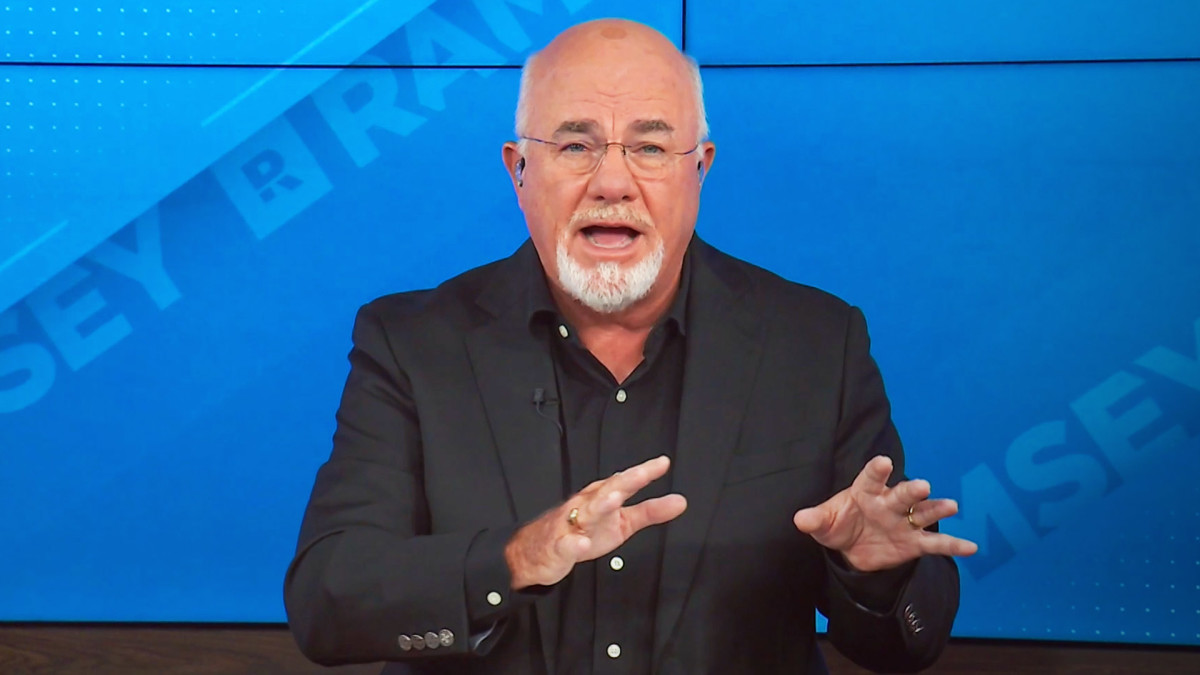

During a recent episode of The Ramsey Show, personal finance author and radio host Dave Ramsey tackled a question from a caller about purchasing a new car, offering insights and a cautionary message to listeners weighing the decision.

Ramsey frequently challenges the widespread belief in a “perfect” vehicle, urging buyers to let go of the fantasy. He believes a car should meet real-life demands, not an idealized version of them.

💵💰Don't miss the move: Subscribe to TheStreet's free daily newsletter💰💵

When it comes to choosing a vehicle, Ramsey has encouraged people to begin with lifestyle questions: whether a car or truck is better suited, how many passengers they usually drive, fuel efficiency needs, and cargo space.

He said that these factors help clarify which models are genuinely useful rather than simply desirable.

Ramsey warns that no vehicle satisfies every personal preference. Recognizing the difference between necessities and luxuries — and thinking ahead about long-term use — allows buyers to make smarter choices.

Ramsey’s advice consistently emphasizes budget discipline. He views paying interest as a financial misstep and firmly recommends buying a dependable used car with cash over financing a brand-new model. Doing so preserves financial stability and prevents unnecessary debt.

Related: Dave Ramsey sends major message to Americans on IRAs, Roth IRAs

He also suggests taking time with the search for a car. Ramsey urges buyers to investigate both online listings and physical dealerships, reminding them that rushing into the first decent-looking deal could mean missing out on something better.

Before any of that, though, Ramsey stresses the importance of deciding whether the current vehicle truly needs replacing.

Many people make the leap based on impulse rather than practical need, and he suggests that a realistic evaluation of the car’s condition should come first.

Ramsey also delivers a warning about common car-buying mistakes.

While he acknowledges the emotional draw of a shiny new ride, he reminds people that poor financial decisions in this area can have long-lasting consequences — unless they take a deliberate, informed approach that turns the odds in their favor.

Image source: TheStreet

Dave Ramsey has blunt words about car values

In an episode of The Ramsey Show, a 24-year-old caller identifying himself as Micah asked Ramsey about buying a car.

“I'm currently debt-free,” Micah said. “I make $80,000 a year. I am currently maxing out my 401(k) and IRA. I want to buy a car that costs $30,000. However, I don't want to get rid of my current car. It would just be a play car.”

“It's a sports car,” he continued. “I have $30,000 in cash that I'm prepared to pay for this car. I'm not sure if it's better to put this in a different sort of investment portfolio or if it would be OK to splurge and buy this car.”

Ramsey then ascertained that the caller's current vehicle is worth $13,000 and the car he is interested in buying is a 2019 Nissan 370Z.

More on cars:

- Dave Ramsey has blunt words for Americans buying a car

- Alphabet's Waymo flexes on Tesla Robotaxi with latest update

- Tesla faces its most serious court battle in years

“Here's the thing,” Ramsey said. “I love cars, I drove here today in my Raptor. I love big engines. I like things that make noise. I'm redneck. I want a loud muffler, all that.”

“But the stupid things go down in value, like a rock,” he emphasized. “That's where Chevy got that. ‘Like a rock.' And that includes that sweet Nissan you're talking about. And that includes my sweet Raptor.”

“They go down in value.”

Related: Jean Chatzky sends strong message on buying vs. leasing a car

Dave Ramsey explains wealth and car buying

Ramsey offered a word of advice about building wealth and how it often relates to car ownership.

“If you're going to build wealth, you have to keep as small an amount as possible going into things that go down in value,” he said. “So consequently, we find millionaires driving very conservative used cars until they've got substantial money.”

The Ramsey Show host explained that one of the guidelines he suggests people use is to not have more than half their annual income tied up in vehicles.

“So adding up all of your little toys with motors and wheels, does it add up to more than half your annual income?” he asked. “Because if it does, you've probably got too much in things going down in value while you're trying to build wealth.”

Ramsey noted that with those vehicles, Micah would have about $45,000 in two cars.

“You make $80,000 and so you're over half,” Ramsey said. “So, sweet car. And you've got the cash. You can do it.”

“I mean, you can afford it obviously, but the warning is that you're putting money in the wrong places if you want to be wealthy.”

Related: Dave Ramsey has blunt words for Americans buying a car