New York

—

The Dow on Friday was on pace to close at its first record high of the year, reflecting steady optimism on Wall Street despite signs of underlying turbulence in the economy.

Stock futures were mixed Friday morning. Dow futures jumped 290 points, or 0.62%. S&P 500 futures rose 0.1%. Meanwhile, Nasdaq Composite futures fell 0.1%.

Dow futures were higher Friday after shares in UnitedHealth (UNH) – a significant component of the Dow – jumped 12.6% during premarket trading. Berkshire Hathaway (BRK.B) on Thursday afternoon revealed a stake in the healthcare giant, sending its shares higher after the closing bell. UnitedHealth shares are down 46% this year.

While the S&P 500 and Nasdaq have notched 18 and 19 record highs this year, respectively, the Dow is still chasing its first record milestone since December 4. Hopes of a Federal Reserve rate cut next month have boosted stocks in recent weeks.

The Dow needs a gain of roughly 163 points, or 0.36%, to hit an intraday record high. The index needs to finish with a gain of 103 points, or 0.23%, to close at a record high.

It’s been a remarkable rebound for the Dow, which has surged almost 20% since hitting a low point in early April.

The Dow in recent weeks has flirted with closing at a record high as investors have tried to look past concerns about President Donald Trump’s tariffs, despite signs of the trade policy boosting certain prices.

The market has been buoyed by a strong corporate earnings season and undeterred investor enthusiasm about AI.

Stocks soared earlier this week after Consumer Price Index data for July showed headline annual inflation rose in line with expectations, cooling Wall Street’s nerves and boosting arguments that the Federal Reserve will cut interest rates in September.

The Dow surged 947 points, or 2.15%, across Tuesday and Wednesday. The S&P 500 and Nasdaq hit back-to-back record highs.

“For investors, the fear was that an even hotter number would remove the prospect of a September rate cut altogether, particularly if the tariff impact became more obvious,” analysts at Deutsche Bank said in a Tuesday note. “So the fact that CPI was broadly as expected was met with relief.”

Yet the stock market rally was put on pause on Thursday after Producer Price Index data for July showed that wholesale inflation rose at its fastest monthly pace in three years.

The faster-than-expected rise in producer prices dented hopes for certainty about Fed rate cuts in September, and sent stocks lower. But investors shook off worries in the afternoon and stocks closed flat.

Traders on Wednesday had begun fully penciling in a Fed rate cut in September, according to the CME FedWatch tool. Traders on Thursday dialed back those expectations and began pricing in a 7% chance the Fed holds rates steady.

“Thursday’s PPI was much stronger-than-expected and suggests that tariffs are causing inflation which adds lots of complexity to the Federal Reserve’s potential rate cut plans this fall,” Clark Geranen, chief market strategist at CalBay Investments, said in emailed commentary.

While uncertainty looms over the economy, stock market investors for now embracing enthusiasm about robust corporate earnings and the prospect of a potential Fed rate-cutting cycle.

The Fed cutting its benchmark interest rate is often seen as fuel for stocks to climb higher. A rate cut can lower bond yields, making higher-yielding assets like stocks more appealing for investors. It can also lower savings rates, encouraging spending and investing.

Meanwhile, volatility in the market has largely dissipated. Wall Street’s fear gauge, the CBOE Volatility Index, this week hit its lowest level this year.

“We just got through earnings season with good earnings, a Fed that’s about to embark on a cutting cycle and Trump doing micro-level disruptive things but not macro-level disruptive things,” said Scott Ladner, chief investment officer at Horizon Investments.

“We don’t see a whole lot of massive headwinds,” Ladner said.

It’s been a whirlwind year for the US stock market.

The Dow in early April had dropped 16% from its previous December peak. The blue-chip index was on track for its worst April decline since 1932 before Trump paused his initial “Liberation Day” tariffs, swiftly lifting stocks out of their slump.

The S&P and Nasdaq hit record highs on June 27 and have since climbed further into record high territory.

The Dow has flirted with hitting a record high for the past month. The index on July 23 closed just four points shy of a record high before pulling back the next day.

The Dow has been weighed down by UnitedHealth (UNH), Salesforce (CRM), Merck (MRK) and Apple (AAPL), which are down roughly 46%, 39%, 17% and 7%, respectively, this year.

UnitedHealth shares surging on Friday helped push the Dow to a record high.

Meanwhile, the best performing companies in the Dow have been Nvidia (NVDA), Boeing (BA), Goldman Sachs (GS) and 3M Company (MMM), which are up 35%, 32%, 30% and 24%, respectively, this year.

Nvidia was added to the index in November, replacing Intel (INTC).

The Dow — officially the Dow Jones Industrial Average — has been around since 1896. The index initially included 12 companies before expanding to 30 companies in 1928.

For the past 97 years, different companies have rotated into the 30-company index, reflecting the evolving nature of the US economy.

In comparison, the S&P 500 — the other benchmark US stock index — tracks 500 companies.

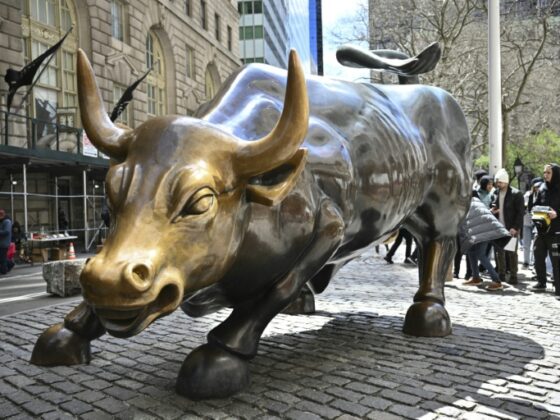

While the Dow provides less of a scope of the market than the broader S&P 500, it’s an iconic symbol of the US stock market, according to Sam Stovall, chief investment strategist at CFRA Research.

“It is the sentimental favorite because it is the oldest,” Stovall said. “More people have been familiar with it.”

The S&P 500 was established in 1957 (though precursors of the index existed in different forms since the 1920s). The tech-heavy Nasdaq Composite was established in 1971.

Stovall said people are often aware of the “Dow” as being identifiable with the US stock market and Wall Street while the S&P 500 can be less well-known.

It’s not just US markets cheering record highs this week. Japan’s Nikkei 225 clinched an all-time high this week, while the MSCI all-country world index — tracking shares across the globe — also hit a fresh record high.