Updated on July 8th, 2025 by Nathan Parsh

Becton, Dickinson & Company (BDX) has increased its dividend for 53 consecutive years, and as a result, it recently joined the exclusive list of Dividend Kings.

The Dividend Kings have raised dividend payouts for at least 50 consecutive years.

You can download the full list of Dividend Kings, plus important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

You can see all 55 Dividend Kings here.

BDX has maintained its long history of dividend increases thanks to its superior position in the industry. Its competitive advantages have fueled the company’s long-term growth.

As we see the potential for continued growth in the healthcare industry, BDX should continue to increase its dividend each year.

This article will discuss BDX’s business model, growth catalysts, and expected returns.

Business Overview

Becton, Dickinson & Company is a global leader in the medical supply industry. Founded in 1897, it operates in 190 countries and generates annual sales of almost $19 billion. Nearly half of the company’s revenue comes from outside the U.S. BDX is valued at $50 billion.

The company operates three segments. First, the Medical Division includes needles for drug delivery systems, as well as surgical blades. The Life Sciences division provides products for collecting and transporting diagnostic specimens. Lastly, the Intervention segment includes several of the products produced by what used to be Bard.

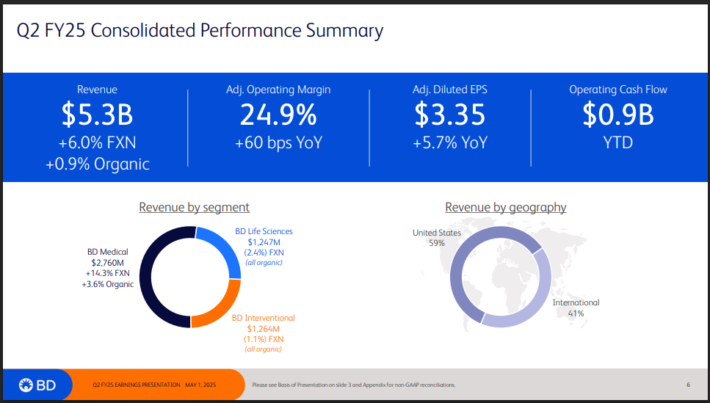

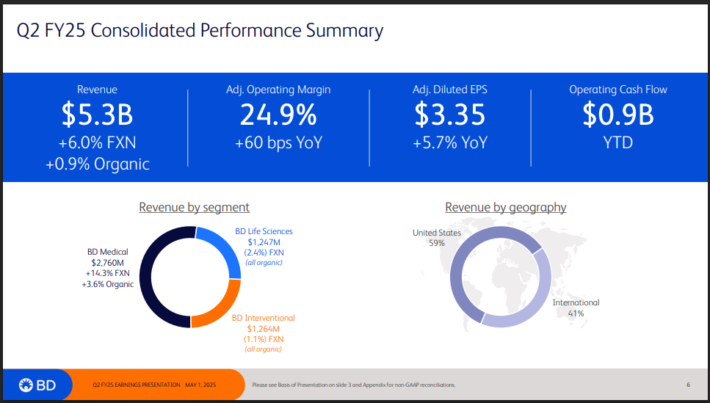

On May 1st, 2025, BD released earnings results for the second quarter of fiscal year 2025.

Source: Investor Presentation

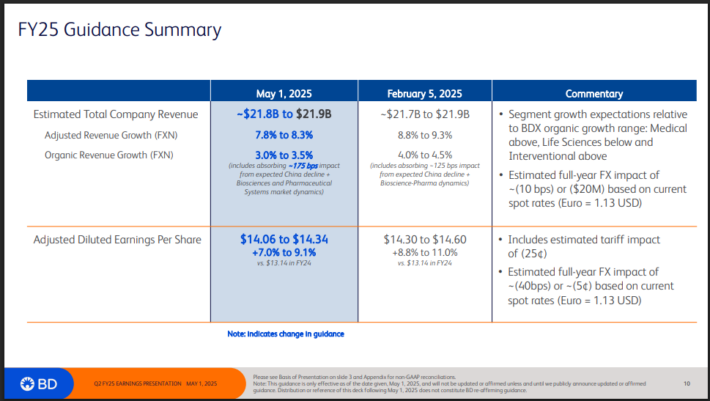

For the quarter, revenue grew 4.5% to $5.3 billion, with the top line improving 6% when excluding the impact of currency exchange. Adjusted earnings-per-share of $3.36 compared favorably to $3.17 in the prior year.

Revenue for the U.S. increased by 7%, while international revenue rose 4.7% when excluding the impact of currency exchange. Organic growth was 0.7% for the period. Results across the company’s segments were mixed. The Medical segment grew 3.6% organically while Life Sciences declined 2.4% and Interventional was down 1.1%. Year-to-date cash from continuing operations decreased 37% to $857 million while free cash flow fell 44% to $623 million.

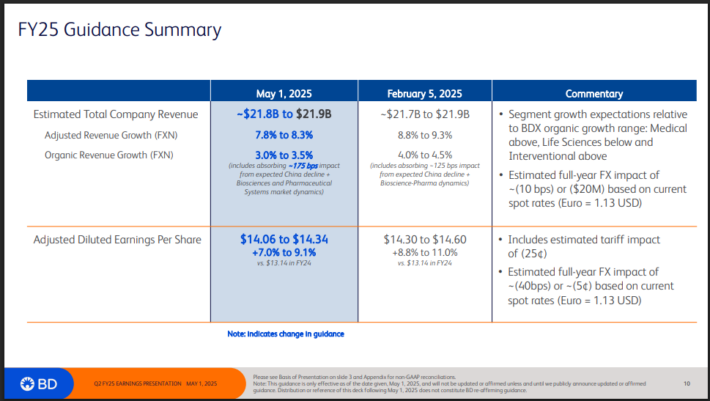

BD raised its projected revenue forecast for the year to a range of $21.8 billion to $21.9 billion, up from the previously reported range of $21.7 billion to $21.9 billion. The company lowered the midpoint for adjusted earnings-per-share for the fiscal year from $14.45 to $14.20 due to an expected headwind of $0.25 per share due to tariffs.

