Aritificial intelligence (AI) will not replace investment managers, but investment managers that successfully integrate AI will replace those that do not. AI is surrounded by hype, but at its core it is an automation technology with the potential to power significant breakthroughs in the industry. It also has the potential to restore the primacy of active management, but in a new form. However, the reaction in the industry has so far been more about marketing than reality.

So far, traditional fundamental managers have tended to be skeptical about applying AI, while in the quant space there has been a tendency to overstate, recast or even rebrand traditional approaches as quasi-AI. In the rare cases where AI has been integrated by investment groups, it remains uncertain whether there is the necessary experience to manage these complex technologies safely.

The underlying issue? A significant AI skills gap at all levels of almost all investment firms. While this presents risks to industry incumbents, for ambitious investment professionals, with the right aptitudes and drive, the AI skills gap presents a huge opportunity.

The Skills Gap: A Critical Risk for Asset Owners and Allocators

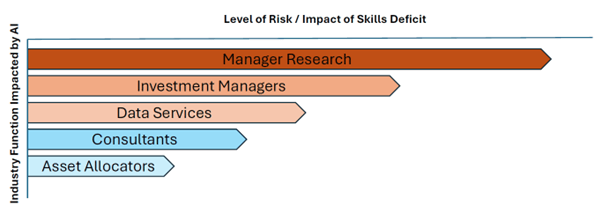

The AI skills gap poses its most significant risk via two key roles in the industry: manager researchers and investment managers. As the gatekeepers who approve or reject investment strategies, manager researchers need to be equipped with the skills to critically evaluate AI-driven approaches. Without these skills, they risk either overlooking superior strategies or, worse, endorsing flawed ones. Meanwhile, investment managers face growing pressure to assure clients they are harnessing AI, risking exaggeration or misapplication.

However, this situation provides an opportunity for individuals with the right aptitude and drive to stand out from the crowd. One of the most accessible paths for investment professionals to close their own AI skills gaps, is the CFA’s Professional Certificate in Data Science, launched in April 2023, to which I was proud to contribute. This program is the most relevant and thoughtfully designed resource on AI for investment professionals currently available.

Risk to Asset Allocators of an AI Skills Deficit by Function:

Are Investment Managers Really Using AI?

An AI-driven investment approach is a systematic process that should be designed to automate away much of the fundamental analyst’s role in driving security selection, and the quant analyst role in “discovering” the long-term causal drivers of return characteristics.

In the recent industry survey “AI Integration in Investment Management,” Mercer recently reported that more than half of managers (54%) surveyed say they use AI within investment strategies. The authors of the report “recognize the potential for ‘AI washing’” from respondents, where firms may exaggerate their use of AI to appear more advanced or competitive.

Most investment groups now use Microsoft Copilot, ChatGPT in an ad-hoc way, or data sources that use AI such as natural language processing (NLP) or LLMs. To claim AI integration in these cases is a stretch. Some more egregious “AI washing” examples include some managers simply misclassifying traditional linear factor approaches as “AI.”

Exaggerating capabilities has always been an issue in areas of the industry where demand has outstripped supply, but exaggerating AI integration risks manager researchers inadvertently endorsing AI laggards or risk takers and overlooking more competitive opportunities.

AI and the Revival of Active Management

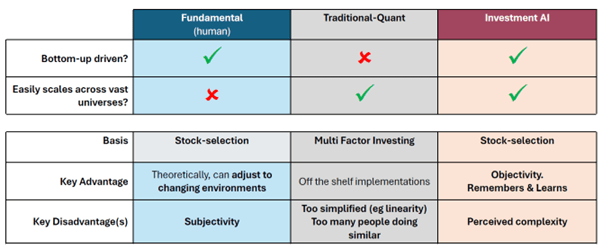

The rise of AI will challenge passive and factor-based investing. AI’s key advantage is that it has the potential to combine the best elements of fundamentally active investing and quant investing, at greater scale and for lower cost.

Traditional, fundamentally active strategies, which rely on teams of analysts to form qualitative, bottom-up views on investments, are limited by their scalability and their subjectivity. There are only so many companies an analyst can form a qualitative view on. Conversely, quantitative strategies are almost universally factor-based, lacking the nuanced insight that bottom-up, human analysis provides.

A correctly designed AI offers a unique opportunity to systematically form bottom-up views on investments and then deploy this at scale. This could revolutionize active management by reducing costs, increasing objectivity, efficiency, with the potential to generate superior return characteristics. However, the successful integration of AI into investment strategies depends heavily on the availability of the right skillsets, deep investment-AI experience, and AI- and tech-fluent investment leadership within firms.

Conclusion

AI is more than just another technology. It is a transformative force with the potential to redefine investment management. The industry’s most significant barrier to harnessing this power is the widening AI skills gap. Those managers who fail to address this critical challenge will fall behind, struggling to leverage AI effectively or, perhaps, safely. For asset allocators and owners, the message is clear: ensure that managers and service providers you partner with are not only adopting AI but are doing so with the right expertise at every level of their organization. For ambitious investment professionals with the right aptitude and drive the AI skills gap will be the opportunity of a generation.