After months of hard work from the eth2 research team, along with Consensys and DeepWork Studio, we're happy to announce the release of the eth2 validator launchpad (testnet version).

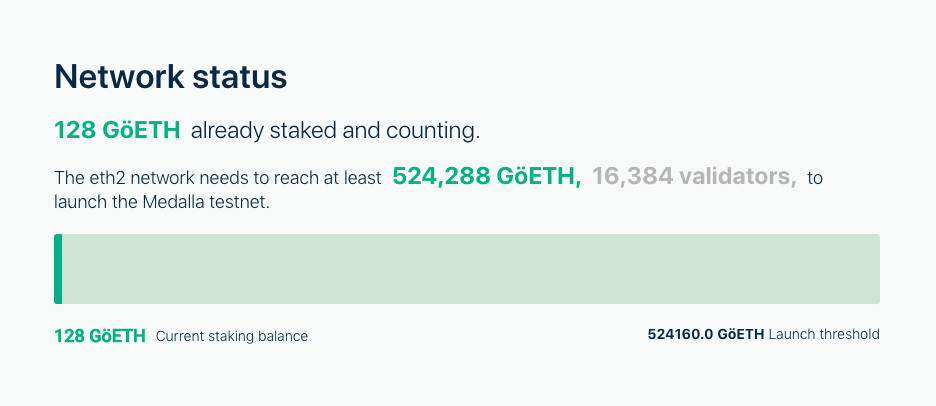

We're releasing it now so that you can keep track of, and make deposits into, the upcoming Medalla multi-client testnet. But we'll continue to fine-tune the interface in the run-up to mainnet launch.

The idea behind the launchpad is to make the process of becoming an eth2 validator as easy as possible, without compromising on security and education.

In contrast to using a third-party service, running your own validator comes with the responsibility of managing your own keys. This responsibility brings with it an inescapable tradeoff between ease-of-use, security, and education.

Education

The first mission of the launchpad is to help validators educate themselves about all aspects of the process. Above all, we want to make sure validators know what they're doing, and why they're doing it.

The basics

We start with the basics. Before you even begin the sign-up process, you should understand what eth2 is, and why validators are necessary for eth2 to work properly.

Timelines and milestones

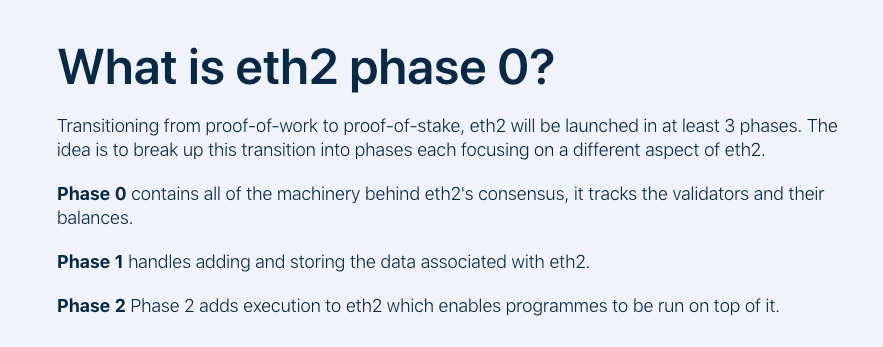

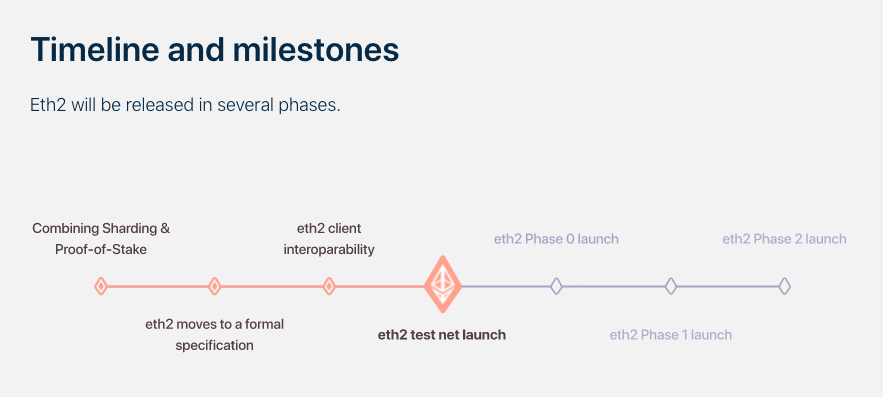

You should also understand that eth2 will be released in several phases.

