Editor’s Note: This is the first in a series of articles that challenge the conventional wisdom that stocks always outperform bonds over the long term and that a negative correlation between bonds and stocks leads to effective diversification. In it, Edward McQuarrie draws from his research analyzing US stock and bond records dating back to 1792.

CFA Institute Research and Policy Center recently hosted a panel discussion comprising McQuarrie, Rob Arnott, Elroy Dimson, Roger Ibbotson, and Jeremy Siegel. Laurence B. Siegel moderated. The webinar unveils divergent views on the equity risk premium and McQuarrie’s thesis. Subscribe to Research and Policy Center, and you will be notified when the video airs.

Edward McQuarrie:

When I tell acquaintances that I’ve put together the historical record of stock and bond performance back to 1792, the first reaction is generally, “I didn’t know there were stocks and bonds 200 years ago!”

They aren’t familiar with Jeremy Siegel’s book, Stocks for the Long Run, which is now in its 6th edition, where he presents a 200-year series of stock and bond returns that he first compiled 30 years ago.

The book conveys a simple message with compelling support from that history. That is, stocks have always made buy-and-hold investors wealthy, and the wealth accumulation possible from stocks far exceeds that of any alternative, such as bonds.

My new research, “Stocks for the Long Run? Sometimes Yes, Sometimes No,” which was published in the Financial Analysts Journal, suggests otherwise. I will begin to explain those findings in this article. But first, a reminder of the theoretical support that undergirds Siegel’s “Stocks for the Long Run” thesis.

Risk and Return

Bonds, especially government bonds, are a “fixed income” asset. Investors get the coupon and the return of principal at maturity. Nothing less, but also nothing more. The risk is minimal, and the promised return is accordingly small, because it is largely assured.

Stocks are risk assets. No guarantees. Your investment could go to zero.

Notably, investors are risk averse. No utility maximizer would put a penny into stocks without a promise of upside, i.e., the potential for a strong return far enough in excess of fixed income returns to compensate for the much greater risk of investing in stocks.

Therefore, over any lengthy interval, after short-term fluctuations shake out, stocks can be expected to outperform bonds, exactly as Siegel’s history shows.

The Conundrum

If stocks will assuredly outperform bonds over intervals of, say, 20 years or more, where is the risk?

And if stocks aren’t risky over long intervals, why should their returns exceed the returns on bonds that are not risky?

The logic behind “Stocks for the Long Run” blows up. Theory says, “Expected return is a positive function of risk.”

But the Siegel history shows no risk for holding stocks over longer intervals. The stock investor always wins.

The Resolution

I call it a conundrum, not a paradox, because it is easily resolved. All that is needed is a demonstration that sometimes, regardless of the holding period, stocks do blow up, leading to underperformance in either absolute terms or relative to bonds.

Stocks can win most of the time, over intervals of any length, if they lose some of the time, over intervals of any length. Those occasional shortfalls are sufficient to restore risk.

And risk is the key to any reasonable expectation of earning an excess return over a government bond benchmark.

I found those shortfalls in the historical record I compiled.

The Updated Historical Record

My Financial Analysts Journal article contains a summary of how I compiled the historical data. The online appendix goes into more detail and includes the raw data if you’d like to play around with it.

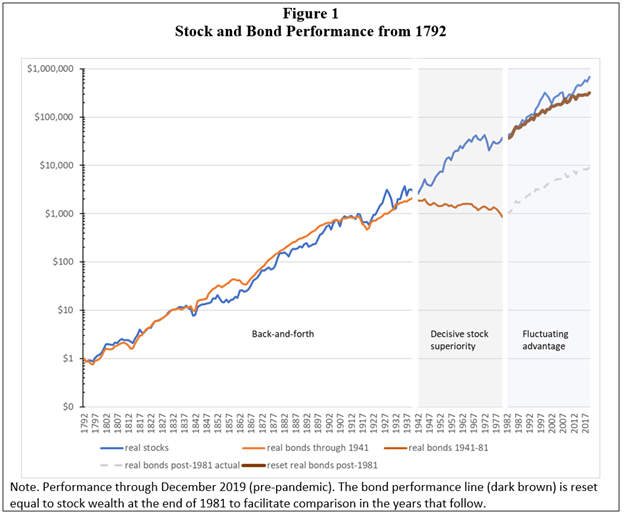

Here is a chart depicting the updated historical record:

What do you see?

- For almost 150 years, stocks and bonds produced about the same wealth. It was a horse race, with the lead swinging back and forth. Stocks would occasionally leap ahead, as in the 1920s, but would also occasionally fall behind, as in the decades before the Civil War. Net, the picture is one of parity performance until World War II.

- Then, during and after the war, the wealth lines dramatically diverge. Over the four decades from 1942 through 1981, stocks piled up an enormous lead over bonds. The stock investor would have turned $10,000 into $136,900 real dollars. The bond investor would have lost money, turning $10,000 into a real $4,060.

Think about that for a moment: You would have lost money in “safe” government bonds. After the war, bonds proved to be a risk asset.

Again, what happened after World War II was not that stocks performed extraordinarily well. If you mentally draw a straight line from the beginning of the stock line in 1792 to its end in 2019 (this chart stops before the pandemic), there is not much deviation in the second panel. There was a slight upward displacement through about 1966, but the inflation of the 1970s and the bear market of 1973 to 1974 brought stocks back on trend.

Rather, bonds performed extraordinarily poorly during this period. Nowhere else in the chart do you see a multi-decade period of ever-declining bond wealth. The decades through WW I come closest, but the decline was abrupt and abbreviated — nothing like the multi-decade swoon that followed the second world war.

The third panel represents my innovation in chart design. In a conventional multi-century chart, once wealth lines have diverged, as in the middle panel, the human eye cannot detect if parity performance has resumed. In a Siegel-style chart, (see p. 28 in the 6th edition of “Stocks for the Long Run” or p. 82 in the 5th edition), what you see is a gap in stock and bond performance that appears to continue to the present day. To see the return to parity performance that did occur after 1981, it is necessary to reset the bond wealth line equal to the stock line as of 1981. Once that is done, the near-parity performance of the ensuing four decades becomes visible.

The title of my paper, “Stocks for the Long Run? Sometimes Yes. Sometimes No,” sums up this chart.

How Bad Can it Get?

The Panic of 1837 was the second worst disaster for investors in the entire US record, rivalled only by the Crash of 1929 and the Great Depression that followed. The panic of 1837 was measurably worse than the Panics of 1819, 1857, 1873, 1893, 1907, or even the mini-Crash of 1921.

The largest single stock in 1840 was the Second Bank of the United States

(BUS). It accounted for about as much of total market capitalization as the Magnificent Seven today. It failed spectacularly, plunging in price from $120 to $1.50 and never recovered.

Multi-decade stock returns that include the 1840s and 1850s are therefore among the worst in the US record, with the most substantial equity deficits.

Unfortunately, Siegel’s data sources omitted the Second BUS along with other banks that failed in the Panic of 1837, as well as the turnpikes, canals, and railroads in the 19th century that either went bust or never paid a dividend.

In other words, the bad stuff got left out. My data collection found these poor returns and added them back to the record.

Objections?

“Fascinating historical research, Professor. But it’s hard for me to see the relevance of a stock decline from 200 years ago to investing today. So much has changed,” is the typical retort to my research findings.

I will respond in my next post.

If you liked this post, don’t forget to subscribe to Enterprising Investor and the CFA Institute Research and Policy Center.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / Rudenkoi

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.