Environmental, social, and governance (ESG) ratings should reflect the risks that such factors pose to a company’s financial performance and how well equipped that company is to manage those risks. Such ratings may assess carbon emissions (E), health and safety in the workplace (S), and executive compensation structures (G), among other criteria.

ESG ratings are predicated on the notion that companies with better ESG scores will exhibit better financial performance over time because they face lower ESG risks, are more adept at managing them, or some combination thereof. As a corollary, assuming markets are efficient, higher ESG ratings should also lead to higher valuations.

So, do better ESG scores correlate with improved financial performance, or better valuations?

There is no simple answer. The literature is diverse and lacks clear consensus. Part of the problem is how to conduct the assessments. Should researchers compare companies in different industries? What role should balance sheet size or market capitalization play? How long is a suitable observation period? What is the proper measure of financial performance — return on assets, net income, operational expenditures (opex) ratios, free cash flow, revenue growth, or some combination? For market valuations, are market prices sufficient, or should they be adjusted for volatility and liquidity? Should the effect of rising (or falling) ESG scores be taken with a lag, and if so, how much of one?

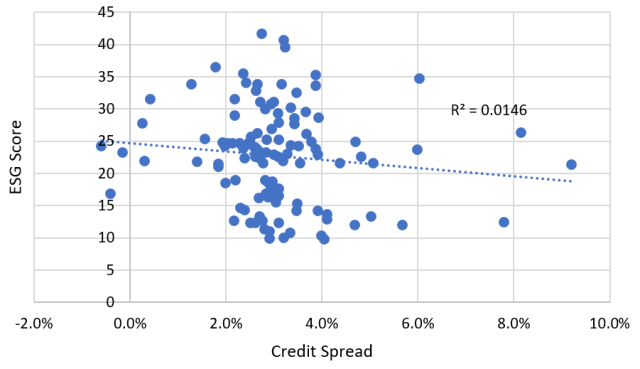

In order to provide a clear, if limited, signal, we formulated a narrow hypothesis: that the bond market views companies with better ESG ratings as better credit risks, and as such, these firms’ corporate bonds should have lower risk-adjusted yields. If the effect is significant, a sample set that adequately reflects the overall market should demonstrate the effect at any given point in time.

We created a universe of large US companies with ESG ratings and with publicly quoted bonds maturing in 2024 and 2025. We selected 10 issuers from each of the 11 sectors defined in the S&P 500 methodology and derived their risk-adjusted yields (credit spreads) by subtracting the comparable maturity US Treasury yield from the current corporate bond yield. We took all our observations from a single two-day period, 6–7 April 2023, and sourced our ESG scores from Sustainalytics.

According to our hypothesis, corporate bond credit spreads should have a negative correlation with ESG ratings. After all, better ESG ratings should result in higher bond prices and thus lower risk-adjusted yields.

But that is not what we found. There was, in fact, no significant correlation. As the graphic below demonstrates, our results show wide dispersion and an R-squared of only 0.0146. In fact, since Sustainalytics uses an inverse rating scale in which lower scores indicate better ratings, the line of best fit actually slopes away from our hypothesis. That is, better ESG ratings actually correlate with higher credit spreads.

Company ESG Scores vs. Risk-Adjusted Bond Yield

The correlation coefficients varied substantially by sector. Utilities and four other sectors show some support for the hypothesis, or positive correlation, given the inverse ESG ratings scale. Communications Services and four other sectors support the contrary view, that better ESG ratings are associated with higher yields. Of course, with only 10 issuers per sector, these results may not be indicative.

Correlations by Sector

| Sector | R-Value |

| Communications Services | –0.66 |

| Financial | –0.29 |

| Health Care | –0.26 |

| Technology | –0.12 |

| Consumer Staples | –0.03 |

| Energy | 0.00 |

| Industrials | 0.01 |

| Materials | 0.02 |

| Real Estate | 0.02 |

| Consumer Discretionary | 0.19 |

| Utilities | 0.45 |

| Average | –0.06 |

Why might bond investors ignore ESG scores when making investment decisions? Several factors could be at work. First, credit rating practices are well-developed, and credit rating agencies are far more consistent in their determinations than ESG rating agencies. So, bond investors may feel that ESG scores add little to their credit risk assessments.

Also, even if bond investors believe ESG scores convey real information, they may not view the risks such metrics measure as the most salient. The bond buyer is concerned first and foremost with the company’s contractual obligation to make debt service payments in full and on time. So, while employee diversity and the structure of the board of directors may loom large in ESG ratings, bond buyers may not view them as especially critical.

If you liked this post, don’t forget to subscribe to Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images /Liyao Xie

Professional Learning for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report professional learning (PL) credits earned, including content on Enterprising Investor. Members can record credits easily using their online PL tracker.