And where we currently stand in that timeline.

Rewards

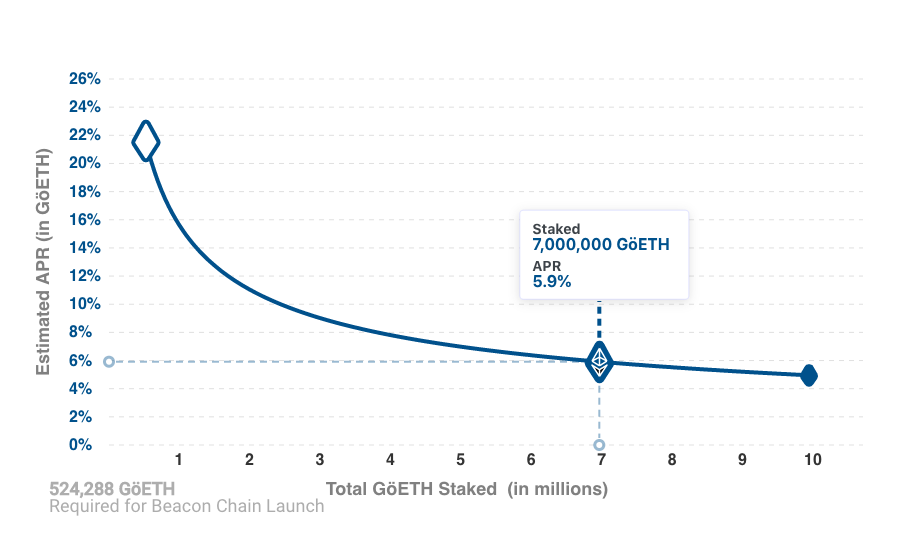

Before deciding whether to run a validator, it's important to have a good grasp on the amount of rewards you stand to receive.

In particular, you should understand that rewards are not fixed, but dynamic (a function of the amount of eth staked in the network).

In plain English, if the total amount of ETH staked is low, the annual reward is high, but as the total stake rises, the reward received by each validator starts to fall.

Once you feel you have a good grasp of the above concepts, you're ready to start the sign up process.

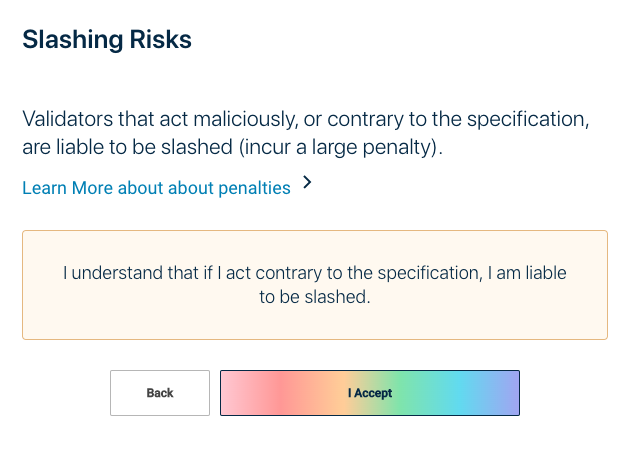

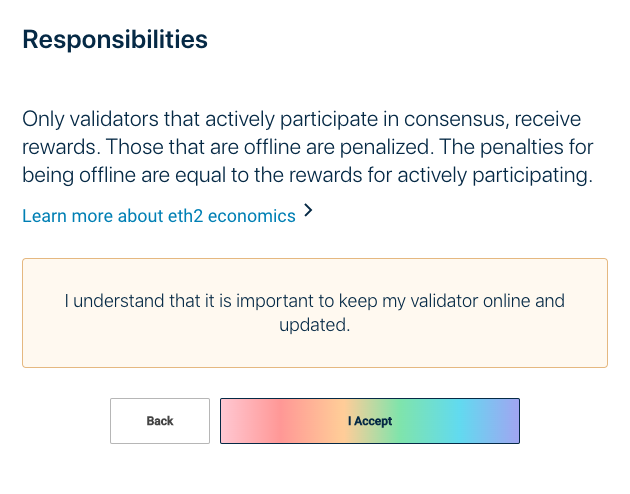

The first part consists of a series of statement pairs — a piece of information followed by an acknowledgment of the form “I understand this piece of information” — that can be broadly divided into three categories: risk, responsibility, and security (although there is some overlap between all three).

