Updated on July 9th, 2025 by Felix Martinez

In 2024, National Fuel Gas (NFG) raised its dividend for the 55th consecutive year. That puts the company among the elite Dividend Kings, a small group of stocks that have increased their payouts for at least 50 consecutive years.

You can see the full list of all 55 Dividend Kings here.

We have compiled a comprehensive list of all 55 Dividend Kings, including key financial metrics such as price-to-earnings ratios and dividend yields. You can access the spreadsheet by clicking on the link below:

National Fuel Gas has remained a relatively small company, trading at a market capitalization of $7.5 billion. However, a small market cap is not a negative feature when investing; quite the contrary.

Despite its small size, National Fuel Gas has promising long-term growth prospects and a reasonable valuation. Additionally, the stock offers a dividend yield of 2.6%, which is significantly higher than the 1.2% yield of the S&P 500, and there is room for further dividend increases in the future.

Business Overview

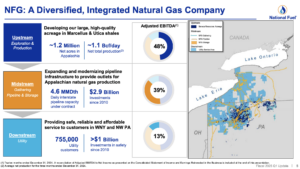

National Fuel Gas is a diversified and vertically integrated company operating in four segments: Exploration and Production, Pipeline and Storage, Gathering, and Utility. The upstream segment (exploration and production) is by far the most important one, as it generates 48% of the company’s EBITDA.

The midstream division (pipeline & storage, and gathering) generates 39% of EBITDA, while the downstream segment (utility) generates the remaining 13% of EBITDA.

While National Fuel Gas appears to be a pure commodity stock on the surface, with all the disadvantages associated with the boom-and-bust cycles of commodity producers, the company has a superior business model compared to other commodity producers. Thanks to its vertically integrated business model, it enjoys significant synergies.

Source: Investor Presentation

Its midstream and downstream businesses provide a substantial buffer when natural gas prices decrease. Moreover, the company enjoys higher returns on its investments, as both its upstream and midstream divisions benefit from its investments in production growth projects.

National Fuel Gas Company reported Q2 2025 GAAP net income of $216 million ($2.37 per share), up 32% from $166.3 million ($1.80 per share) in Q2 2024. Adjusted operating results were $218.3 million ($2.39 per share), a 34% increase, driven by higher natural gas prices and production. Seneca’s Exploration and Production segment produced a record 105.5 Bcf of natural gas, up 3%, with earnings of $97.8 million, boosted by a $0.38/Mcf price increase to $2.94/Mcf and lower operating costs. The Utility segment’s net income rose 44% to $63.5 million, driven by a 2024 New York rate settlement. Pipeline & Storage earnings increased 5% to $31.7 million, while Gathering earnings fell 8% to $26.3 million due to higher expenses.

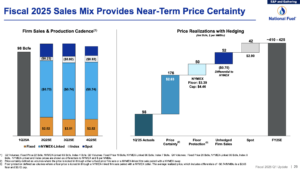

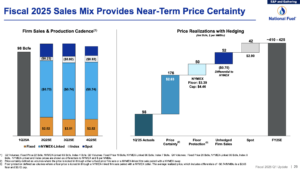

The company raised its fiscal 2025 adjusted EPS guidance to $6.75–$7.05, up $0.15 at the midpoint, reflecting stronger Seneca production (415–425 Bcf) and lower unit costs. Capital expenditures are expected to remain at $885–$960 million. Financing activities included $1 billion in new notes to refinance $950 million in debt, resulting in an after-tax loss of $1.7 million. The company assumes NYMEX natural gas prices of $3.50/MMBtu for the rest of 2025, with sensitivities showing EPS ranges of $6.50–$7.35 based on price fluctuations.

CEO David Bauer highlighted strong operational results, particularly in the Eastern Development Area, and the benefits of recent rate settlements. National Fuel’s integrated model and risk management position it to navigate economic uncertainties. The company expects to maintain affordable customer rates while investing in infrastructure, driving long-term growth and shareholder value despite potential tariff impacts.

Growth Prospects

National Fuel Gas pursues growth by increasing its natural gas production and expanding its pipeline network. The company has grown its earnings per share at an average annual rate of 7.8% since 2014.

As the price of natural gas was significantly higher in 2014 than it is today, the growth in earnings has primarily resulted from the company’s consistent production growth.

And the company has promising growth prospects ahead.

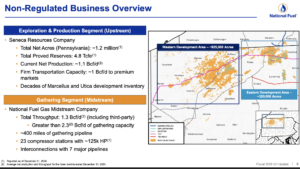

Source: Investor Presentation

Thanks to a recent partial recovery in natural gas prices, National Fuel Gas has slightly raised its guidance for earnings per share in fiscal 2025.

Moreover, the company still has promising growth prospects in the long run, especially given that natural gas is considered a much cleaner fuel than oil products, and hence it is much more resilient to the ongoing boom of renewable energy projects than oil products.

Overall, we expect National Fuel Gas to grow its earnings per share by approximately 3.0% annually over the next five years, driven by the company’s sustained production growth, as well as the high cyclicality of natural gas prices.

Competitive Advantages & Recession Performance

As mentioned above, the upstream segment of National Fuel Gas generates 48% of its total EBITDA, with natural gas comprising roughly 90% of the total output. The company is vulnerable to fluctuations in the price of natural gas. This sensitivity was apparent in 2015 and 2016, when the price of natural gas collapsed, resulting in substantial losses for the company.

On the other hand, thanks to its vertically integrated business model, National Fuel Gas is more resilient to downturns than most oil and gas producers, as its midstream and utility businesses provide a substantial buffer during downturns.

The superior business model of National Fuel Gas helps explain its admirable dividend growth record. The company has paid uninterrupted dividends for 122 consecutive years and has raised its dividend for 55 straight years.

This is an impressive achievement for a commodity producer, as commodities are infamous for their high cyclicality, which results in dramatic boom-and-bust cycles.

Source: Investor Presentation

Given the healthy payout ratio of 29% (based on expected 2025 adjusted EPS) and the company’s decent balance sheet, the dividend can be considered safe for the foreseeable future. We expect National Fuel Gas to continue increasing its dividend for many years to come.

Valuation & Expected Returns

National Fuel Gas is currently trading at 11.7 times its expected earnings of $6.90 per share this year. This earnings multiple is lower than the average price-to-earnings ratio of 13.0 over the last five years. Our fair value estimate for NFG stock is a P/E of 12.6. If the P/E multiple expands from 11.7 to 12.6 by 2030, it will lift annual returns by 1.4% per year over the next five years.

Given the 3% estimated annual growth of earnings-per-share, the 2.6% dividend, and a 1.4% annualized expansion of the price-to-earnings ratio, we expect National Fuel Gas to offer a 7.0% average annual total return over the next five years. This makes the stock a “hold” in our view.

Final Thoughts

National Fuel Gas is highly sensitive to fluctuations in the price of natural gas. On the other hand, its midstream and utility segments provide strong support to its financial results during downturns.

Overall, the midstream and utility segments provide reliable cash flows, while the upstream segment offers long-term growth potential thanks to strong production growth.

Additionally, National Fuel Gas stock is currently reasonably priced. Given an expected 3% growth in earnings over the intermediate term, its 2.6% dividend yield, and its reasonable valuation, we view the stock as a “hold” here. We will upgrade it to “buy” if it corrects and provides an expected annual return of 10% or greater.

Additional Reading

The following databases of stocks contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.