Donald Trump calls for UK to cut taxes on North Sea oil

Donald Trump is in the UK, and by the looks of it he has been talking to someone with an interest in the oil industry: he has said the UK’s taxes on North Sea oil “make no sense”.

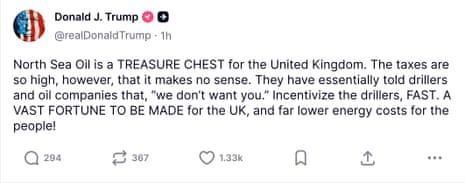

The US president wrote on the social network he owns, Truth Social, that the UK should “incentivize the drillers” and that there was “A VAST FORTUNE TO BE MADE for the UK, and far lower energy costs for the people”.

Trump made the comments on a trip to several golf courses he owns, where he met European Commission leader Ursula von der Leyen as well as Keir Starmer. It is the latest example of the mixing of his personal financial interests with official diplomacy.

Trump has long been supported by the US fossil fuel industry, and he made “Drill, baby, drill” one of his election mantras. Yet he has not usually been concerned with other countries’ oil production efforts – indeed, his trade deals, including this week’s with the EU – have focused on getting trading partners to buy more energy products from the US.

The UK is planning to wind down North Sea oil production, because it would conflict with its duty to try to reach net zero carbon emissions by 2050. The Conservative government imposed a “windfall tax” on the North Sea in 2022 after energy prices soared in the wake of Russia’s invasion of Ukraine.

The UK government has argued that increasing drilling in the North Sea would not have an appreciable effect on lowering energy prices, because any oil and gas would be sold into the global market.

Here is Trump’s post:

Key events

The FTSE 100 is up 0.5% at lunchtime in London – and was earlier just 20 points shy of its record high.

Two-thirds of the index constituents are up today, but the stand-out performer is Games Workshop, the maker of Warhammer game figurines. Its share price has risen 6.7% today after it upped its dividend and reported stronger-than-expected pre-tax profits for the year, up 29.5% to £262.8m.

But it was not all good news: they highlighted a £12m cost from Donald Trump’s tariffs and – err, somewhat unusually – the presence of a single bat blocking development of one of its car parks. Rachel Reeves would be appalled.

Games Workshop (genuinely) said in its annual results that things were mostly “solid”, but:

The exception was the news about tariffs and the cute looking pipistrelle bat that is delaying our work on our new temporary car park. We are carefully looking after the bat and we hope the uncertainty around tariffs is resolved soon. We are also mindful of the increased risk of supply chain disruption as a direct consequence of conflicts around the world, which we highlight as a principal risk.

Boeing narrowed its losses in the second quarter of 2025 as America’s planemaking champion increased the rate of production of its bestselling 737 Max.

The Seattle-based company reported a net loss of $612m between April and June, compared with a $1.4bn loss in the same period last year.

The manufacturer is trying to turn itself around after years of crisis triggered by two fatal crashes of the 737 Max, followed by the coronavirus pandemic and a mid-air door panel blow-out last year that reignited controversy around the company’s safety record.

The company is now producing 38 737 Max planes each month. Europe’s Airbus, Boeing’s bitter rival, is aiming to produce 75 of its A320 planes a month.

Kelly Ortberg, Boeing’s chief executive, said:

Our fundamental changes to strengthen safety and quality are producing improved results as we stabilise our operations and deliver higher-quality airplanes, products and services to our customers.

As we look to the second half of the year, we remain focused on restoring trust and making continued progress in our recovery while operating in a dynamic global environment.

Boeing booked 625 net orders of new aircraft after cancellations and conversions.

Tariffs will cost Stellantis €1.5bn in 2025

The maker of the Fiat, Jeep and Vauxhall car brands has said that it expects a €1.5bn hit from tariffs this year.

Stellantis, the world’s fifth-largest carmaker by sales, combines operations in France, Italy and Detroit (as well as a smaller operation in the UK producing vans), making it vulnerable to changes in trade conditions.

It said the 2025 net tariff impact would be approximately €1.5bn, of which only €300m was incurred in the first half of the year.

The company is trying to recover from a sales slump – particularly in the US – that resulted in the ousting of former chief executive Carlos Tavares. He was replaced by Antonio Filosa, a company veteran. Filosa said:

2025 is turning out to be a tough year, but also one of gradual improvement. Signs of progress are evident when comparing H1 2025 to H2 2024, in the form of improved volumes, Net revenues, and adjusted operating income, despite intensifying external headwinds.

Our new leadership team, while realistic about the challenges, will continue making the tough decisions needed to re-establish profitable growth and significantly improved results.

Stellantis’s shares fell by 1.9% on Tuesday.

