Updated on July 8th, 2025 by Felix Martinez

The Dividend Kings are an illustrious group of companies. These companies stand apart from the vast majority of the market as they have raised dividends for at least 50 consecutive years.

We believe that investors should view the Dividend Kings as the highest-quality dividend growth stocks to buy for the long term.

With this in mind, we created a full list of all the Dividend Kings.

You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking the link below:

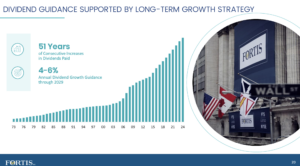

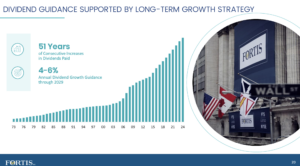

This group is so exclusive that there are only 55 companies that qualify as Dividend Kings. Fortis Inc. (FTS) recently raised its dividend for the 51st consecutive year, joining the list of Dividend Kings.

This article will provide an overview of the company’s business, its growth prospects, competitive advantages, and expected returns.

Business Overview

Fortis is Canada’s largest investor-owned utility business with operations in Canada, the United States, and the Caribbean. It is cross-listed in Toronto and New York.

Fortis trades with a current after-tax yield of 3.7% (about 4.3% before the 15% withholding tax applied by the Canadian government). Unless otherwise noted, US$ is used in this research report.

Fortis currently has 99% regulated assets: 82% regulated electric and 17% regulated gas. Approximately 64% are in the U.S., 33% in Canada, and 3% in the Caribbean.

Source: Investor Presentation

Fortis Inc. reported Q1 2025 net earnings of $499 million ($1.00 per share), up 8.7% from $459 million ($0.93 per share) in Q1 2024. Revenue rose 7.1% to $3.338 billion, driven by rate base growth and a stronger U.S. dollar (1.43 vs. 1.35). Operating cash flow increased 57.9% to $1.213 billion. Capital expenditures grew 25.9% to $1.420 billion, supporting a $5.2 billion 2025 plan.

Segment earnings: ITC $150 million (+8.7%), UNS Energy $81 million (-8.0%), Central Hudson $65 million (+75.7%), FortisBC Energy $156 million (+6.8%), FortisAlberta $37 million (-17.8%), FortisBC Electric $21 million (+5.0%), Other Electric $42 million (+23.5%). Corporate and Other loss widened to $53 million from $49 million.

Fortis maintained its $26.0 billion capital plan for 2025–2029, targeting a 6.5% rate base growth to $53.0 billion. Dividend guidance of 4–6% annual growth through 2029 was reaffirmed, with a Q1 dividend of $0.615 per share (+4.2%). CEO David Hutchens highlighted the operational strength and tariff resilience, supporting growth and a 50% reduction in GHG emissions by 2030.

Growth Prospects

Utility companies are typically classified as slow, but steady growers. Indeed, we expect Fortis to grow its earnings per share by 5.5% annually over the next five years. This growth will be driven by multiple factors.

After releasing its five-year capital plan of CAD$26 billion (roughly $18.7 billion in U.S. dollars) for 2025 to 2029, which suggests a mid-year rate base growth at a compound annual growth rate of ~6.5%. The company also maintained its dividend growth guidance of 4% to 6% through 2029.

Source: Investor Presentation

The capital plan includes investing in areas such as a greener and more efficient grid and a shift from fossil fuels to solar and wind generation. Importantly, this growth rate is before the impact of acquisitions, which have historically been important for Fortis.

Competitive Advantages & Recession Performance

Utility companies often benefit from multiple advantages. The first is that they usually operate in a near-monopoly on the areas that they service.

Because demand for Fortis’s utility services remains relatively stable across various economic environments, Fortis’s results have been relatively resilient in the face of economic uncertainties, including the current one, where inflation and interest rates are higher than in recent history.

Additionally, Fortis is unique due to its cross-border exposure. Its timely U.S. acquisitions of regulated utilities since 2013 have allowed Fortis to generate more than half of its revenue from that country.

Given these built-in advantages, many utilities often outperform other sectors of the market during recessions. Below are the company’s earnings-per-share results during and after the Great Recession:

- 2007 earnings-per-share: $1.32

- 2008 earnings-per-share: $1.52 (15% increase)

- 2009 earnings-per-share: $1.51 (~1% decrease)

- 2010 earnings-per-share: $1.81 (20% increase)

The company grew its diluted earnings per share in 2008, followed by a minor decline in 2009, which was the worst year of the recession. Fortis then quickly rebounded with 20% earnings growth in 2010.

Valuation & Expected Total Returns

We expect Fortis to generate earnings per share of US$2.44 in 2025. At the current share price, FTS stock trades for a price-to-earnings ratio of 19.2.

Given the company’s stable business model, we believe fair value is 19 times earnings, which is close to the average valuation of the stock for the last five years.

Reverting to our target valuation by 2030 would result in a multiple compression, reducing annual returns by 0.3%. In addition, we expect annual EPS growth of 5.5% which will also contribute to shareholder returns.

Finally, dividends will boost returns as FTS stock currently yields 3.9%.

Source: Investor Presentation

FTS has now raised its dividend for 51 consecutive years. Fortis’ payout ratio has traditionally been about 70% of earnings. The dividend is important to management, and we believe it is safe and is expected to continue rising for years to come.

Therefore, FTS is expected to return an average of 10.1% per year through 2029. An expected return above 9.1% qualifies FTS stock as a hold.

Final Thoughts

There is much to like about Fortis, including its recession-proof business model, the high success rate of rate increase approvals, and its long history of dividend growth. Only the most well-run businesses can pay dividends for as long as Fortis has.

Shares of Fortis appear reasonably valued. The company should continue to grow its earnings and, consequently, its dividends for many years. With an expected return of slightly more than 9%, the stock is a hold.

Additional Reading

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.