The last 12 months have been difficult for equity income investors. The top 20% of dividend-paying stocks in the S&P 500 Index have returned 13.5% in the 12 months through March. That compares to a 29.9% return for the broader S&P 500.

My message to equity income investors is: hang in there. High-yielding stocks are positioned to perform better over the next year. History, inherent biases, mean reversion, and the current market backdrop point to a comeback.

Figure 1: Top Quintile of Dividend Yield

As of 03/31/24; Note: 1QDY or Top Quintile of Dividend Yield. Source: S&P, Bloomberg & Wealth Enhancement Group

Over the long term, buying high-yielding stocks has been a sound strategy. During the past 30 years, the highest quintile of dividend-paying stocks in the S&P 500 (20%, or 100 equities) has outperformed. From December 31, 1994, through March 31, 2024, stocks in the top quintile returned 11.9% per year. Over the same period, the S&P 500 returned 10.4% per year. That is a 1.5% premium for high-yielding stocks.

While the top quintile of dividend-paying stocks is more volatile than the broader S&P 500, it has a similar Sharpe Ratio and, by design, it has a much higher dividend yield.

An equity income strategy is often categorized as a value strategy because it tends to favor lower price-to-book stocks. The top dividend-paying stocks have also outperformed the Russell 1000 Value Index over the 1994 to 2024 period.

Volatility in the top-yielding stocks is, not surprisingly, higher since this assumes a one-factor model. Adding a metric for dividend growth to avoid distressed companies at risk of cutting their dividend would be beneficial, but the focus of this piece is just yield.

Figure 2: Top Quintile of Dividend Yield, With Equally Weighted Stocks

A sector-neutral strategy has also outperformed the S&P500 and Russell 1000 Value indices over the past 20 years, but to a smaller degree. Understandably, some sectors perform better with this strategy than others, depending in part on the level of high-yielding stocks in the sector. For example, the industrial and financial sectors perform well in a sector-neutral strategy, while the consumer discretionary and technology sectors do not.

Why Have High-Yielding Stocks Outperformed?

There may be a few reasons for the historical outperformance of high-yielding stocks. First, behavioral economists have shown many investors who want a source of income prefer automatic dividends, rather than home-made dividends achieved by selling a holding.

Second, Benjamin Graham pointed out that paying dividends disciplines company management to generate attractive returns while allocating capital wisely. In other words, management agency costs are lowered.

Third, unqualified dividends have a higher tax rate than capital gains and therefore should theoretically be associated with higher returns to compensate equity holders.

Finally, we would suggest that many investors who focus on a stock’s exciting growth story and pay little attention to dull dividends paid through profits and cashflow are likely manifesting a narrow framing bias.

To wit, price targets are routinely made by assigning a multiple to earnings. These targets cite growth with faint consideration to return on capital, which is an equally important ingredient to valuation multiples. Naturally, an all-encompassing discounted cash flow model or a dividend discount model valuation is best.

The outlook for dividend-paying stocks is favorable. Just using a reversion to the mean framework points to upside. Over the last 30 calendar years, the correlation of the one-year forward return to the previous year has been -0.3 for the highest quintile of dividend-paying stocks in the S&P 500.

A Mechanical Reversion to the Mean Exercise

Knowing that 2023’s return was 6.9%, the 30-year average return was 11.9%, and the 30-year correlation was -0.3, we can naively forecast a 2024 return of 13.5% [-0.3 (6.9%-11.9%) + 11.9%]. A return closer to the mean. A similar calculation can be done for the S&P 500 to project a 10.0% 2024 return.

This mechanical reversion to the mean exercise points to high-yielding stocks outperforming this year. However, it is very important to consider which average to revert toward. Two key fundamental metrics are return on assets (ROA) and earnings growth. Over the last 30 years, the top quintile of dividend paying stocks in the S&P 500 averaged a 4.4% ROA and had an 8.1% one-year forward earnings-per-share (EPS) growth estimate.

Currently, their ROA is 3.6%. After bottoming a year ago at 2.5%, one-year forward EPS growth is now projected to be 11.9%. With ROA just below average and expected EPS growth above average, underlying fundamentals are now close to normal, which points to the 30-year mean return of 11.9% as a reasonable bogey for reversion.

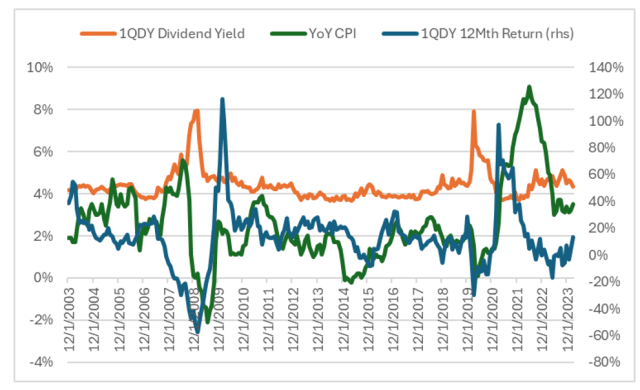

Going a step further to calibrate the outlook for dividend stocks, we can model returns against several variables. Two of the better factors to forecast one-year forward returns of the top quintile dividend stocks in the S&P 500 are dividend yield and year-over-year CPI (consumer price index). The former series is a valuation yardstick and the latter is a rough proxy for rates. Both metrics are correlated to one-year forward dividend returns.

Currently, the dividend yield of the top quintile of dividend-paying stocks is at its 20-year average, while YoY CPI is above average and has been declining (see Figure 2). If the consensus expectation that YoY CPI will continue to decline over the next year is correct, dividend-paying stocks will benefit.

Figure 3: Dividend Yield, CPI, and 12-Month Returns

As of 03/31/24; Note: 1QDY or Top Quintile of Dividend Yield. Source: S&P, Bloomberg & Wealth Enhancement Group

While equity income investors have had a rough patch, it has been brief in the context of the historical performance of dividend-paying stocks. I will repeat my message to investors seeking equity income: hang in there. History, inherent biases, mean reversion, and the current market backdrop point to a comeback.

If you liked this post, don’t forget to subscribe to Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image courtesy of Nick Webb. This file is licensed under the Creative Commons Attribution 2.0 Generic license. Cropped.

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.