Ethereum (ETH) has surged above the $4,000 mark for the first time since last December, signaling a strong return of bullish momentum. After several days of heightened volatility and market uncertainty, buyers have regained control, pushing prices to levels not seen in months. The breakout reflects a combination of improving market sentiment, robust fundamentals, and growing institutional interest in the leading smart contract platform.

Related Reading

On-chain data from CryptoQuant adds further fuel to the bullish narrative, showing that ETH exchange reserves continue to decline steadily. This trend suggests that investors — particularly large holders — are moving their coins off exchanges, reducing available liquidity in the open market. With demand for ETH rising across decentralized finance (DeFi), real-world assets (RWA), and staking activities, the conditions for a potential supply shock are forming.

Market analysts point to this tightening supply, coupled with consistent buying pressure, as a catalyst for further gains. If the trend continues, Ethereum could start a sustained rally, bringing the next major resistance levels into focus. For now, traders are closely watching whether ETH can maintain its position above $4,000 and build a stronger base for a potential run toward its all-time highs.

Ethereum Smart Money Drains Liquidity

According to the latest data from CryptoQuant, only 18.8 million ETH remains on centralized exchanges — a historic low that underscores the growing scarcity of Ethereum in the open market. This is not the result of retail traders making small withdrawals. Instead, it reflects a deliberate move by institutional players and “smart money” to accumulate and secure large amounts of ETH off exchanges.

This accelerated outflow is creating a clear supply squeeze. With fewer coins available for spot trading, upward price pressure is likely to build, especially if demand continues its current trajectory. The pace of accumulation suggests that these large holders are positioning for a long-term play, reducing market liquidity and setting the stage for significant price volatility to the upside.

Adding to the bullish outlook, public companies are beginning to adopt Ethereum as part of their treasury strategies. Sharplink Gaming, for example, has recently purchased substantial amounts of ETH, joining a growing list of firms diversifying into digital assets. Meanwhile, increasing legal clarity in the United States is opening the door for broader adoption, lowering barriers for both institutional and corporate participation in the Ethereum ecosystem.

Related Reading

These converging factors — institutional accumulation, reduced exchange reserves, and regulatory green lights — are forming a market environment unlike anything seen before in Ethereum’s history. If the trend persists, analysts expect the coming months to deliver unprecedented price action, fueled by a perfect storm of tightening supply and rising demand. In such conditions, Ethereum could not only sustain its position above $4,000 but also make a decisive push toward new all-time highs.

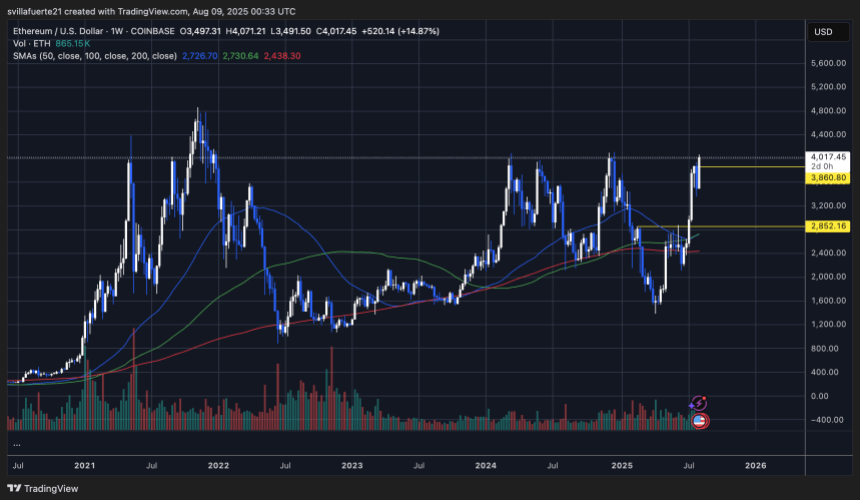

ETH Breaks $4,000, Tests Key Weekly Resistance

Ethereum’s weekly chart shows a decisive breakout above the $3,860 resistance level, pushing the price to $4,017 — its highest level since December 2024. This surge marks a 14.87% weekly gain, highlighting strong bullish momentum following weeks of accumulation and recovery from the $2,852 support zone.

The current price action is supported by the 50, 100, and 200-week SMAs trending below the market, with the 50-week SMA at $2,726 reinforcing the strength of the long-term uptrend. Volume has also spiked significantly, indicating that the breakout is driven by real buying interest rather than speculative noise.

Featured image from Dall-E, chart from TradingView

![Security alert [Implementation of BLOCKHASH instruction in C++ and Go clients can potentially cause consensus issue – Fixed. Please update.] Security alert [Implementation of BLOCKHASH instruction in C++ and Go clients can potentially cause consensus issue – Fixed. Please update.]](https://moneyvisa.com/wp-content/uploads/2025/07/Announcing-the-Trillion-Dollar-Security-Initiative-560x420.jpeg)