Consumer goods maker Procter & Gamble has reported that tariffs took a bite out of its profit margins in the last quarter.

P&G reports that its gross margin in April-June fell by 50 basis points compared with the same quarter a year ago.

It explains:

The decrease was driven by 150 basis points of unfavorable product mix, 70 basis points of product/package reinvestments, 40 basis points of higher commodity costs, 40 basis points of higher costs from tariffs and 40 basis points of other miscellaneous items and rounding.

But this squeeze on profits was partly offset by 240 basis points of productivity savings, while higher prices added 50 basis points to profit margins.

P&G, whose brands include Pantene, Head & Shoulders, Pampers, Ariel and Fairy, also reported that net sales were flat over the last year.

Think tank: Trump tariffs will raise the cost of food for Americans

Graeme Wearden

Americans have been warned that Donald Trump’s tariffs are likely to lead to higher food prices in the shops.

New analysis from the Tax Foundation, a think tank, shows that it will not be possible for US retailers to switch to domestic producers to replace an imported product once it incurs a higher tariff.

They cite bananas, which the US has “a limited ability to produce” and “Brazilian coffee”, which US producers cannot simply make.

Tax Foundation explain:

In 2024, the US imported about $221 billion in food products, 74 percent of which ($163 billion) faced the Trump tariffs. While these imports currently face tariff rates ranging from 10 percent to 30 percent, they will exceed 30 percent for some countries if the reciprocal tariffs go into effect on August 1.

The top five exporters of food products to the US, in order, are Mexico, Canada, the EU, Brazil, and China, accounting for 62 percent of total US food imports.

Donald Trump’s call for lower taxes on North Sea oil was based on the idea that it would be a “treasure chest” for the UK. That is strongly disputed in some quarters.

There is little doubt that there is money to be made for oil companies – although much less than in the North Sea’s heyday – the idea that it would cut energy prices is questionable. Oil is a global market, so it is unlikely that the relatively small amounts left in the North Sea would impact prices. Another option would be to force the oil to be kept in the UK at a lower price – but that would represent nearly unprecedented state control of the industry.

James Alexander, chief executive of UK Sustainable Investment and Finance (UKSIF), a lobby group for green investors, said:

Investors have repeatedly expressed their desire to support the UK’s clean energy transition, provided the right policy framework and signals are in place.

Expanding drilling will have no impact on energy bills, as crude oil is bought and sold at international prices. It would also undermine the UK’s green credentials with investors, which risks driving investment, growth and jobs out of our country.

The idea that North Sea oil is an untapped ‘treasure’ is just another false myth told about our heavily depleted reserves.

US and Chinese officials have arrived in Sweden for the second day of trade talks in an effort to avert a return to huge tariffs on Chinese goods on 12 August.

Pictures from Sweden show the Chinese delegation led by vice premier He Lifeng arriving on Tuesday.

Donald Trump calls for UK to cut taxes on North Sea oil

Donald Trump is in the UK, and by the looks of it he has been talking to someone with an interest in the oil industry: he has said the UK’s taxes on North Sea oil “make no sense”.

The US president wrote on the social network he owns, Truth Social, that the UK should “incentivize the drillers” and that there was “A VAST FORTUNE TO BE MADE for the UK, and far lower energy costs for the people”.

Trump made the comments on a trip to several golf courses he owns, where he met European Commission leader Ursula von der Leyen as well as Keir Starmer. It is the latest example of the mixing of his personal financial interests with official diplomacy.

Trump has long been supported by the US fossil fuel industry, and he made “Drill, baby, drill” one of his election mantras. Yet he has not usually been concerned with other countries’ oil production efforts – indeed, his trade deals, including this week’s with the EU – have focused on getting trading partners to buy more energy products from the US.

The UK is planning to wind down North Sea oil production, because it would conflict with its duty to try to reach net zero carbon emissions by 2050. The Conservative government imposed a “windfall tax” on the North Sea in 2022 after energy prices soared in the wake of Russia’s invasion of Ukraine.

The UK government has argued that increasing drilling in the North Sea would not have an appreciable effect on lowering energy prices, because any oil and gas would be sold into the global market.

Here is Trump’s post:

Dutch healthcare technology company Philips has lowered its estimated impact from import tariffs after the US and EU agreed a deal to limit tariffs on European goods to 15%.

The tariffs will still cost the company between €150m (£130m) and €200m “after substantial mitigations” it said – but that is lower than the €250m to €300m that it had estimated before.

Profit margins in the third quarter will be lower than last year, thanks to the tariffs, Philips said.

That just about sums up a lot of the reaction to the EU-US trade deal: it is better than the alternative, but not that much better.

The number of UK house purchases dropped in April after buyers raced to beat a stamp duty increases. That wobble now appears to be firmly in the rear-view mirror, however.

