Updated on July 8th, 2025 by Felix Martinez

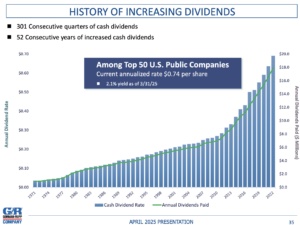

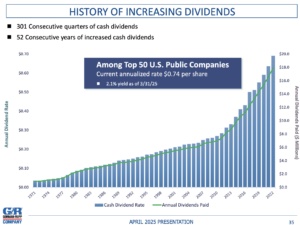

In 2022, The Gorman-Rupp Company (GRC) announced that it was increasing its quarterly dividend for the 50th consecutive year.

As a result, it became a member of the Dividend Kings. The Dividend Kings are a group of just 55 stocks that have raised their dividends for a minimum of 50 straight years.

This group is among our favorites for investors. That is because their high-quality business models, which have enabled dividend growth for decades, are likely to continue doing so in the future.

With this in mind, we created a full list of all 55 Dividend Kings.

You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

This article will examine Gorman-Rupp’s business overview, growth prospects, competitive advantages, and expected returns for the next five years.

Business Overview

Gorman-Rupp has been in business since 1933. The company began as a manufacturer of pumps and pumping systems and has evolved into a leading supplier of critical systems that industrial clients rely on to run their businesses.

The company generates revenue exceeding $660 million annually and has a market capitalization of $996 million.

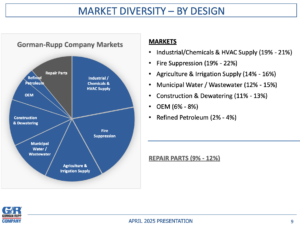

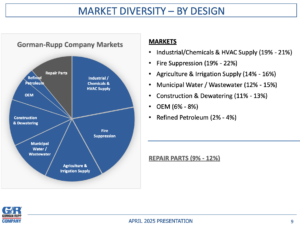

Despite its size, Gorman-Rupp is a key cog for many industrial customers. Its products are used in a wide variety of end markets, including agriculture, air conditioning, construction, fire protection, heating, industrial, liquid handling, military, original equipment, petroleum, ventilation, water, and wastewater.

Source: Investor Presentation

The company’s water-related businesses account for over half of its annual revenue, non-water-related businesses contribute roughly 30%, and repair parts account for the remainder.

The Gorman-Rupp Company reported Q1 2025 net income of $12.1 million ($0.46 per share), up 53.8% from $7.9 million ($0.30 per share) in Q1 2024. Net sales grew 2.9% to $163.9 million from $159.3 million, driven by increases in municipal ($1.8 million), repair ($3.2 million), OEM ($2.5 million), petroleum ($1.0 million), and fire suppression ($0.7 million) markets, though offset by declines in construction ($2.7 million), agriculture ($0.9 million), and industrial ($0.9 million) markets. Adjusted EBITDA rose 5.3% to $29.7 million, with operating income up 8.3% to $22.1 million and an operating margin of 13.5% (up 70 basis points), fueled by pricing gains and SG&A leverage.

Gross profit increased 4.0% to $50.3 million, with a gross margin of 30.7% (up 30 basis points). SG&A expenses were $25.1 million (15.3% of sales), slightly up from $24.9 million. Interest expense decreased 38.5% to $6.2 million, primarily due to refinancing and a $14.6 million reduction in debt to $352.2 million. Operating cash flow doubled to $21.1 million from $10.7 million. Capital expenditures totaled $3.0 million, with a full-year plan of $20.0 million. The order backlog was $217.8 million, down from $234.2 million in Q1 2024 but up from $206.0 million at year-end 2024.

CEO Scott A. King emphasized the strong demand for flood control and stormwater management from municipalities, driving sales and backlog growth. The U.S.-based supply chain is expected to mitigate the impacts of tariffs through pricing adjustments. While no specific 2025 guidance was provided, Gorman-Rupp remains optimistic about achieving profitable growth, supported by a $0.185 per share dividend and share repurchases, which reflect confidence in its financial and operational strength.

