Short-term rentals (STRs) have obvious upside: cash flow, appreciation, and the added perk of owning a property in a place you enjoy visiting. However, as every experienced host knows, the postcard view doesn’t always translate to profits.

Regulations, seasonality, property taxes, and nightly rate caps can significantly impact your deal. That’s why we analyzed 31 of the most beautiful towns in America, a list straight out of Condé Nast Traveler, and ran the numbers like an investor would.

We examined median home prices from Zillow, estimated annual STR revenue with predicted averages using Mashvisor, Rabbu, Airbtics, and PriceLabs, and calculated a simple yield (gross revenue divided by price). Then we added the crucial layer most “best towns” lists leave out: local STR rules.

The results show a mix of possible winners with double-digit yields and more friendly policies, big-budget prestige towns where returns are slim, and do-not-invest destinations where moratoriums or outright bans make STRs all but impossible.

The Numbers First

Here’s the data on prices, yields, classifications, and regulatory notes for all 31 towns we examined:

Tough but possible

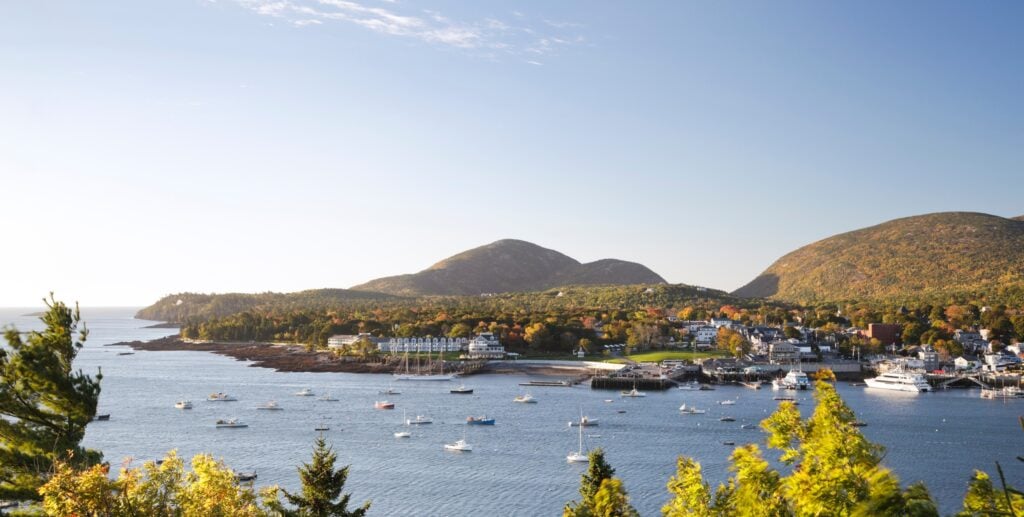

- Bar Harbor, ME: $677K homes, $97K revenue, 14% yield. VR-2 rentals are capped at 9% and require a four-night minimum.

- Ketchikan, AK: $399K homes, $44K revenue, 11% yield. Zoning permit and parking space required.

- Lake Geneva, WI: $399K homes, $68K revenue, 17% yield. License needed, 180-day cap, two-night min.

- Lake Placid, NY: $358K homes, $53K revenue, 15% yield. New unhosted STRs are banned; hosted STRs are capped in neighborhoods.

Potential

- Beaufort, SC: $410K homes, $44K revenue, 11% yield. 6% cap per neighborhood.

- Camden, ME: $674K homes, $58K revenue, 9% yield. 150-license cap.

- Deadwood, SD: $445K homes, $35K revenue, 8% yield. STRs are banned in residential areas except during the Sturgis Motorcycle Rally.

- Eureka Springs, AR: $311K homes, $23K revenue, 7% yield. New STRs are banned in residential areas.

- Gatlinburg, TN: $411K homes, $54K revenue, 13% yield. STRs are banned in some zones, but allowed in most.

- Harpers Ferry, WV: $396K homes, $38K revenue, 10% yield. Registration and taxes.

- Hudson Valley, NY: $437K homes, $53K revenue, 12% yield. Must be registered and pay fees.

- Jekyll Island, GA: $875K homes, $77K revenue, Application process.

- Lewes, DE: $605K homes, $52K revenue, 9% yield. License and local contact.

- Mackinac Island, MI: $490K homes, $37K revenue, 7.6% yield. Rentals <30 days treated as hotels.

- Montpelier, VT: $437K homes, $34K revenue, 8% yield. Rental registration and taxes.

- Rockport, MA: $869K homes, $61K revenue, 7% yield. State STR registration and taxes.

- St. Augustine, FL: $441K homes, $52K revenue, 12% yield. Strict zoning rules.

- St. Michaels, MD: $730K homes, $79K revenue, 11% yield. License and inspections.

- Sedona, AZ: $904K homes, $71K revenue, 8% yield. Registration and taxes.

- Taos, NM: $449K homes, $45K revenue, 10% yield. 120-permit cap.

- Whitefish, MT: $858K homes, $70K revenue, 8% yield. Only certain zones are allowed.

- Woodstock, VT: $712K homes, $54K annual STR revenue, 7.6% yield. Town ordinance with caps.

Big budget

- Block Island, RI: $1.8M homes, $84K revenue, 5% yield. Annual registration, two ppl/bedroom.

- Carmel, CA: $2.36M homes, $125K revenue, 5% yield. STRs are banned in R-1 zones (the single-family district).

- Jackson, WY: $1.9M homes, $79K revenue, 4% yield. STRs limited to three stays/60 nights in residential.

- Snowmass Village, CO: $2.1M homes, $130K revenue, 6% yield. Annual permit, four-night min.

Don’t invest

- Cannon Beach, OR: $890K homes, $69K revenue, 8% yield. 14-day rules.

