US stock futures fluttered above the flatline late Monday after Wall Street's latest record-setting run, bolstered by more artificial intelligence hopes.

Dow Jones Industrial Average futures (YM=F), futures tied to the S&P 500 (ES=F) as well as those on the tech-heavy Nasdaq (NQ=F) all stayed just above the baseline.

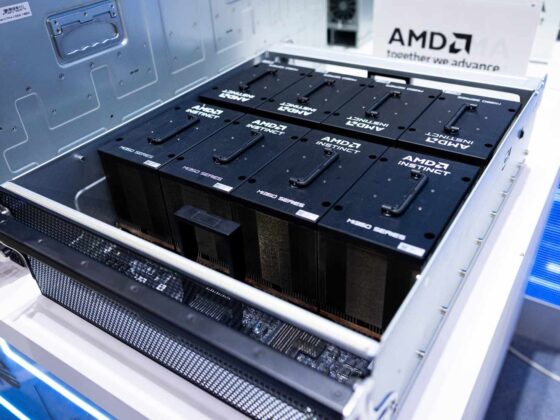

The S&P 500 (^GSPC) and Nasdaq Composite (^IXIC) rose to their latest records on Monday, boosted by news of a multibillion-dollar deal between AMD (AMD) and OpenAI (OPAI.PVT) that sent the chip company's stock rocketing higher.

The deal gives the ChatGPT maker the right to acquire up to 10% of AMD as part of what executives have described as “the world’s most ambitious AI buildout.” OpenAI also inked an investment from Nvidia (NVDA) last week. AMD shares rose 1.5% in after-hours trading Monday.

Overall, the deal added fuel to the AI-based fire that has powered Wall Street's bull-market run to records. The recent run has strategists once again lifting their targets for the S&P 500 though much rests on the upcoming earnings season from Big Tech names.

Those earnings will take on even greater prominence in the weeks ahead if the US government remains shuttered, suspending the release of key economic data. The shutdown has already postponed the release of September's jobs report, and next week's consumer and producer inflation reports could be next to see a delay.

In corporates, Tesla (TSLA) looks to be in focus into Tuesday after a 5% stock gain Monday. CEO Elon Musk teased a potential product launch Tuesday in a series of cryptic X posts.

Coming soon

Stock market coverage for Tuesday, October 7, 2025.