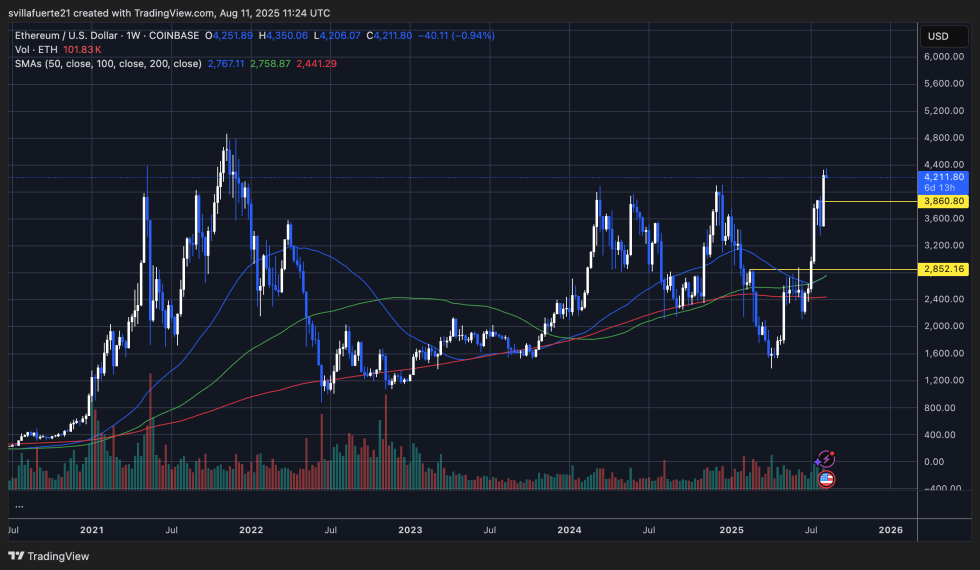

Ethereum Weekly Chart Analysis: Testing Multi-Year Highs

Ethereum (ETH) has extended its bullish momentum, trading at $4,211 after reaching a high of $4,350 this week. This move comes after a clean breakout above the $3,860 resistance, a level that had acted as a major ceiling multiple times in the past. On the weekly timeframe, ETH is now just below its all-time high region, signaling strong market confidence.

The 50-week SMA sits at $2,767, well below current prices, reflecting a solid uptrend and strong distance from long-term support zones. The $2,852 level marks another key support, aligning with the 100-week SMA, while the 200-week SMA at $2,441 represents the long-term bullish threshold.

Volume has picked up during the breakout, suggesting that this rally is supported by genuine buying interest rather than low-liquidity price movements. However, with ETH approaching historically significant resistance, some consolidation could occur before a decisive breakout toward new highs.

If bulls maintain control, the next target lies in price discovery above $4,400, with upside potential toward $5,000. On the downside, holding $3,860 as support will be crucial to sustain the bullish structure and avoid a deeper retracement.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.