Ethereum (ETH) trades above the $4,400 price mark following a rather eventful market week. Although CoinMarketCap data reports the altcoin notched up a net weekly gain of 4.21%, a sharp 7.14% pullback toward the end of the week has dampened sentiment, introducing a more cautious undertone. With ETH now consolidating in a sideways range, crypto analyst Amr Taha has outlined both short and long-term market outlooks, drawing on recent exchange flows and futures market activity.

Bearish Funding Rates Vs. Bullish On-Chain Flows: Ethereum At A Crossroads

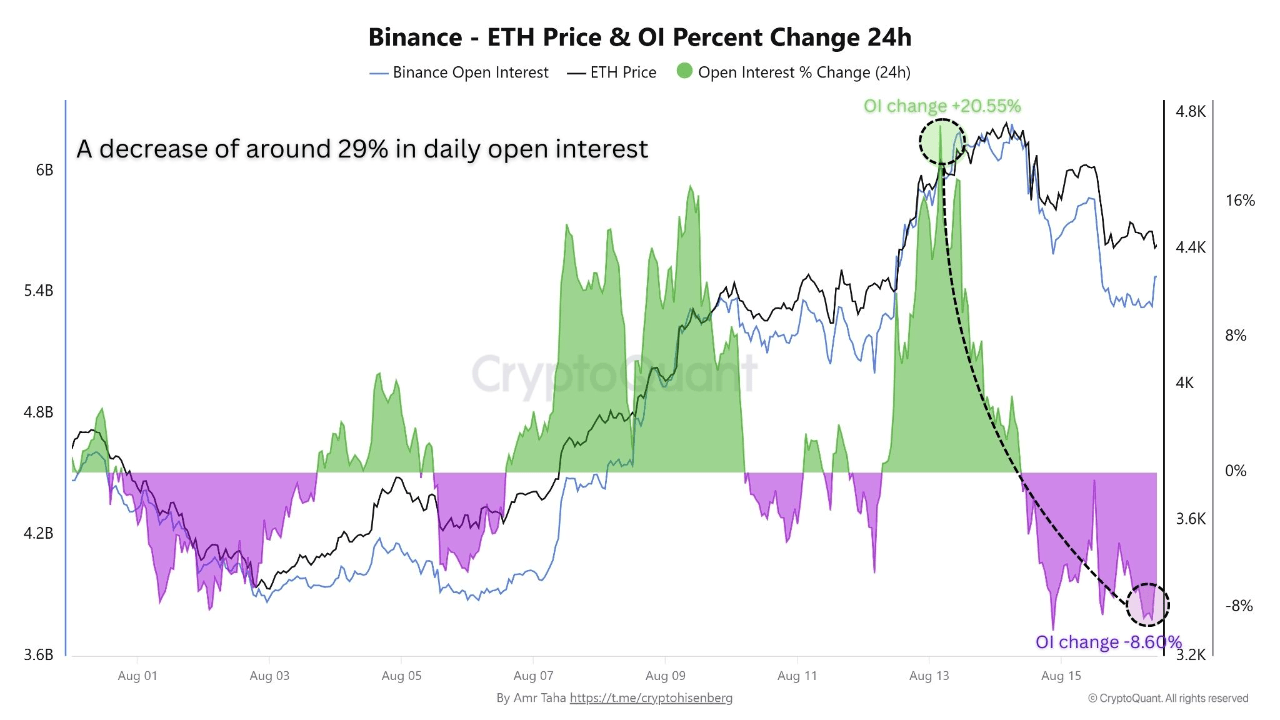

In a recent QuickTake post on CryptoQuant, Taha provides valuable insight into the price trajectory of Ethereum as both futures market positioning and exchange balances are undergoing significant changes. In studying recent developments in the derivative markets, the crypto expert observes a 29% decline in Open Interest over the past two days, following a drop in ETH prices from above $4,700 to below $4,400, which suggests that traders are rapidly closing or liquidating positions amid market turbulence.

Adding to the bearish atmosphere, perpetual futures funding rates turned negative across major exchanges. Negative funding rates occur when short positions dominate, meaning traders are paying to maintain bearish bets. While this reflects prevailing pessimism, Amr Taha states that history shows that such extremes often coincide with oversold conditions and can precede a rebound if other bullish catalysts emerge.

Amid this derivative market situation, spot market data paints a different picture. In recent days, Taha explains that 200,000 ETH, worth approximately $888 million, were withdrawn from major centralized exchanges. Coinbase saw an outflow of 128,000 ETH, while Binance recorded 72,000 ETH leaving its platform.

Generally, large-scale exchange withdrawals are often interpreted as a bullish signal. When investors remove funds from trading platforms, they typically move them into cold storage wallets for multiple reasons, such as long-term holding or staking, which signals confidence in future price appreciation. There are also instances where institutions move their assets off exchanges to perform over-the-counter (OTC) transactions.

This dual narrative, i.e., bearish derivatives activity and bullish spot outflows, highlights Ethereum’s complex short-term outlook. On one hand, negative funding rates and collapsing open interest indicate traders are cautious, expecting further downside in the near term. On the other hand, shrinking exchange balances reduce immediate selling pressure, creating conditions that could support a strong price floor.

Interestingly, Amr Taha also notes that similar waves of ETH withdrawals from exchanges have preceded notable rallies, as reduced exchange liquidity tightens supply, indicating potential for a long-term price rally.

ETH Price Overview

At press time, Ethereum trades at $4,446, reflecting a 0.19% gain in the past day. Notably, investors’ attention remains heavily on the 4,400 support level in the coming sessions. A decisive bounce could validate the view that Ethereum is oversold, while sustained weakness may see ETH retest lower zones before a potential recovery.

Featured image from The Economic Times, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.