Growth Prospects

Gorman-Rupp’s role in its industry is crucial, as the company’s products are essential for these end markets to perform their basic functions. This makes this relatively small company a vital part of the industrial sector.

That said, the company’s long-term earnings growth is often correlated with the health of the economy. Earnings volatility has been a concern, as revenue can fluctuate significantly from year to year.

The company has been very effective at managing costs, which has enabled stable margins over the last decade; however, there have been periods of weakness.

One factor working in Gorman-Rupp’s favor is the aging infrastructure that plagues its main market of the U.S. The American Society of Civil Engineers rates the country’s infrastructure as poor.

Overall, the aging infrastructure system receives a C- from the organization, with particularly poor grades for drinking water, wastewater, and stormwater systems.

It is estimated that $2.6 trillion will be required to be spent over the next decade to fix and improve water, wastewater, and flood control systems, meeting the need for infrastructure improvements. This should have Gorman-Rupp well-positioned for years to come.

Another way Gorman-Rupp attempts to augment its organic growth is through strategic acquisitions.

A good example of this was the previously discussed Fill-Rite purchase. Using cash on hand and new debt, Gorman-Rupp paid $525 million for Fill-Rite, which was formerly a division of Tuthill Corporation.

Fill-Rite’s portfolio includes high-performance liquid transfer pumps, mechanical and digital meters, precision weights, hoses, nozzles, and a range of accessories.

The addition of Fill-Rite was made possible because Gorman-Rupp’s balance sheet is in remarkably good shape even after issuing new debt to fund the purchase.

Before this acquisition, the company had zero long-term debt on its balance sheet. Debt has increased, but remains manageable given the significant impact Fill-Rite has already had on results.

Competitive Advantages and Recession Performance

Gorman-Rupp has become an industry leader, in large part, due to its ability to offer a variety of products to meet the needs of different end markets. The company’s diversified portfolio helps protect against declines in any one area of its business.

Fire Suppression is the most significant contributor to sales, but this accounts for only around a fifth of the total revenue that Gorman-Rupp generates each year.

This diversification can help alleviate declines in a certain area.

However, Gorman-Rupp isn’t immune to the impacts of a recession. Listed below are the company’s earnings-per-share totals during and after the Great Recession:

- 2008 earnings-per-share: $1.04 (24% decrease)

- 2009 earnings-per-share: $0.70 (33% decrease)

- 2010 earnings-per-share: $0.93 (33% increase)

- 2011 earnings-per-share: $1.10 (18% increase)

Gorman-Rupp suffered significant declines during the Great Recession. The company experienced a rebound shortly after this period, as the economy began to recover and demand improved. The company established a new high for earnings per share shortly after the downturn.

At the same time, the company continued to increase its dividend, just as it had for decades.

While business results are likely to suffer during the next economic downturn, we believe that the tailwinds supporting the company’s business model will enable continued dividend growth.

Source: Investor Presentation

Valuation and Expected Returns

Shares of Gorman-Rupp are trading at 18.2 times our expected 2025 earnings per share of $2.10. We believe that fair value lies closer to 23 times earnings, which means an expanding P/E could enhance annual returns by approximately 4.9% per year over the next five years.

Between organic growth and the ability to add key businesses to its portfolio, we forecast that Gorman-Rupp can achieve an average annual earnings-per-share growth of 6% through 2030.

The dividend will also add to the stock performance. Presently, Gorman-Rupp is yielding 1.9%, which tops the 1.2% average yield of the S&P 500 Index.

Therefore, Gorman-Rupp is projected to return 12.8% per year on average through 2030. However, we think the stock is a Hold in our view.

Final Thoughts

The Dividend Kings are an exclusive list of companies that have established extremely long histories of dividend growth.

This feat is so rare that there are just 55 companies that meet the lone requirement of at least five decades of dividend growth.

Gorman-Rupp is a relatively new addition to this list. The company’s impressive business model, ability to make strategic acquisitions, and favorable industry tailwinds should position it to continue growing its dividend.

The stock is also reasonably priced and has double-digit total return potential over the next five years, earning Gorman-Rupp a hold recommendation.

Additional Reading

The following databases of stocks contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.