The number of mortgages approved by British banks rose to 64,200 in June, according to the Bank of England. That was up from 63,300 in May, and 60,900 in April. It also beat economists’ expectations of a reading of 63,000.

The total net borrowing of mortgage debt by individuals increased by £3.1bn to £5.3bn in June, the Bank said.

Consumers also borrowed more, with net borrowing up to £1.4bn, from £0.9bn in the previous month, the Bank said. Credit card borrowing drove the increase.

Barclays beats estimates with profits up by 28%

Kalyeena Makortoff

Barclays has reported strong second quarter results this morning, allowing its chief executive CS Venkatakrishnan to announce another £1.4bn in returns for shareholders.

That includes a £1bn share buyback and an interim dividend worth 3p per share.

It came as second quarter profits rose 28% to £2.5bn, beating consensus estimates for £2.2bn, thanks to higher income from its investment bank, as well as hedging investments which are making up for falling interest rates.

The takeover of Tesco Bank proved to be a double edged sword this quarter, contributing to higher income for its UK business, as well as a 22% rise in credit impairment charges and 4% increase in costs.

Economic uncertainty in the US was also partly to blame for the rise in impairments to £469m – which is the money that the banks need to put aside to protect themselves and cover current and future defaults.

Its legal and conduct costs ballooned, rising to £76m from £7m last year, with a hefty chunk arising from a £42m FCA fine for historic failures in its anti-money laundering controls, as revelaed earlier this month.

Barclays is also in the midst of a number of legal battles, including a class action lawsuit in the US over claims that Barclays and its chairman Nigel Higgs defrauded and misled investors over Staley’s relationship with the child sex offender Jeffrey Epstein.

The Barclays CEO also sidestepped a number of questions during the media call this morning, including from the Guardian, which asked whether the bank was reviewing any of its banking relationships for exposure to Israeli forces in light of the humanitarian crisis in Gaza, which Israeli human rights organisations are now calling a genocide.

The CEO did not answer the question but said:

This is now coming upon two years. We’ve said many times that we feel great sadness for the loss of life, the suffering that’s taking place at an enormous scale, day by day. We wish for it to end, and we will do our best to provide comfort to those who are suffering.

Venkatakrishnan also declined to comment on our report last week, that chancellor Rachel Reeves is considering using legislation to overrule the supreme court, in order to help protect lenders like Barclays from a £44bn compensation bill over the car finance commission scandal. He said:

We will consider the decision of the Supreme Court when it comes out. We should note that we are not a party to that case, so I really can’t comment on it any further at this time.

Anglian Water fined £62.8m over sewage leaks

Joanna Partridge

Anglian Water has been ordered to pay £62.8m by the water regulator, Ofwat, over failures in managing its wastewater treatment works and network that meant it was unable to cope with sewage flows.

The regulator found that the company, which supplies water to 7 million customers across the east of England and Hartlepool, “failed to operate, maintain and upgrade its wastewater assets adequately”, leading to a breach of its legal obligations.

Anglian Water is one of six water companies – including Thames Water, United Utilities and Yorkshire Water – that have been banned from paying bonuses for the 2024-25 financial year to their chief executives and chief financial officers.

The Water (Special Measures) Act 2025 brought in by Labour prohibits performance-related payments to senior executives of water companies that repeatedly pollute English and Welsh waterways with sewage.

You can read the full story here:

Lisa O’Carroll

Pharmaceutical exports from the EU to the US could be hit by 15% tariffs as soon as Friday, according to the White House.

It published a fact sheet summarising the deal with the EU that stated pharma will be taxed at the base rate agreed in deal sealed at Donald Trump’s golf course in Scotland on Sunday.

But it has caused yet more confusion because it comes less than 24 hours after EU officials were told that pharma would remain duty-free until Trump’s “section 232” national security investigations into pharma and semiconductors concluded.

As part of President Trump’s strategy to establish balanced trade, EU exports to the US will be liable for a tariff rate of 15%, including on autos and auto parts, pharmaceuticals, and semiconductors.

However, Trump had also said earlier this month he was going to phase in tariffs for pharma this week.

The text also says that the EU has agreed not to introduce a tech tax. It said:

The United States and the European Union intend to address unjustified digital trade barriers. In that respect, the European Union confirms that it will not adopt or maintain network usage fees. Furthermore, the United States and the European Union will maintain zero customs duties on electronic transmissions.

Drug company AstraZeneca’s profits jumped by 30% year-on-year in the second quarter of 2025 to $3.1bn (£2.3bn), as sales surged in the US.

The largest UK-listed company reported an 11% increase in sales to $13.8bn, beating forecasts.