- Friday Harbor, WA: $887K homes, $37K revenue, 4% yield. Registration and taxes.

- Magnolia Springs, AL: $403K homes, $29K revenue, 7% yield. STR moratorium.

- Paia, HI: $1.3M homes, $92K revenue, 7% yield. STR moratorium.

- Portsmouth, NH: $776K homes, $50K revenue, 6.5% yield. STRs are illegal in residential areas.

- Woodstock, VT: $712K homes, $53K annual STR revenue, 7.6% yield, Town ordinance with caps.

Breaking It Down Further

Now that we have the numbers in hand, let’s analyze these markets further.

Tough but possible

These are the markets that make investors’ palms sweaty. On paper, the yields are incredible. We’re talking 14% to 17% in places like Lake Geneva, WI, and Bar Harbor, ME.

But here’s the catch: You’re not just buying a property; you’re buying into a set of rules that force you to operate differently.

Take Lake Geneva. Yes, a 17% yield looks like mailbox money, but the city caps you at 180 days and enforces spacing rules between stays. That means you don’t really own a year-round STR; you own a seasonal machine. Still, if you’re priced out of the mountains or beach markets, Lake Geneva is one of the few Midwest towns where the cash flow rivals the big names.

Bar Harbor is another one where the rules seem painful, but scarcity is your friend. Nonowner STRs are capped at 9% of parcels and require four-night minimums. Most investors see that as a deal-breaker. I see it as a moat. Once you’re in, there’s less chance of a race to the bottom on nightly rates.

Lake Placid, NY, also fits this mold. The 15% yield is real, but “unhosted” STRs are banned in most neighborhoods. That’s not a spreadsheet problem; that’s a strategy problem. You either play the hosted game, find a commercial area, or wait for a grandfathered permit to become available.

Bottom line: If you’re willing to work around restrictions, these markets pay off. The rules weed out casual hosts, which can leave more room for pros.

Potential

This is the most enormous bucket—markets where the numbers work, but the local rules are more like guardrails than roadblocks.

Gatlinburg, TN, is the headline act here. You get a 13% yield and a market that’s bulletproof thanks to the Smokies. The only catch is zoning. Buy in the wrong district (like R-1A or R-2A), and you’re sitting on a non-cash-flowing vacation home. Buy in the right district, and you’ve got a forever STR.

Then you’ve got markets like Taos, NM, and Beaufort, SC, where caps limit supply. Taos only issues 120 permits citywide, and Beaufort caps STRs at 6% per neighborhood. Both rules sound scary, but think about the moat they create. Fewer permits mean less competition, which means higher occupancy and pricing power if you already have one.

The Northeast is a mixed bag. Hudson Valley, NY, yields 12%, but only if you follow owner-occupancy rules and zoning. Camden, ME, limits licenses, and Rockport, MA, punts to statewide registration and taxes. In other words, you can make money in all three, but you’ve got to accept the paperwork as part of your underwriting.

Some places in this tier are more niche. Eureka Springs, AR, banned new STRs in residential zones, which caps growth but protects existing operators. Deadwood, SD, only really makes sense if you’re capitalizing on the Sturgis Motorcycle Rally (which takes place in August) or outside city limits. Whitefish, MT, requires you to buy in the correct zone. If you can live with those quirks, the numbers hold.

Investors should view these towns in the same way they would a property with deferred maintenance. The bones are good, but you need to manage the risk to unlock the value.

Big budget

This category is where the numbers stop making sense from a pure cash flow perspective.

Jackson, WY, is the classic example. Homes average nearly $2M, and even with strong nightly rates, your yield barely breaks 4%. Add in the three-stay/60-night cap in residential zones, and you’re essentially buying bragging rights, not cash flow.

Carmel-by-the-Sea, CA, tells a similar story. Beautiful town, insane demand, but STRs are banned in R-1 zones. Unless you’re sitting on a legal nonconforming unit, you’re looking at a $2.3M home that doesn’t cash flow.

Snowmass Village, CO, appears more lucrative in terms of revenue, with $130K annually, but again, with $2M home prices and heavy permitting, your yield is only 6%. Fine if you want a ski house that pays its bills. Not great if you’re trying to scale.

These aren’t cash flow plays. They’re trophy assets. You buy here for appreciation, for legacy, or because you can afford to. For most investors, these are “look but don’t touch” markets.

Don’t invest

And then there are the markets where the math might look OK, but the rules basically shut the door. Most will still allow STRs in specific commercial zones or outside city limits, but you never know when they will crack down even more.

Portsmouth, NH, is the clearest: STRs are illegal in residential zones, full stop.

Paia, HI, and Magnolia Springs, AL, both have moratoriums in place. That’s the government telling you they don’t want you in their market, for now.

Cannon Beach, OR, is a case study in how to strangle a market: Limiting stays to once every 14 days results in a collapse of occupancy. On paper, the yield is 8%. In reality, you’re running half-empty.

Friday Harbor, WA, has a 337-permit cap and a moratorium on new applications. That’s a closed shop unless someone else gives theirs up.

This is the category where you look at the numbers and think, “Too good to be true.” And in most cases, you’d be right.

Final Thoughts

What this list really shows is that you can’t invest off yield alone. The 31 prettiest towns in America aren’t necessarily the 31 best STR markets. Some will make you rich. Some will make you crazy. And some won’t let you in at all.

As an investor, you’ve got to underwrite not just the property, but the politics. Rules change. Caps get enforced. Moratoriums pop up.

If you’re already in one of these markets, you’ve probably got a moat. If you’re trying to get in, the best plays are in the “Tough but possible” and “Potential” tiers—places with demand, strong yields, and rules that create barriers to entry rather than brick walls.