Risk and responsibility

The eth2 network can only work successfully if validators understand their responsibilities and the risks involved.

With respect to risk, we want you to understand what your slashing risks are, as well as the inherent risks involved with being an early adopter.

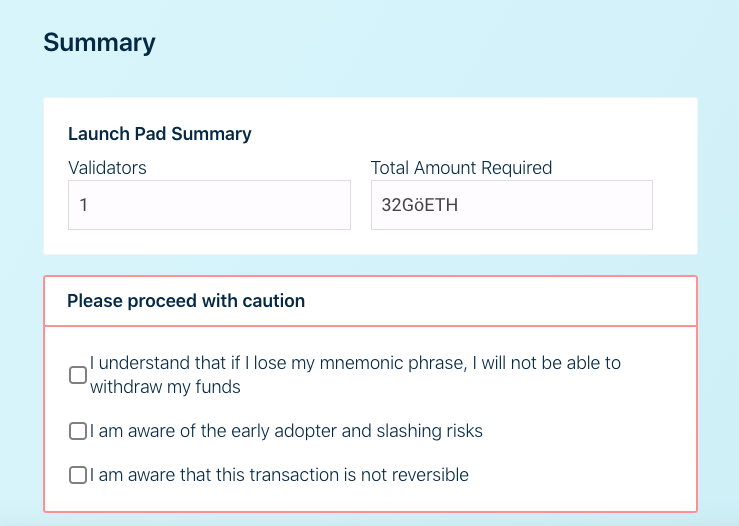

With respect to responsibility, we want to make sure you understand that you will only receive rewards if you actively participate in consensus, and that this process is non-reversible (you won't be able to transfer your staked ETH out of eth2 until much later).

a couple of examples of statement pairs

Security (keys)

In contrast to joining a staking pool, running your own validator comes with the responsibility of managing your own keys.

Before we jump into generating keys, we want you to understand what they do, and how they're created. Most importantly, you should understand that your keys are derived from a unique mnemonic, and that you won't be able to withdraw your funds without access to this mnemonic.

Key generation

Once you've accepted the risks and responsibilities, the dapp instructs you on how to use a separate command line interface (CLI) app to generate your keys offline.

What does this look like, in practice?

1. Choose preferred language

Upon entering the interactive CLI you'll be asked to choose your preferred language

Please choose your mnemonic language (czech, chinese_traditional, chinese_simplified, english, spanish, italian, korean) [english]:

2. Type password to secure keystores & generate mnemonic

You'll then be asked to type a password

Type the password that secures your validator keystore(s):

Correctly confirming the password, generates your mnemonic (24 words that are used to generate your private keys).

3. Write down Mnemonic

Write it down and store it safely (you'll need it to retrieve your deposit)

This is your seed phrase. Write it down and store it safely, it is the ONLY way to retrieve your deposit. crater positive retire course wide arch ring zoo leader cup steak head spoon host about acquire across duck firm frog raccoon gasp exist valid Press any key when you have written down your mnemonic.

4. Generate keys, keystores, and deposit data

Please type your mnemonic (separated by spaces) to confirm you have written it down:

Once you've proven that you have written down your mnemonic, you'll get your keys:

##### ##### ## ##### ## ### ## ####### ######################### ## ## ##### ## ## ## ##### ## ## ## ## ## ### ######## ## #### ## ## ### ##### ##### # ## # ##### # # # ##### ## ## ## ## ## ## ## ### ## ## ############### ## ## ### ## ## ############################# ## ## ### ####### ################# ### ## ## ## ## ## ### ############## ############# Creating your keys. Saving your keystore(s). Creating your deposit(s). Verifying your keystore(s). Verifying your deposit(s). Success! Your keys can be found at: <YOUR_FOLDER_PATH>

That's it!