The company’s acquisition strategy and innovation initiatives are noteworthy. BD completed its $4.2 billion acquisition of Edwards Lifesciences’ Critical Care Product Group in September of 2024, bolstering its portfolio in advanced monitoring technology.

In February, BD announced its intention to separate its Biosciences and Diagnostic Solutions businesses from the rest of the company, as it continues to execute its BD 2025 strategy to unlock growth and value for shareholders. The remaining business will be a pure-play medical technology company that has leading positions in many large and growing end-markets. The Biosciences and Diagnostic Solutions business will also be a leader in its respective areas of operation, with annual sales exceeding $3 billion. Recurring revenue represents more than 80% of this total. The separation is expected to be completed in fiscal 2026.

In recent years, BD secured FDA approval for its Life Sciences division to collect self-collected cervical cancer screening samples in healthcare settings, thereby enhancing its diagnostic capabilities. Furthermore, BD expanded its single-cell research offerings by launching the BD Rhapsody™ ATAC-Seq Assay. These strategic moves align with BD’s goals under its BD 2025 strategy, as noted by CEO Tom Polen, who highlighted the company’s drive toward innovation and leadership in the MedTech sector.

Additionally, BD released its 2024 Annual Report, underlining its commitment to transparency in product security and corporate responsibility. The company’s solid financials, strategic acquisitions, and focus on sustainability signal BD’s ongoing transformation and its confidence in achieving its long-term goals.

Growth Prospects

Healthcare stocks like BDX are typically purchased for their steady long-term growth. BDX is no exception; the company has grown its earnings per share by 7% per year over the past decade.

Going forward, we expect the company to post an 8% annual EPS growth rate over the next five years. This growth will be driven mainly by the aging U.S. population, which is expected to continue rising demand for healthcare supplies in the future.

U.S. health expenditures are expected to total $5.295 trillion in 2025 and rise to $7.705 trillion in 2032, representing a 46% increase over this period.

This should be a broad tailwind from which major healthcare manufacturers, such as BDX, will benefit.

BDX continues investing heavily in product innovation, which is critical to the company’s long-term growth objectives.

Becton, Dickinson & Company has aggressively added to its core business. This includes the company’s $24 billion acquisition of Bard in 2017, its $1.525 billion purchase of pharmacy automation solutions provider Parata Systems in 2022, and its $4+ billion acquisition of Edwards Lifesciences’ Critical Care Product Group, among many others.

Further acquisitions and share repurchases over the long term are likely to lead to additional growth in the future.

Competitive Advantages & Recession Performance

Becton, Dickinson & Company has significant competitive advantages, including scale and a vast patent portfolio. These advantages are due to high investment spending.

BDX spends over $1.1 billion each year on research and development. This investment is critical to the company’s ability to generate long-term growth and maintain its industry leadership.

The company aims for a balanced capital allocation structure.

Source: Investor Presentation

It is clear that its R&D spending has paid off, as the company possesses over 29,000 active patents.

These competitive advantages enable the company to achieve consistent growth, even during economic downturns.

Becton, Dickinson & Company steadily grew earnings during the Great Recession. Becton Dickinson’s earnings-per-share during the recession are as follows:

- 2007 earnings-per-share of $3.84

- 2008 earnings-per-share of $4.46 (16% increase)

- 2009 earnings-per-share of $4.95 (11% increase)

- 2010 earnings-per-share of $4.94 (0.2% decline)

Becton, Dickinson & Company generated double-digit earnings growth in 2008 and 2009, during the worst years of the recession. It took a small step back in 2010 but continued to grow in the years since, along with the economic recovery.

The ability to consistently grow earnings each year during the Great Recession, arguably the worst economic downturn in decades, is extremely impressive.

The company continued to perform well in 2020, despite the coronavirus pandemic causing the U.S. economy to enter a recession. BDX remained highly profitable and continued its streak of dividend increases.

The reason for its recession resilience is that healthcare patients need medical supplies regardless of the state of the broader economy. This helps maintain steady demand from year to year.

Valuation & Expected Returns

We expect BDX to generate earnings per share of $14.20 this year. As a result, the stock is currently trading at a price-to-earnings ratio of 12.2.

We consider 19.0 to be a valuation for this stock, which is slightly below the 10-year average multiple.

As a result, we view BDX stock as undervalued right now.

If the P/E multiple increases from 12.2 to 19.0 over the next five years, shareholder returns would increase by 9.3% annually.

Additionally, dividend and earnings-per-share growth will enhance shareholder returns. BDX shares currently yield 2.4%. We expect 8% annual EPS growth over the next five years.

Therefore, BDX stock is expected to generate annual returns of 19.4% over the next five years.

Final Thoughts

Becton, Dickinson & Company is one of the newest members of the exclusive Dividend Kings list. Due to its leading position in the healthcare industry, the company has maintained a dividend growth streak of over 50 consecutive years.

Thanks to the aging U.S. population, the company is expected to benefit from this long-term growth catalyst, which should enable BDX to continue raising its dividend for many years to come.

BDX is currently trading at a valuation significantly below our target. We see the potential for annual returns of more than 19% over the next five years, making BDX stock a buy at the present time.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.