AstraZeneca’s share price rose 1.9% on Tuesday morning, behind only Games Workshop on the FTSE 100.

The strong sales come with the pharmaceutical industry bracing for more tariffs from Donald Trump’s US administration if, as expected, it finds that reliance on drug imports are a threat to national security.

AstraZeneca has already pledged to increase spending in the US, including last week’s announcement of a $50bn investment in the US to expand manufacturing in the state of Virginia.

Pascal Soriot, AstraZeneca’s chief executive, said:

Our strong momentum in revenue growth continued through the first half of the year and the delivery from our broad and diverse pipeline has been excellent.

As we enter our next phase of growth, we have pledged $50bn to continue to grow in the US, which includes the largest manufacturing investment in AstraZeneca’s history, set for Virginia. This landmark investment reflects not only America’s importance but also our confidence in our innovative medicines to transform global health and power AstraZeneca’s ambition to deliver $80bn revenue by 2030.

The UK has not reached ‘peak Greggs' – chief executive

Greggs’s chief executive has said the UK has not reached “peak Greggs”, after the bakery chain reported a dip in profits that it blamed on lower demand – and the hot weather.

The company, famed for its sausage rolls (and various other foodstuffs wrapped in pastry), said the first half of the year was “impacted by challenging market footfall, more weather disruption than in 2024, and phasing of cost headwinds”.

Roisin Currie told reporters that trading in July “has still been quite soft” – but hit back at the suggestion that the chain’s expansion had reached its peak, Reuters reported.

The company – a member of the FTSE 100 – said it had opened 87 new shops in the first half of 2025 with 56 closures, and it said it had “continued expansion of footprint beyond traditional high street locations”.

The bakery’s pre-tax profits dropped from £74m in the first half of last year to £64m this year, despite an increase in total sales to over £1bn.

Trading is open on European stock markets, and it is looking fairly quiet in the first trades.

The FTSE 100 has gained 0.1%. The top risers are gambling company Entain – up 2.1% after it was boosted by rival BetMGM raising its full-year guidance – and Warhammer figurine maker Games Workshop, up 1.5% after saying profits jumped 30%.

The Euro Stoxx index of Europe’s biggest companies rose 0.2% in the early trades, while France’s Cac 40 was up 0.1% and Germany’s Dax rose 0.4%.

US-China talks extension ‘likely' as Trump targets ‘world tariff'

Good morning, and welcome to our live coverage of business, economics and financial markets.

After the US and EU announced the outline of a trade deal that would limit tariffs to 15%, it looks like talks with China could be the next on the agenda, with an extension of a truce in the trade war “likely”, according to a top official in the Trump administration.

US Treasury chief Scott Bessent arrived yesterday in Sweden, alongside China’s vice premier He Lifeng, according to Reuters. Back in the US, Howard Lutnick, the commerce secretary told Fox News that a delay to a higher tariff deadline was probable:

Is that a likely outcome? Sure, it seems that way, but let’s leave it to President Trump to decide.

Donald Trump triggered financial market chaos after slapping tariffs at 145% on China. However, in May he announced a 90-day pause, lowering tariffs to (a still significant) 30%. That left a deadline of 12 August for the talks, but it is

US trade representative Jamieson Greer told the CNBC news channel he did not expect “some kind of enormous breakthrough today” at the talks in Stockholm, although he flagged that a deal last month to speed up rare earth metal imports from China to the US would be on the agenda. He said:

What I expect is continued monitoring and checking in on the implementation of our agreement thus far, making sure that key critical minerals are flowing between the parties and setting the groundwork for enhanced trade and balanced trade going forward.

It came after the US and EU announced a deal to limit tariffs to 15%. The end of market uncertainty appeared to be welcomed at first by markets on Monday – only for the mood to sour somewhat later in the day. The French prime minister, François Bayrou, said the EU had capitulated to Donald Trump, and said it was a “dark day” for the EU.

Trump on Monday suggested that he could impose a “world tariff” on all of the countries that have not agreed a trade deal. That tariff could be 15% or 20% – meaning that, after all the negotiating effort, the EU could be left with similar terms to the rest of the world.

At his golf course in Scotland yesterday, while visiting UK Prime Minister Keir Starmer, Trump said:

I would say it’ll be somewhere in the 15 to 20% range. Probably one of those two numbers.

On the prospects of Chinese talks, Trump said:

I’d love to see China open up their country.

Back in May, Trump had said that China had already “agreed to open up” – but it appears there may be more work to be done.

The agenda

-

9:30am BST: Bank of England mortgage approvals (June; previous: 63,032; consensus: 63,000)

-

9:30am BST: Bank of England consumer credit (June; previous: £859m; consensus: £1.2bn)