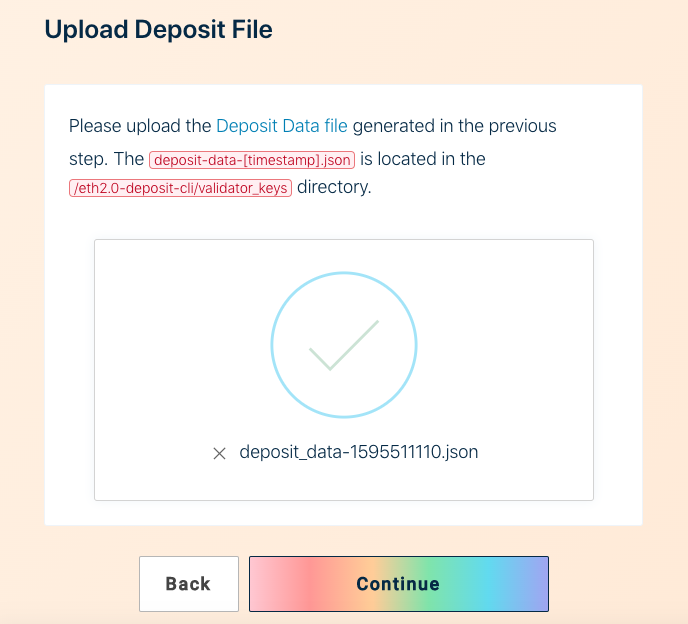

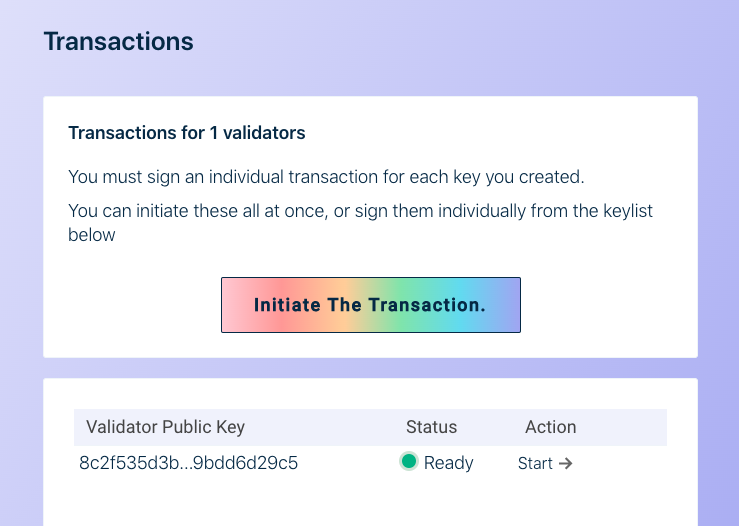

Transactions

Once you've safely generated your keys, we guide you through how you to upload your public keys online, where they will then be verified and sent off to the deposit contract.

.

.

.

We verify that the data you're uploading is valid.

.

.

.

Double check that you understand the most important things.

.

.

.

And then help you send off those transactions.

.

.

.

.

.

.

And voila! That's all there is to it. You've successfuly deposited and committed to becoming a validator on eth2!

Now that you've made your deposit, the next step is to choose your client (the software you'll use to set up your Beacon Node, import your keystores, and run your Validator).

It looks like they'll be no fewer than four clients running at genesis — Lighthouse, Nimbus, Prysm, and Teku. Although the client teams won't have Medalla specific documentation ready until closer to August 4th, now is probably a good time to start doing research on which client (or clients) you want to test out. Have a look at their docs, play around with their local testnets, and don't hesitate to get in touch directly with the teams (discord is probably the place to go).

The Launchpad has been an important project for us as something that can create a welcoming and educational experience for beacon chain and eth2 onboarding. Still, we expect other great interfaces to come online over time from client operators and leading teams, and we hope that you'll try their releases when the time comes too.

We hope you enjoyed this simple walkthrough. We can't wait for you to use the launchpad to make your Medalla testnet deposits 🎉

Special thanks to both Consensys and DeepWork Studio 💙

P.S. If you'd like a basic overview of what it means to be a validator in eth2, along with clear descriptions of the responsibilities involved, you might be interested in checking out our FAQ.

P.P.S If you come across any issues with the launchpad, please don't hesitate to report them here.